COMMENT OF THE DAY: LIKE THE BAYOUS, HOUSTON OIL DEVELOPMENT FLOWS WEST TO EAST  “. . . First, low oil prices are absolutely TERRIBLE for upstream (Schlumberger, Baker Hughes, Fluor, etc). However, it’s not necessarily terrible for downstream. Expensive or cheap, oil has to be refined and there has been no reduction in the demand of downstream products (gas, polymers, aromatics etc). If you know the Houston energy market then you know that Upstream is located heavily in Katy and Sugarland. Downstream is located primarily on the East Side of Houston, with some exceptions (like the EM woodlands campus). More central or (to a degree) eastern housing markets should still see significant demand.

Second, understand that some oil companies move very slowly. Capital expense budgets are planned years in advance. Those don’t necessarily just get ripped up and thrown out the window just because the price of oil has tanked. Yet again, UPSTREAM is definitely cancelling capital left and right, I mean only a moron would drill a new low margin well right now, but Downstream? I believe at least 2 new crackers are coming online this year and a new 500+ kta polymer reactor is as well. Those aren’t stopping, and low oil prices wouldn’t stop them anyways.” [MrEction, commenting on Downtown Foreclosure Auctions in Their Final Year; Bramble’s Debut; Krispy Kreme’s Opening Date] Illustration: Lulu

“. . . First, low oil prices are absolutely TERRIBLE for upstream (Schlumberger, Baker Hughes, Fluor, etc). However, it’s not necessarily terrible for downstream. Expensive or cheap, oil has to be refined and there has been no reduction in the demand of downstream products (gas, polymers, aromatics etc). If you know the Houston energy market then you know that Upstream is located heavily in Katy and Sugarland. Downstream is located primarily on the East Side of Houston, with some exceptions (like the EM woodlands campus). More central or (to a degree) eastern housing markets should still see significant demand.

Second, understand that some oil companies move very slowly. Capital expense budgets are planned years in advance. Those don’t necessarily just get ripped up and thrown out the window just because the price of oil has tanked. Yet again, UPSTREAM is definitely cancelling capital left and right, I mean only a moron would drill a new low margin well right now, but Downstream? I believe at least 2 new crackers are coming online this year and a new 500+ kta polymer reactor is as well. Those aren’t stopping, and low oil prices wouldn’t stop them anyways.” [MrEction, commenting on Downtown Foreclosure Auctions in Their Final Year; Bramble’s Debut; Krispy Kreme’s Opening Date] Illustration: Lulu

Tag: Price Trends

COMMENT OF THE DAY RUNNER-UP: WHAT DIFFERENCE DOES THE PRICE OF OIL MAKE TO HOUSTON REAL ESTATE?  “Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [c.l., commenting on Houston Housing Market Reaches All-Time Highs — Before It Crashes, Dips a Little, Remains Steady, or Climbs Further] Illustration: Lulu

“Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [c.l., commenting on Houston Housing Market Reaches All-Time Highs — Before It Crashes, Dips a Little, Remains Steady, or Climbs Further] Illustration: Lulu

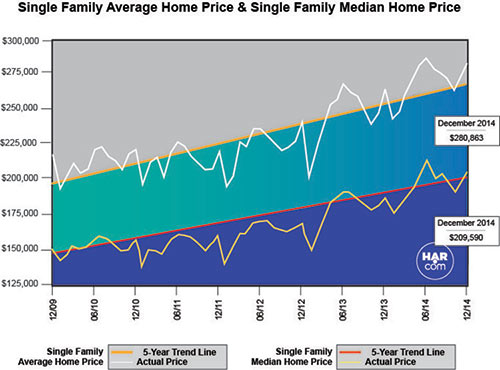

Is this Houston real estate’s Wile E. Coyote off-the-cliff-but-hasn’t-realized-he’s-gonna-fall-yet moment? Or is a new era dawning, in which out-of-state investors new to this whole “Houston is booming” thing swoop in to buy up everything and save the day? A fresh serving of home-sales data from real estate agents is available this morning . . . to support either notion. This past December was a record-breaking month for home sales, the Houston Association of Realtors claims in its latest report. Total property sales were up 11 percent over last December, and the current 2.5-months supply of inventory (a comforting term to those who regularly consider a home to be an off-the-shelf item) is scored as “the lowest level of all time.” Total dollar volume of housing sales for this past month was up a whopping 18.1 percent over December of last year. Both average and median sales prices for single-family homes reached “historic highs for a December in Houston.”

