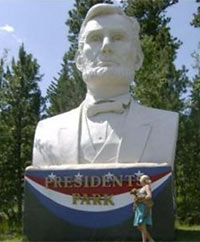

COMMENT OF THE DAY: WHERE TO PICK UP 20 TONS OF ABE  “Hey, now you can buy your own David Adickes Presidential sculpture! Its listed on ebay.com. Check out ebay listing #180818753008.” [ck, commenting on So We Put Our Heads Together and Decided To Take Presidents Day Off]

“Hey, now you can buy your own David Adickes Presidential sculpture! Its listed on ebay.com. Check out ebay listing #180818753008.” [ck, commenting on So We Put Our Heads Together and Decided To Take Presidents Day Off]

Comments

COMMENT OF THE DAY: MAKING HOUSTON HISTORY “that IS history, and a culture. it may not work in most parts, but some people see it as a progressive sign that we are not willing to be bound to what worked 100, 50, and sometimes 20 years ago . . . that in Houston, if it ain’t perfect or up to snuff, knock it down and make it so.” [HTX REZ, commenting on Daily Demolition Report: The Best a Demo Can Get]

COMMENT OF THE DAY: WE JUST RUN THE NUMBERS “If you dig a bit deeper into the Milhaus proformas, what the developer is REALLY saying is that there won’t be retail because: 1. lenders don’t like it; 2. buyers don’t like it; 3. adding retail reduces my return on cost somewhat; AND 4. mostly because of #1 and #2, it kills my numbers. If you look at the overall return on cost (NOI/cost) you get 7.7% return on cost with retail vs 8.7% return on cost without retail. That’s a substantial difference, but not eye popping. If the Midtown TIRZ really wanted some retail in the deal, they could easily toss Millhaus a bone and bridge this 100 basis point gap with ease. The real problem, at least according to Millhaus (not that I disagree), is that the lenders and buyers treat mixed use differently. In the example comparison, Millhaus assumes the non-retail deal gets a permanent loan underwrittien to 1.25 DSC [debt service coverage] vs 1.30 DSC for the with-retail deal. This means a larger permanent loan upon completion for the no-retail deal (more cash in Millhaus pocket). He’s assuming lenders will get more aggressive on a apartments-only deal. He also thinks his eventual buyer will prefer a non-retail deal. He calculates the as-completed value using a 7.00% cap rate for the non-retail project, but uses a 7.25% cap rate for apartments+retail project. What he’s really saying is, ‘Don’t blame me for not including retail in my development. Blame the lenders and buyers.’†[Bernard, commenting on Nixing Milhaus Retail: Why These New Midtown Apartments Won’t Have Shops on the Ground Floor]

COMMENT OF THE DAY: BUT A SPOONFUL OF SUGAR WILL HELP THE HISTORY GO DOWN “If you won’t drink coffee at the former Mary’s building, then you probably don’t want to know what went on at The Empire Cafe, when it was known as The Locker.” [Darogr, commenting on Restored Mary’s Mural on Westheimer Painted Over Again]

COMMENT OF THE DAY: YOU CAN’T HANDLE THE DATA VISUALIZATION “I think this tool is wonderful for home buyers, now they can actually do research that us agents do. However there are still some very important reports available only to agent. What my clients see so useful is a map/grid type of report. I can take a certain section of a neighborhood and include criteria like … sqft 2000-2500, bedrooms 3-4, counter = granite, built between 2000-2005, one story homes only, lot size 5000-7000, located on a cul de sac, and the house faces WEST…. Realtors have AMAZING TOOLS AVAILABLE TO THEM.. the only problem is some realtors DO NOT know how to use them. Hence our slogan is “Leave Realty to The Pros†…hahahahhaha… Well hope this info helps, if you have any questions please let me know.. IM HERE TO HELP.” [texasrealtypros.com, commenting on New Real Estate Listings Website Reveals Hidden Price Histories]

COMMENT OF THE DAY: BEWARE THE ALLURING BAYOU PARK PLAN “This appears to be a banking scheme that would have the Federal Reserve Bank(s) finance and hold securities on these important lands in many large cities across the US. More scrutiny of the fine print and long-term ramifications is needed before yielding to the sensuous propaganda.” [Dana-X, commenting on Enormous Plan To Build Bayou-Side Parks: The Movie]

