COMMENT OF THE DAY: THE GHOST OF WILSHIRE VILLAGE “Where is Jay Cohen in all of this? Supposedly he sold the property and yet continued to collect rent from the ‘squatters’ as they are referred to by Dilick. Did he, does he, still own an interest in the property?” [Matt Mystery, commenting on Wilshire Village Owners Try To Hold Off the Bank]

Search Results: wilshire village

River Oaks Examiner reporter Mike Reed makes a valiant stab at deciphering the latest twists in the ongoing legal battle between the owner of the 7.68-acre site at the corner of West Alabama and Dunlavy where the Wilshire Village Apartments stood until last summer and Wedge Real Estate Finance, the lender that’s been trying since then to foreclose on the property. All that time, Matthew Dilick, the managing partner of property owner Alabama & Dunlavy Ltd., has been using a portfolio of delaying tactics to forestall foreclosure — hoping to sell or refinance the property before it’s taken from him and “two unnamed limited partners.”

According to Wedge, a Feb. 2 foreclosure sale marked the fourth month in a row such a sale had been scheduled, only to be halted by court actions.

Conspicuous among the court documents was a check for $1 million from Tour Partners Ltd., of Spring, Texas, to Wedge, dated Jan. 29 with “Alabama Dunlavy funding†written on it. The address on the check matches that of the Augusta Pines Golf Club.

The president of Tour Funding, Dennis Wilkerson, who signed the check, did not return calls from the Examiner. Neither did attorneys for either party in the lawsuit and foreclosure proceedings.

However, a few pieces of the puzzle were available through court documents:

Negotiation to lease the property for use as an H-E-B grocery store have been conducted by a “purchaser†identified as R.H. Abercrombie.

- Wilshire Village fate: Legal moves, H-E-B overtures [River Oaks Examiner]

- Wilshire Village coverage [Swamplot]

Photo: Swamplot inbox

Swamplot has been covering the whole sorry Wilshire Village debacle since longtime tenants of the decrepit 1940 garden apartment complex at the corner of West Alabama and Dunlavy received a rather curious eviction notice early last year. You can find all our posts on the topic — in reverse order — starting here. But even Swamplot readers haven’t heard the full story of Wilshire Village. It’s now become apparent that — as compelling and absurd a plot as the whole soap opera has seemed to follow — a whole ’nother equally gripping drama was taking place behind the scenes.

Since our last post on the subject earlier this week, a whole bunch of new documents have appeared covering what appears to be an ongoing legal battle over the property between Matthew Dilick and Wedge Real Estate Finance. And they’re all available online here. (Click on the “documents” button to see them — but you’ll need to sign up for a free account to get access.) Frankly, we need your help to sift through all the paperwork and figure out what really happened. There’s a lot to look through, but we’ve already discovered some rather startling details, which we’ll be reporting on soon.

If you’ve got legal training, or just fancy yourself an armchair courthouse sleuth, we’re happy to receive any document summaries or commentary you can send us. But what we’d really like to assemble is a definitive timeline of events. And that’s the format we’d prefer to receive your submissions in: A date, an event, and a specific reference to the document that confirms it.

What’ll it all add up to? Maybe a better picture of the secret real-estate history of one large Inner Loop site in Houston. Maybe — more. Who knows? But we can’t see what the jigsaw puzzle shows until we find all the pieces and fit them together. Can you help?

Photo of apartment at Wilshire Village (now demolished): Katharine Shilcutt

WILSHIRE VILLAGE OWNERS SAY NEVERMIND ABOUT THAT LAWSUIT Those plot twists just keep twisting! The owners of the former Wilshire Village Apartments at the corner of West Alabama and Dunlavy have dropped the lawsuit they filed at the beginning of this month — the one that claimed their about-to-foreclose lender, Wedge Real Estate Finance, interfered with the owners’ attempts to sell the now-vacant 7.68-acre property. Why? Explains a source: “Whether that is because the claim became moot, or was settled, is unknown.” Of course, they can always refile later! [Swamplot inbox; previously on Swamplot]

Wilshire Village rubberneckers: Pull on over; you are in for quite a treat! The gift that keeps on giving — the tragicomedy of real estate errors at the corner of West Alabama and Dunlavy in Montrose — has come through with another rich round of jaw-dropping twists. It’s up to us to recount and gawk.