Separately, using her own calculations from MLS data, buyers’ agent Judy Thompson has updated her hand-carved regular roundup of appreciation rates and market conditions for the 21 well-known (and mostly Inner Loop) neighborhoods she’s been tracking on her West U Real Estate website for the past decade. (“In some areas I have had to make value judgments about which sales might have been lot value sales that were not listed that way,” she explains.) Of note: Of the tracked neighborhoods, little old Westbury led the increase in average sales price per sq. ft., rising 22 percent in the last year; the combined average for 2014 was an 11 percent uptick.

- The Houston Real Estate Market Breaks Records in 2014 [HAR]

- Appreciation [West U Real Estate]

Chart: HAR

COMMENT OF THE DAY: WE’RE NOWHERE NEAR PEAK MONTROSE  “I don’t think we’re anywhere close to the peak of property values in Montrose. You can still get an older 1,500 square foot townhome in the area for under $250,000. The average price for a bigger (~2,500sf) recent construction townhome is probably around $600,000. Those prices would be laughably low in comparable neighborhoods in most cities. Gentrification doesn’t really stop halfway like that barring a major economic downturn — once the ball starts rolling like this it just keeps going until the whole neighborhood is gleaming and wealthy. If you think Montrose has reached that point yet, you’re wrong. A fully gentrified urban neighborhood doesn’t have horrible apartment complexes like Takara So or vacant lots and skeazy strip centers on its main commercial street. Gentrification isn’t going to stop in Montrose until you can’t get a new townhome for less than a million or an apartment for less than $1,400.” [Christian, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

“I don’t think we’re anywhere close to the peak of property values in Montrose. You can still get an older 1,500 square foot townhome in the area for under $250,000. The average price for a bigger (~2,500sf) recent construction townhome is probably around $600,000. Those prices would be laughably low in comparable neighborhoods in most cities. Gentrification doesn’t really stop halfway like that barring a major economic downturn — once the ball starts rolling like this it just keeps going until the whole neighborhood is gleaming and wealthy. If you think Montrose has reached that point yet, you’re wrong. A fully gentrified urban neighborhood doesn’t have horrible apartment complexes like Takara So or vacant lots and skeazy strip centers on its main commercial street. Gentrification isn’t going to stop in Montrose until you can’t get a new townhome for less than a million or an apartment for less than $1,400.” [Christian, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

COMMENT OF THE DAY: TIME AND SPACE CITY  “. . . Houston is indeed one of the best cities around for middle class folks, but it all comes down to time management and space. Houston provides a convenient lifestyle that affords families much more time and space than they could claim in the hustle and bustle of larger cities like SF, LA, or NYC. however, let’s not sit back and pride ourselves as if this doesn’t pose serious drawbacks that we casually buy into and accept, whether absent-mindedly or begrudgingly.

That same abundance of space and time means our city still isn’t cultured enough to be a mecca for the foreign investors and rich elite seeking out stability in world class cities with lots of amenities, nor is it hospitable for those growing up in low income communities where transportation and education costs all but ensure a lifetime of low-wage labor (for reals, just look at the statistics if you don’t believe me).