COMMENT OF THE DAY: WHAT’S WORTH THE EFFORT “The system IS biased against low-value properties. There’s not a great deal of incentive to even file protest on a $40k mobile home, but there’s plenty of incentive to litigate the value of a downtown highrise in district court; and by that time, the highrise has had three bites at the apple. I’m not sure that there’s an easy solution to the inequity, though. Mass appraisal is a blunt tool by its very design. The right of protest allows for some of the rough edges to be smoothed out.” [TheNiche, commenting on The Office Building Appraisal Discount]

COMMENT OF THE DAY: THE EADO VIRUS “For goodness sake, when are people going to stop referring to random areas within the East End as EaDo! EaDo’s northern most tip is on Commerce. The KBR site is pretty far removed from EaDo’s borders! And realtors, please stop coming up with new names. I recently saw a listing near EaDo, with a location described as “SEDO†(Southeast Downtown). When will the madness stop!” [Eddie, commenting on The Clearings on Clinton]

COMMENT OF THE DAY: THE CLUE THEY’LL BE TEARING IT DOWN “The standard Texas Apartment Association lease does not give the owner the right to cancel the lease in the event of a sale. If the land value is approaching the as-built value, however, a smart landlord is going to put a clause in the lease that allows for a 30-day termination. At the complex I listed above, that was exactly what happened. The landlord had a cancellation clause in the lease for years before the property was sold to a developer. Some tenants may be turned off by it. It may have some affect on the rental rates. You have to weigh the pros and cons. Every situation is different.” [Bernard, commenting on New Owner Orders Everybody Out of the Greenbriar Chateau Apartments]

COMMENT OF THE DAY: LICKED CLEAN BY MILLIONS OF COCKROACHES “Roaches? I didn’t leave them out. I just didn’t see any — as in, not one. No living creatures at all, except us humans. The place smelled clean, like fresh water. I wonder where those roaches went…. and (ugh) what they were eating down there in the ’80s.” [Lisa Gray, commenting on Comment of the Day: The Cockroaches Found That Cistern First]

COMMENT OF THE DAY: THE COCKROACHES FOUND THAT CISTERN FIRST “Back in ’83 until about ’85 my buddies Colin Mazzola, Keith Tashima and myself would go down an open hatch into that thing — they closed it up sometime around ’86 or ’87 — this was back when jogging around the North side os Allen Parkway (near the celemetaries) was a little sketchy — people hanging out in the park near/under the Memorial Dr underpasses — anyway, what Lisa Gray left out was the 10 million roaches down there — we couldn’t hang out there for long — you couldn’t sit down or hang — BUT it was really cool and I remember being totally amazed that the City had an underground aqueduct/storm sewer overflow (yes it flooded and was impossible to go down the ladder) that was open and pretty much abandoned.” [David Beebe, commenting on Poking Around in Buffalo Bayou’s Abandoned Basement]

COMMENT OF THE DAY: ONE OF THESE DAYS THEY’LL HAVE HOUSTON PEGGED “Another version of the same description we’ve heard for the past 5 years. Prior to that, no description was heard. I’d say having any kind of identity is better than none at all. L.A. spent decades being bashed until a new gaggle of journalists discovered the ugly duckling had grown up. I expect a similar timeline for Houston.” [Dana-X, commenting on More Spit Than Polish]

COMMENT OF THE DAY: THE HOUSTON MUSIC UNDERGROUND “it sounds really really cool, but aside from asking Pauline Oliveros to re-record her Deep Listening album i can’t think of a single thing that would make good use of an abandoned cistern.” [joel, commenting on Poking Around in Buffalo Bayou’s Abandoned Basement]

COMMENT OF THE DAY: UP OR DOWN “On the agent side of HAR, you can see the different listing amounts. So while you might avoid the big red arrow showing a decrease, any agent can still see the pricing history. What a lot of agents do is lower their places by a few bucks a day, that way people with searches setup for a given location will keep being notified of their listing (since a price change will kick in a notice to be sent out). I know it works as I just RAISED the price of a rental on HAR and got a ton of calls. Likely because anyone that has an alert setup for my rental type just got ‘re-alerted’ about the apartment.” [Cody, commenting on Back, Slashed: Ken and Linda Lay’s Huntingdon Penthouse]

COMMENT OF THE DAY: TOO EASY “I was really interested in buying . . . when it wasn’t for sale.” [northside girl, commenting on On Second Thought: Yeah, It’s Available]