We’re still combing through documents filed in the recent lawsuit for more goodies. But a reader who’s a few steps ahead of us has dug into them already and found these gems:

The property has been appraised at $26.8 million. Alabama & Dunlavy (“the partnershipâ€) claim that they were jerked around by Wedge [Real Estate Finance, LLC] as follows:

At the instruction of Wedge, the partnership demolished the buildings on the property. They did this in an effort to prepare the site for development and increase its value by “millions of dollars.†Wedge demanded that this be done because Wedge purchased the Amegy $10 million loan, held the $3 million Wedge loan, and wanted to foreclose. Wedge allegedly stated that if the partnership demolished the buildings and increased the value of the property, Wedge would work with the partnership to avoid foreclosure.

So, the partnership – at great expense – “evicted squatters†and demolished the buildings. But, alas, Wedge decided to foreclose on the partnership and also seize $1,000,000 the partnership held in an amegy account that the partnership planned to use to help fund development.

Among the juicy tidbits…

What? There’s more!?

Swamplot is hearing a couple of unconfirmed items about Wilshire Village, the 7.68-acre site at the corner of West Alabama and Dunlavy that’s sat vacant since the 70-year-old yellow-brick garden apartment buildings long left to decay on the site were cleared of their pesky tenants and torn down last year.

First comes a source telling us that on February 2nd the property was somehow foreclosed on — despite the fact that the the owner of the property, an entity called Alabama & Dunlavy Ltd., declared bankruptcy back in November for the apparent express purpose of avoiding such an event.

The next item is even more fun: There’s a lawsuit!

The trees remaining on the site of the former Wilshire Village Apartments at the corner of West Alabama and Dunlavy are sporting some colorful new tags as of late last week, reports a nearby resident:

All the trees have ribbons around them. Trees along Alabama have green ribbons. All the other trees (on about 3/4 of the property) have white ribbons. Exception: green ribbons for 2 live oak trees that flank the old property entrance at Sul Ross. If white ribbons mean TEAR DOWN, then the property will be virtually denuded.

Of course white ribbons don’t mean TEAR DOWN. They mean SURRENDER.

And then there’s the new rumor our informant just heard and is passing along:

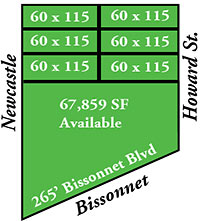

Lauren Meyers, archivist of would-be Houston, digs up an earlier plan for a building at 4500 Bissonnet, on the corner of Mulberry St. in Bellaire. That’s the vacant property long in the possession of legendarily delinquent Wilshire Village landlord Jay H. Cohen, where Matt Dilick, the man who now apparently controls it, is planning to build a 2ish-story stucco mild-West meets retail-Tuscan strip center and sell off the rest of the land.

Back in 1946, Cohen’s father, who had developed the Wilshire Village Apartments on West Alabama and Dunlavy 6 years earlier, planned a 122-home subdivision on the 30-acre strip between Avenue A (now Newcastle St.) and Mulberry St. with a partner. And at the southern end of the property, facing Richmond Rd. (now Bissonnet St.), a sweeping, low-slung modern structure spanning Howard St.: the Mulberry Manor Community Center, designed by Houston architects Lloyd & Morgan.

Meyers quotes a Houston Chronicle report from September 1, 1946:

Let’s see . . . there was today’s planned foreclosure auction for Wilshire Village. What else does Matt Dilick of Commerce Equities have going on?

Let’s see . . . there was today’s planned foreclosure auction for Wilshire Village. What else does Matt Dilick of Commerce Equities have going on?

Swamplot’s neighborhood correspondent for Bellaire reports on Commerce Equities’ proposed development on one portion of a couple of long-vacant tracts at the northeast corner of Bissonnet and Newcastle:

The plots of land at 4400 and 4500 Bissonnet, between Newcastle and the Centerpoint service center, are being cut up and sold. . . .

Evidence of surveying and subdivision in recent weeks has recently given way to signboards indicating that the north third of the open land at 4500 Bissonnet will be cut up into six residential lots while the two-thirds fronting Bissonnet is reserved for commercial. The next block over, across Howard Street, commercial space is being developed to open before April of 2010. According to flyers on broker David Nettles’s website, approximately 62% of the 20,000-some-odd square feet of office space is still available.

But the two parcels — totaling almost 4 acres — have more of a connection to Wilshire Village than just the involvement of Dilick.

By popular demand — and in hopes that even more exciting or sordid detail might be gleaned from the legalese therein — we’re making available the trustee’s sale notices for Wilshire Village that were sent to Swamplot yesterday. The notices describe the foreclosure peril faced by Alabama & Dunlavy Ltd., the limited partnership apparently controlled by Matthew Dilick of Commerce Equities. That partnership owns the 7.68-acre now-vacant property at the corner of West Alabama and Dunlavy.

Here they are:

- Notice of Substitute Trustee’s Sale (Amegy Loan)

- Notice of Substitute Trustee’s Sale (Mezzanine Loan)

Think there’s more — or less — to these documents than meets the eye? Find any clues, factoids, or muck hidden between the lines? Think any of it helps explain the bizarre sequence of events that’s taken place at Wilshire Village over the last few years? Let us know!

- Surprise! Wilshire Village Facing Foreclosure [Swamplot]

- Wilshire Village coverage [Swamplot]

Photo of Sign at Wilshire Village, 1701 West Alabama St.: Swamplot inbox

COMMENT OF THE DAY: SWEET ASS WILSHIRE VILLAGE PARK “Some quick math… 7.68 acres = 334,541 SF. Amegy loan = $10,742,000 = 32.11 PSF. Wedge loan = $3,000,000 = 8.97 PSF. Total loans = $41.08 PSF. It seems to me that the dirt should be worth a lot more than $41 PSF. . . . Amegy doesn’t appear to have a lot of risk of loss in the deal. . . . It’s clear they’ve decided to force the owners hand rather than sit back and let the owners try to sell for max $$$, which ain’t easy in this market. A BK by the owner will only delay the process for so long. Amegy obviously wants their cash back. Even without a foreclosure, it seems that this parcel is going to trade hands soon. Somebody needs to round up some cash real quick and buy this prime piece of dirt and turn it [into a] sweet ass park.” [Bernard, commenting on Surprise! Wilshire Village Facing Foreclosure]

The Wilshire Village soap opera continues: A source sends Swamplot two trustee’s sale notices for the now-demolished 7.68-acre apartment complex at the corner of W. Alabama and Dunlavy.

How deep into it is the owner? There’s a first lien of $10,742,000 to Amegy Bank, now “wholly due and payable”! That lien dates from January 31, 2006 — the same date, according to HCAD, that the owner, a limited partnership named Alabama & Dunlavy Ltd., took over the property.

The second notice documents problems with Alabama & Dunlavy Ltd.’s separate mezzanine financing with Wedge Real Estate, in the amount of $3 million. That separate promissory note appears to date from May 30th of 2008. Both trustee’s sale notices are dated earlier this month.

Our source comments:

It is rather interesting that Wedge Holdings is the mezz lender, with Wedge being Mayor Bill White’s former company. I feel certain that Matt [Dilick] will avert foreclosure by filing bankruptcy, if he has not already done so.

Oh but if if if foreclosure somehow isn’t averted, where and when might eager Swamplotters be able to snap up this fine scraped property?

The purported owner of the Wilshire Village complex at the corner of West Alabama and Dunlavy, who managed to stay out of the media spotlight while the 69-year-old 8-acre complex was emptied and then torn down after a sequence of peculiar events earlier this year, appears at the end of Nancy Sarnoff’s phone line to make a few pronouncements about the property.

First, that big Commerce Equities sign on the property that says “Available”? Well, here’s what it really means:

“We would consider an outright sale if the appropriate user was identified,†owner Matt Dilick of Commerce Equities said.

That’s right: Dilick might wanna do a little creatin’ there himself!

COMMENT OF THE DAY: WILSHIRE VILLAGE LOGIC “I am really amazed at this debate. The principle is very simple. The land is too valuable for the revenue generating capacity of existing structures. You can’t rent those spaces for enough money, no matter how you remodel. This is definately a high density project and could be high-rise site in a better market, where are you going to find north of 7 acres in an area like this? The Fiesta across the street is in the Cohen family, so that could be in play. The Cohen family is surrounded by real estate guys. The real shame here, is that you have complicated personalities that probably prevented any new construction during a time in which it would have been viable, so now they are trying to market a property in a climate that almost no one can get financing that would make a deal work. A new project would have provided comfortable living space in a convenient and desirable location, with maybe even a mixed use component. You tear down 40+ year old properties, that have a great deal of deferred maintanence, for marketing purposes, and now they can showcase those beautiful magnolia trees, which I hope they can preserve as many as possible, but it has to make economic sense. I am sure that if someone will make a fair market value offer, and they are a credible buyer, they would sell. Death to rumors. The dirt could be as much as $100 a foot, if you turned back the clock 2 years. It is special so may still demand it.” [Alexander, commenting on All Cleaned Up and Ready for Sale: What Can We Get for Wilshire Village?]

Here’s a view of the new sign up at the now-scrubbed site of the former Wilshire Village Apartments at the corner of West Alabama and Dunlavy. It’s . . . for sale! Apparently, all that demolition work was just for staging.

Can we get a closeup on that sign?