But hey, i’m a glass half empty kind of guy and won’t be happy until more strides have been taken to make Houston even more hospitable to all and everyone. We may be alright, but we’re certainly not there yet and it remains to be seen what life would be like in this city in a free market that accurately priced energy, pollution and consumption. If you’re middle class, then yes, come to houston and bask in the glow. If you’re on the lower end of the economic spectrum, you should be fighting to get out and place your family in a better environment with greater probabilities for success.” [joel, commenting on Houston Is Hot and Sticky] Illustration: Lulu

“. . . Houston is indeed one of the best cities around for middle class folks, but it all comes down to time management and space. Houston provides a convenient lifestyle that affords families much more time and space than they could claim in the hustle and bustle of larger cities like SF, LA, or NYC. however, let’s not sit back and pride ourselves as if this doesn’t pose serious drawbacks that we casually buy into and accept, whether absent-mindedly or begrudgingly.

That same abundance of space and time means our city still isn’t cultured enough to be a mecca for the foreign investors and rich elite seeking out stability in world class cities with lots of amenities, nor is it hospitable for those growing up in low income communities where transportation and education costs all but ensure a lifetime of low-wage labor (for reals, just look at the statistics if you don’t believe me).

But hey, i’m a glass half empty kind of guy and won’t be happy until more strides have been taken to make Houston even more hospitable to all and everyone. We may be alright, but we’re certainly not there yet and it remains to be seen what life would be like in this city in a free market that accurately priced energy, pollution and consumption. If you’re middle class, then yes, come to houston and bask in the glow. If you’re on the lower end of the economic spectrum, you should be fighting to get out and place your family in a better environment with greater probabilities for success.” [joel, commenting on Houston Is Hot and Sticky] Illustration: Lulu

COMMENT OF THE DAY: WHAT HIGHER GAS PRICES COULD MEAN FOR HOUSTON  “The 64 billion dollar question for Houston is whether the benefits from a spike in gas prices (i.e. increased activity in the energy sector, more jobs, better wages, etc.) would be enough to offset the significant increase in cost of living that would be associated with higher gas prices. I would suspect that it would not as the cost of housing has already put the squeeze on many household budgets already.” [Old School, commenting on New Oil Company Report Holds Out Houston as Shining Example of a ‘Sprawling Metropolis’] Illustration: Lulu

“The 64 billion dollar question for Houston is whether the benefits from a spike in gas prices (i.e. increased activity in the energy sector, more jobs, better wages, etc.) would be enough to offset the significant increase in cost of living that would be associated with higher gas prices. I would suspect that it would not as the cost of housing has already put the squeeze on many household budgets already.” [Old School, commenting on New Oil Company Report Holds Out Houston as Shining Example of a ‘Sprawling Metropolis’] Illustration: Lulu

HAVE HOME PRICES IN LINDALE PARK REALLY JUMPED THAT MUCH, THAT FAST?  “I’d be curious to know what your more knowledgeable readers think about the rising prices in Lindale Park,” a reader writes. “Just today I saw this listing — for north of $400k! Over the past couple of months there have been a number of homes listed, and quickly pending, for around $300k. Most (all?) of these appear to have been flipped.

I bought my (not updated, in need of work, but a not-bad 3-2) house in Lindale Park for around $150k in 2010. There were a number of factors to picking Lindale Park, but the biggest was that we could get a decent-sized house in a close-in neighborhood that seemed to be on the up-and-up without breaking the bank. (The rail was a big reason too.) But when I saw this home — big and updated but right on 610 — for more than $400k . . . my jaw dropped.” [Swamplot inbox] Photo of 511 Kelley St.: HAR

“I’d be curious to know what your more knowledgeable readers think about the rising prices in Lindale Park,” a reader writes. “Just today I saw this listing — for north of $400k! Over the past couple of months there have been a number of homes listed, and quickly pending, for around $300k. Most (all?) of these appear to have been flipped.

I bought my (not updated, in need of work, but a not-bad 3-2) house in Lindale Park for around $150k in 2010. There were a number of factors to picking Lindale Park, but the biggest was that we could get a decent-sized house in a close-in neighborhood that seemed to be on the up-and-up without breaking the bank. (The rail was a big reason too.) But when I saw this home — big and updated but right on 610 — for more than $400k . . . my jaw dropped.” [Swamplot inbox] Photo of 511 Kelley St.: HAR

COMMENT OF THE DAY: INNER LOOP HOME PRICES CAN’T KEEP RISING LIKE THEY HAVE  “. . . Our current population boom was due to an unexpected resurgence in the gulf of mexico oil market and hit our housing supply by complete surprise. However, the housing market will be going full steam for the next few years to catch up on supply and entire new subdivisions are going to be created that are well outside of the property value inflation we’re seeing in town. The vast majority of new residents are already buying well outside of the 610 Loop. Even the snottiest of inner loopers such as myself would eventually consider buying a mansion in the ‘burbs for the same price as a cluttered townhome in the Loop.

. . . Not to say we’re in a bubble right now, but beyond doubt there will be a lot of downward pressure on home prices in the Houston area moving forward unless we see employment start accelerating again. That definitely is not going to be likely no matter how well the gulf market holds up. So I think people claiming there is or isn’t a bubble are being a bit premature, we all have to wait and see. I believe the general expectation is that although values have shot up, there should be enough demand to hold the prices up moving forward. So yes, odds are probably against a bubble, but I would expect that this burst of demand has pulled property valuations forward quite a bit and that folks shouldn’t expect to see gains on home prices for the next 5 years or so as a glut of new apartments and homes come onto the market. There’s still plenty of land to be redeveloped and no shortage of opportunities for increased density in the inner Loop and that’s even before we start really gentrifying the 3rd and 5th wards. For me, i’ll hold off on Inner Loop property until the boomers start dwindling down.” [joel, commenting on Mirroring the Features of a Simple $310K Studewood St. Duplex] Illustration: Lulu

“. . . Our current population boom was due to an unexpected resurgence in the gulf of mexico oil market and hit our housing supply by complete surprise. However, the housing market will be going full steam for the next few years to catch up on supply and entire new subdivisions are going to be created that are well outside of the property value inflation we’re seeing in town. The vast majority of new residents are already buying well outside of the 610 Loop. Even the snottiest of inner loopers such as myself would eventually consider buying a mansion in the ‘burbs for the same price as a cluttered townhome in the Loop.

. . . Not to say we’re in a bubble right now, but beyond doubt there will be a lot of downward pressure on home prices in the Houston area moving forward unless we see employment start accelerating again. That definitely is not going to be likely no matter how well the gulf market holds up. So I think people claiming there is or isn’t a bubble are being a bit premature, we all have to wait and see. I believe the general expectation is that although values have shot up, there should be enough demand to hold the prices up moving forward. So yes, odds are probably against a bubble, but I would expect that this burst of demand has pulled property valuations forward quite a bit and that folks shouldn’t expect to see gains on home prices for the next 5 years or so as a glut of new apartments and homes come onto the market. There’s still plenty of land to be redeveloped and no shortage of opportunities for increased density in the inner Loop and that’s even before we start really gentrifying the 3rd and 5th wards. For me, i’ll hold off on Inner Loop property until the boomers start dwindling down.” [joel, commenting on Mirroring the Features of a Simple $310K Studewood St. Duplex] Illustration: Lulu

GAINING IN HOUSTON’S GAYBORHOODS  So home prices are rising in urban areas — no surprise there. But nowhere are those prices rising faster than in so-called “gayborhoods.” That’s according to Jed Kolko, crunching the numbers for Trulia: “Neighborhoods where same-sex male couples account for more than 1% of all households (that’s three times the national average) had price increases, on average, of 13.8%. In neighborhoods where same-sex female couples account for more than 1% of all households, prices increased by 16.5% –– more than one-and-a-half times the national increase.” Prime Property’s Nancy Sarnoff adds that in Houston in Rosedale prices are up 16 percent and 14 percent in Hyde Park, where the 1920s Jackson Blvd. bungalow shown here is for sale for $425,000. [Trulia Trends; Prime Property] Photo of 1223 Jackson: HAR

So home prices are rising in urban areas — no surprise there. But nowhere are those prices rising faster than in so-called “gayborhoods.” That’s according to Jed Kolko, crunching the numbers for Trulia: “Neighborhoods where same-sex male couples account for more than 1% of all households (that’s three times the national average) had price increases, on average, of 13.8%. In neighborhoods where same-sex female couples account for more than 1% of all households, prices increased by 16.5% –– more than one-and-a-half times the national increase.” Prime Property’s Nancy Sarnoff adds that in Houston in Rosedale prices are up 16 percent and 14 percent in Hyde Park, where the 1920s Jackson Blvd. bungalow shown here is for sale for $425,000. [Trulia Trends; Prime Property] Photo of 1223 Jackson: HAR

THE BOOK OF JOHN STAUB  Maybe literature does have an impact in the real world — or the world of real estate, at least: “After the 2007 publication of The Country Houses of John F. Staub, by [architectural historian] Stephen Fox,” reports Nancy Keates from The Wall Street Journal, “momentum gained to save Staub homes that were being torn down, particularly in the affluent River Oaks neighborhood.” And this retroactive interest is happening all over the country, writes Keates: Homebuyers are looking back, when they’re looking to buy, for “an original source of traditional architecture — as opposed to the newer ‘McMansion’ variety.” Houstonian Calvin Schlenker and his wife paid $6.3 million for their John Staub, a “neo-Georgian” that dates to 1930: ”There’s a very limited inventory, they don’t come on the market very often and there’s great demand,” [Schlenker] says. . . . Houston real-estate agent Janie Miller says Staub homes have more of a premium than ever. ‘You pay so much more it isn’t funny. It’s like buying a diamond from Tiffany’s.'” [Wall Street Journal; previously on Swamplot] Photo of 2110 River Oaks Blvd.: HAR

Maybe literature does have an impact in the real world — or the world of real estate, at least: “After the 2007 publication of The Country Houses of John F. Staub, by [architectural historian] Stephen Fox,” reports Nancy Keates from The Wall Street Journal, “momentum gained to save Staub homes that were being torn down, particularly in the affluent River Oaks neighborhood.” And this retroactive interest is happening all over the country, writes Keates: Homebuyers are looking back, when they’re looking to buy, for “an original source of traditional architecture — as opposed to the newer ‘McMansion’ variety.” Houstonian Calvin Schlenker and his wife paid $6.3 million for their John Staub, a “neo-Georgian” that dates to 1930: ”There’s a very limited inventory, they don’t come on the market very often and there’s great demand,” [Schlenker] says. . . . Houston real-estate agent Janie Miller says Staub homes have more of a premium than ever. ‘You pay so much more it isn’t funny. It’s like buying a diamond from Tiffany’s.'” [Wall Street Journal; previously on Swamplot] Photo of 2110 River Oaks Blvd.: HAR

COMMENT OF THE DAY: ABOUT THAT 35-STORY TOWER ABOUT TO GO UP DOWN THE STREET “I need some opinions. A friend of mine owns a patio home on W Alabama next to this site. Will this help or hurt her property value? There’s a one acre tract between this development and hers, and we don’t know what it’s going to be. I figure it might help her value because it will be near retail and probably a restaurant or two, but who knows?” [Bill, commenting on First Sign of the 35-Story Apartment Tower Coming to Weslayan and West Alabama]

COMMENT OF THE DAY: BIG LOTS “In regards to crazy land values inside the loop, I have an opinion as an active RE broker. Anything that is 2 to 5 acres seems to be in huge demand from institutional multi-family developers. They have lenders that want to lend on apartment projects and the scarcity of larger in-fill tracts result in the $75psf average that hits a range between $60 to $85psf. What is missed here is that owners who sit on dirt in the same dense areas with smaller parcels way under 2 acres, have no market driving forces paying anywhere over $50psf. Home builders used to drive the market, but they have gone on a diet. Hope this helps put it all in perspective; there is just a higher premium paid for larger tracts.” [Janak, commenting on West Ave-Style Apartments and Retail Planned for Dunlavy Fiesta Site?]

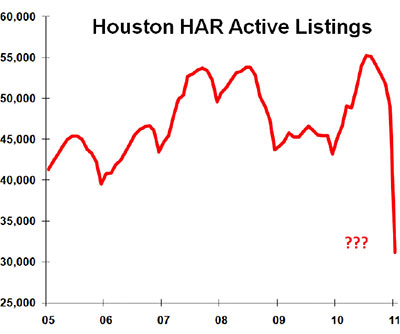

One of the more surprising stats in the latest residential home-sales data released yesterday by the Houston Association of Realtors, Swamplot’s numbers expert is kind enough to point out, is a whopping almost 40 percent drop in the number of listings that were active last January. Whazzat mean? That there were 40 percent fewer active listings this January than in January 2010? No, it’s screwier than that: The latest HAR report says that there were almost 40 percent fewer active listings in January 2010 than their own reports told us a year ago. Revising last year’s numbers down so dramatically, of course, makes it a whole lot easier for the local real-estate organization to announce at least one piece of news in this month’s press release: Listings are up 13.7 percent over this time last year!

But the new report doesn’t mention any adjustments. And it makes similar — though less dramatic — changes to last year’s data in several other categories.

COMMENT OF THE DAY: ARE YOU ALL SHORT-TIMERS HERE? “I have often wondered… Why is there such a collective push towards “improving property valueâ€? I think it’s a terrible thing! My preference is for the value of my property to stabilize. I don’t want it to fall, because it would make the neighborhood as a whole lose value and therefore invite blight; but I don’t want it to rise either, because I will simply have to pay more taxes on it. The only reason for anyone to hope for their property value to rise is because they would prefer to sell it. In my opinion, that’s not a sustainable model, because the only ones that benefit from it are the ones that do not want to keep the house long-term. That’s how you end up with sub-par quality ‘houses’ built by seedy developers. Am I off base?” [Alex, commenting on Where Houston’s Lot-Size Restrictions Went, Year by Year]

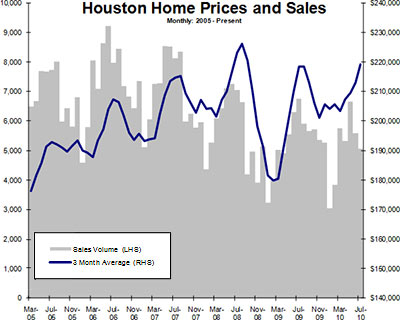

Sales of single-family homes in the Houston area were 25.1 percent lower this July than last, according to HAR data released this week. Swamplot’s occasional home-sales correspondent writes in with a few illustrated comments:

Certainly 25% is an eye catching number but everyone saw it coming with the expiration of the tax credit. . . . This lower volume comes in the middle of a strong April-August selling season, and lower pending sales means we will have another weak month to report for August.

The good news (for homeowners and sellers): home prices haven’t fallen!

Color me impressed (errr…wrong) on pricing trends. Home prices have held up really well in Houston . . . The chart [above] shows this trend. Keep in mind, prices always peak in the summer, so as temperatures cool, so will home prices.

Sales of homes priced between $150K and $250K dropped 35.0 percent. But high-priced home sales suffered too: Sales of homes above $500K dropped 22.7 percent.

These are homes that are NOT really influenced by the $8,000 tax credit. I have been arguing for a long time that the high end market in Houston is actually much worse than the market for moderately priced homes. Builders have been building giant houses for years and they are languishing . . .

Speaking of which, [here’s a chart showing the] total number of HAR active listings: