COMMENT OF THE DAY: THE PROBLEMS SPRAWL SOLVES  “. . . the concern about cities expanding out into the suburbs is about worker mobility and our ability to fund adequate infrastructure. That’s great if the woodlands, katy, and sugarland could become real functioning cities comparable to that of Houston. However, it’s unsustainable if you have poor transportation options affecting the supply of qualified labor and an undiversified industry base that leads to boom and bust cycles. We can barely afford Metro’s reach in central Houston and with more low-income workers being pushed further from the city’s core we will continue to lose workers from our supply of labor.

I love Houston the way it’s always been though. having multiple office centers spread across town helps keep housing demand distributed across a wider area rather than turning the central part of town into an enclave for well paid dual income families only. Allowing land to continue being gobbled up further and further out allows for affordable housing for new residents increasing our supply of labor. Anything that helps cities expand, even if endless suburban sprawl, and make better use of their existing resources and infrastructure is a positive to me.” [joel, commenting on Comment of the Day: West Houston’s Plan for Suburban Domination] Illustration: Lulu

“. . . the concern about cities expanding out into the suburbs is about worker mobility and our ability to fund adequate infrastructure. That’s great if the woodlands, katy, and sugarland could become real functioning cities comparable to that of Houston. However, it’s unsustainable if you have poor transportation options affecting the supply of qualified labor and an undiversified industry base that leads to boom and bust cycles. We can barely afford Metro’s reach in central Houston and with more low-income workers being pushed further from the city’s core we will continue to lose workers from our supply of labor.

I love Houston the way it’s always been though. having multiple office centers spread across town helps keep housing demand distributed across a wider area rather than turning the central part of town into an enclave for well paid dual income families only. Allowing land to continue being gobbled up further and further out allows for affordable housing for new residents increasing our supply of labor. Anything that helps cities expand, even if endless suburban sprawl, and make better use of their existing resources and infrastructure is a positive to me.” [joel, commenting on Comment of the Day: West Houston’s Plan for Suburban Domination] Illustration: Lulu

Comments

COMMENT OF THE DAY RUNNER-UP: WHAT DIFFERENCE DOES THE PRICE OF OIL MAKE TO HOUSTON REAL ESTATE?  “Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [c.l., commenting on Houston Housing Market Reaches All-Time Highs — Before It Crashes, Dips a Little, Remains Steady, or Climbs Further] Illustration: Lulu

“Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [c.l., commenting on Houston Housing Market Reaches All-Time Highs — Before It Crashes, Dips a Little, Remains Steady, or Climbs Further] Illustration: Lulu

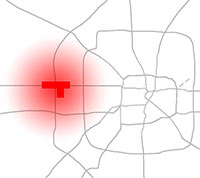

COMMENT OF THE DAY: WEST HOUSTON’S PLAN FOR SUBURBAN DOMINATION  “Houston does not have a centralized downtown district. After Gerry Hines built the Galleria, the city fractured into numerous regional shopping centers and has remained decentralized since. Perhaps Houston functions better this way.

Humpty Dumpty fell off the wall and all the King’s men cannot put Humpty Dumpty back together again.

MetroNational and Midway Cos. are determined to reconstruct Houston with a new centralized downtown district in CityCentre. They envision Memorial Drive and Gessner as commercial 8-lane thoroughfares. They envision the corridor of residential neighborhoods between the Katy Freeeway and Memorial Drive as one big mega shopping center, an expansion of Memorial City that stretches on for miles. They envision deed restricted neighborhoods of Walnut Bend and Briargrove Park as office parks. Don’t believe me? Just go to the West Houston Association website and click on 2050 map. They are serious about remapping Houston. And what are they going to do with all the storm water run-off from these commercial buildings? They are going to channel it into Buffalo Bayou, of course. To do this they have to deforest the bayou and widen and deepen and concrete it. They are determined to do it. And where are they going to get the money to do this? Out of TIRZ 17 and MetroNational Bank.” [Memorial Resident, commenting on Comment of the Day: Houston’s Westward Tilt] Illustration: Lulu

“Houston does not have a centralized downtown district. After Gerry Hines built the Galleria, the city fractured into numerous regional shopping centers and has remained decentralized since. Perhaps Houston functions better this way.

Humpty Dumpty fell off the wall and all the King’s men cannot put Humpty Dumpty back together again.

MetroNational and Midway Cos. are determined to reconstruct Houston with a new centralized downtown district in CityCentre. They envision Memorial Drive and Gessner as commercial 8-lane thoroughfares. They envision the corridor of residential neighborhoods between the Katy Freeeway and Memorial Drive as one big mega shopping center, an expansion of Memorial City that stretches on for miles. They envision deed restricted neighborhoods of Walnut Bend and Briargrove Park as office parks. Don’t believe me? Just go to the West Houston Association website and click on 2050 map. They are serious about remapping Houston. And what are they going to do with all the storm water run-off from these commercial buildings? They are going to channel it into Buffalo Bayou, of course. To do this they have to deforest the bayou and widen and deepen and concrete it. They are determined to do it. And where are they going to get the money to do this? Out of TIRZ 17 and MetroNational Bank.” [Memorial Resident, commenting on Comment of the Day: Houston’s Westward Tilt] Illustration: Lulu

COMMENT OF THE DAY: HOUSTON’S WESTWARD TILT  “News flash: the energy corridor is now the economic center of town. Downtown is just where companies go to save on rents bc the EC might be too pricey. There are — of course — big legacy companies still downtown but three super majors are between HW 6 and Dairy Ashford.” [Houstonian, commmenting on Another Chelsea Gets Away] Illustration: Lulu

“News flash: the energy corridor is now the economic center of town. Downtown is just where companies go to save on rents bc the EC might be too pricey. There are — of course — big legacy companies still downtown but three super majors are between HW 6 and Dairy Ashford.” [Houstonian, commmenting on Another Chelsea Gets Away] Illustration: Lulu

COMMENT OF THE DAY: WHAT LIFE FORMS HOMES GOT RIGHT  “I’m also a big Life Forms fan, I own and live in one in the Woodlands. So happens I’m an architect, too. Life Forms is the only company I know that has built suburban tract homes which are innovative, spatially unique, extremely livable, and which complement the landscape. Truly American, as I would like to say it. Many of Life Forms homes were also created for a price point that allowed normal folks like us to experience unique and honest architecture. I do that every day now. Scott Mitchell deserves unique credit as an exceptional architect, a brilliant home builder, and a true innovator.

Most American architecture amounts to mindlessly recompiled ‘tradition,’ endlessly mundane and pretentious. No where is this more evident than in American tract homes. Bad copies of architectural forms and inspiration: selectively applied pastiche . . . that is the norm. As the ‘home of the free and the brave,’ as social and technological pioneers, we Americans ought to pride ourselves on our residential buildings, too. Life Forms challenged the organization, layout, forms, spaces, use of light . . . just about everything that’s bad about the typical american home. Sure some of the details may look dated to us now, and not all the experiments they did were successful. But many of them were. . . .” [Paul Schuyler, commenting on A Look at George Mitchell’s Decked-Out Home in The Woodlands, All Cleaned Up and Cleared Out for Sale] Illustration: Lulu

“I’m also a big Life Forms fan, I own and live in one in the Woodlands. So happens I’m an architect, too. Life Forms is the only company I know that has built suburban tract homes which are innovative, spatially unique, extremely livable, and which complement the landscape. Truly American, as I would like to say it. Many of Life Forms homes were also created for a price point that allowed normal folks like us to experience unique and honest architecture. I do that every day now. Scott Mitchell deserves unique credit as an exceptional architect, a brilliant home builder, and a true innovator.

Most American architecture amounts to mindlessly recompiled ‘tradition,’ endlessly mundane and pretentious. No where is this more evident than in American tract homes. Bad copies of architectural forms and inspiration: selectively applied pastiche . . . that is the norm. As the ‘home of the free and the brave,’ as social and technological pioneers, we Americans ought to pride ourselves on our residential buildings, too. Life Forms challenged the organization, layout, forms, spaces, use of light . . . just about everything that’s bad about the typical american home. Sure some of the details may look dated to us now, and not all the experiments they did were successful. But many of them were. . . .” [Paul Schuyler, commenting on A Look at George Mitchell’s Decked-Out Home in The Woodlands, All Cleaned Up and Cleared Out for Sale] Illustration: Lulu

COMMENT OF THE DAY: HOUSTON REAL ESTATE PROBLEMS, WITH OR WITHOUT CHEAP OIL  “The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

“The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

COMMENT OF THE DAY: WHY IS ANYONE LIVING THAT CLOSE TO A REFINERY?  “Tax policy should probably discourage residential habitation in neighborhoods near the Houston Ship Channel and encourage people to move away from them. As such, giving existing residents or residential property owners a tax cut in order to reward them for residing there or maintaining and leasing housing to other people would be extraordinarily counterproductive and stupid.

Manchester in particular is a neighborhood where the City or State government should seriously consider its options with respect to eminent domain. There’s nothing quite like it anywhere else in the region. Even the furthest north residential bits and pieces of Pasadena are better isolated from refinery activities and more integrated into their city than is Manchester.” [TheNiche, commenting on Baytown Buc-ee’s Is Here; Goodbye Mission Burrito, Hello Ãœberrito Mexican Grill] Illustration: Lulu

“Tax policy should probably discourage residential habitation in neighborhoods near the Houston Ship Channel and encourage people to move away from them. As such, giving existing residents or residential property owners a tax cut in order to reward them for residing there or maintaining and leasing housing to other people would be extraordinarily counterproductive and stupid.

Manchester in particular is a neighborhood where the City or State government should seriously consider its options with respect to eminent domain. There’s nothing quite like it anywhere else in the region. Even the furthest north residential bits and pieces of Pasadena are better isolated from refinery activities and more integrated into their city than is Manchester.” [TheNiche, commenting on Baytown Buc-ee’s Is Here; Goodbye Mission Burrito, Hello Ãœberrito Mexican Grill] Illustration: Lulu

COMMENT OF THE DAY: BOSTON. IT’S WORTH IT TOO.  “I live in Boston which is pretty much the anti-Houston, moving there as an adult fleeing some of the things Blue Dog celebrates. Born and raised in sprawling Omaha, Nebraska, with its struggling downtown and leapfrogging subdivisions, I came east seeking the density, the option of subways and streetcars and walking because of the relative proximity of destinations, the historic architecture of row houses and institutions, the amenities of a major gateway city with an urban vibe. You’d hate Boston, the high cost of living, the terrible traffic on our chaotic layout of colliding streets, the lack of space, and the cold winters. I don’t like those things either, but I’ve decided to live with them because of the things I do like. You’ve made your choice too, and you intelligently don’t deny that you live in flat, sprawling, hot-humid, ten-lane-wide highway beribboned mass of strip mall scattered anonymity because you like it. And no snobby eastern elitist transplant so blinkered, he can’t appreciate the collective expression of American freedom that is Post Oak or The Woodlands or Sugarland or cul-de-sac-paradise-of-your-choice will . . . convince you otherwise. Midtown does seem to me kind of nice though :-)” [Robert H, commenting on Comment of the Day: The Real Houston Is Outside Those Tiny Urban Islands] Illustration: Lulu

“I live in Boston which is pretty much the anti-Houston, moving there as an adult fleeing some of the things Blue Dog celebrates. Born and raised in sprawling Omaha, Nebraska, with its struggling downtown and leapfrogging subdivisions, I came east seeking the density, the option of subways and streetcars and walking because of the relative proximity of destinations, the historic architecture of row houses and institutions, the amenities of a major gateway city with an urban vibe. You’d hate Boston, the high cost of living, the terrible traffic on our chaotic layout of colliding streets, the lack of space, and the cold winters. I don’t like those things either, but I’ve decided to live with them because of the things I do like. You’ve made your choice too, and you intelligently don’t deny that you live in flat, sprawling, hot-humid, ten-lane-wide highway beribboned mass of strip mall scattered anonymity because you like it. And no snobby eastern elitist transplant so blinkered, he can’t appreciate the collective expression of American freedom that is Post Oak or The Woodlands or Sugarland or cul-de-sac-paradise-of-your-choice will . . . convince you otherwise. Midtown does seem to me kind of nice though :-)” [Robert H, commenting on Comment of the Day: The Real Houston Is Outside Those Tiny Urban Islands] Illustration: Lulu

COMMENT OF THE DAY: ENJOY THE RIDE  “Houston: the wonder city that showed the country how laissez-faire economics, conservative values, and lax planning lead to growth and prosperity.

It turns out Houston was just benefiting from another bubble and a siphoning of wealth from the rest of the country via higher gasoline prices.

The shale boom was supposedly proof that peak oil was dead and we can keep building car-dependent cities. Houston was riding into the future in its new Mercedes.

It turns out that shale was only accessible at prices too high to pay to maintain strong economies around the world. When consumers cut oil demand, the shale, deepwater, and tar sands dry up.

We’re on the slope downward, folks. Oil prices will likely spike again when demand returns, Houston may boom temporarily, but consumers aren’t going to be able to pay for it forever. After the spike, demand slackens, prices drop, and expensive new oil projects are cancelled. Production drops, demand outstrips supply, and we hit another price spike. Over and over it goes until we one day wonder why we can’t afford to open the oil taps as wide as we could in the 2000-2010s. The thriving economies will be the ones that depend least on oil.” [Carpetbagger, commenting on Oil Price Plunge Leads to Stock Downgrade for New Greenway Plaza Owners] Illustration: Lulu

“Houston: the wonder city that showed the country how laissez-faire economics, conservative values, and lax planning lead to growth and prosperity.

It turns out Houston was just benefiting from another bubble and a siphoning of wealth from the rest of the country via higher gasoline prices.

The shale boom was supposedly proof that peak oil was dead and we can keep building car-dependent cities. Houston was riding into the future in its new Mercedes.

It turns out that shale was only accessible at prices too high to pay to maintain strong economies around the world. When consumers cut oil demand, the shale, deepwater, and tar sands dry up.

We’re on the slope downward, folks. Oil prices will likely spike again when demand returns, Houston may boom temporarily, but consumers aren’t going to be able to pay for it forever. After the spike, demand slackens, prices drop, and expensive new oil projects are cancelled. Production drops, demand outstrips supply, and we hit another price spike. Over and over it goes until we one day wonder why we can’t afford to open the oil taps as wide as we could in the 2000-2010s. The thriving economies will be the ones that depend least on oil.” [Carpetbagger, commenting on Oil Price Plunge Leads to Stock Downgrade for New Greenway Plaza Owners] Illustration: Lulu

COMMENT OF THE DAY: WHY THE WATER IN YOUR NATURALLY FILTERED BAYOU-SIDE SWIMMING HOLE IS GOING TO BE BROWN  “I’ll bite. Here’s a very simple engineering analysis.

Problems with stream-fed swimming pools in Houston are going to be three-fold:

1) Silt (in engineer-speak, Total-Suspended-Solids or TSS). TSS is treated with sedimentation basins. That can be a large pool (that people don’t swim in) adjacent to the real pool. In water/wastewater treatment plants, a coagulant like alum is usually added to sedimentation basins to make TSS precipitate out quicker. If you’re going to do this with no chemicals, you’ve got to be willing to accept either VERY long treatment times, or only partially successful results. The tiny diameter of the clay particles that make up the TSS in our bayous just flat out won’t come out of suspension without a coagulant, so the water WILL be brown. It’s not necessarily a deal breaker — the water in Galveston’s brown too.

2) Bacteria (in engineer-speak, total coliform count). See here. Usually these are E. Coli, algae, and some protests. ALL streams/lakes/oceans in the entire world have this, even the cleanest and clearest. Realistically, to get an insurance policy to operate, the water’s going to have to be disinfected to some degree. That means chlorination (chemicals), ozonation (chemicals), or UV disinfection. More on UV in a minute.

3) Dissolved oxygen content. You don’t want the water to turn anaerobic. If there’s enough carbon-containing compounds dissolved in the water, the bacteria naturally in the water will eat it rapidly, causing the bacteria to use up all the oxygen that’s already dissolved in the water. This leads to any/all fish in the water suddenly dying off, as well as noxious smells and other really terrible stuff. You can make sure the dissolved oxygen doesn’t drop by filtering out carbon containing compounds (takes chemicals), or using aerators. A dual-way to solve the #2 and #3 issues is by passing the water over a very shallow (less than 6-in. deep) bed of rocks at a fast speed. Think rapids. This lets the water simultaneously re-oxygenate and also absorb huge amounts of UV. This might be the sort of silver bullet that makes this possible in Houston.

So: This is going to be expensive, but it’s probably do-able. However, the water is still going to be brown. Sorry.” [Ornlu, commenting on Bayou Swimming Hole Promoters Jump To Kickstarter To Jumpstart Project] Illustration: Houston Needs a Swimming Hole

“I’ll bite. Here’s a very simple engineering analysis.

Problems with stream-fed swimming pools in Houston are going to be three-fold:

1) Silt (in engineer-speak, Total-Suspended-Solids or TSS). TSS is treated with sedimentation basins. That can be a large pool (that people don’t swim in) adjacent to the real pool. In water/wastewater treatment plants, a coagulant like alum is usually added to sedimentation basins to make TSS precipitate out quicker. If you’re going to do this with no chemicals, you’ve got to be willing to accept either VERY long treatment times, or only partially successful results. The tiny diameter of the clay particles that make up the TSS in our bayous just flat out won’t come out of suspension without a coagulant, so the water WILL be brown. It’s not necessarily a deal breaker — the water in Galveston’s brown too.

2) Bacteria (in engineer-speak, total coliform count). See here. Usually these are E. Coli, algae, and some protests. ALL streams/lakes/oceans in the entire world have this, even the cleanest and clearest. Realistically, to get an insurance policy to operate, the water’s going to have to be disinfected to some degree. That means chlorination (chemicals), ozonation (chemicals), or UV disinfection. More on UV in a minute.

3) Dissolved oxygen content. You don’t want the water to turn anaerobic. If there’s enough carbon-containing compounds dissolved in the water, the bacteria naturally in the water will eat it rapidly, causing the bacteria to use up all the oxygen that’s already dissolved in the water. This leads to any/all fish in the water suddenly dying off, as well as noxious smells and other really terrible stuff. You can make sure the dissolved oxygen doesn’t drop by filtering out carbon containing compounds (takes chemicals), or using aerators. A dual-way to solve the #2 and #3 issues is by passing the water over a very shallow (less than 6-in. deep) bed of rocks at a fast speed. Think rapids. This lets the water simultaneously re-oxygenate and also absorb huge amounts of UV. This might be the sort of silver bullet that makes this possible in Houston.

So: This is going to be expensive, but it’s probably do-able. However, the water is still going to be brown. Sorry.” [Ornlu, commenting on Bayou Swimming Hole Promoters Jump To Kickstarter To Jumpstart Project] Illustration: Houston Needs a Swimming Hole

COMMENT OF THE DAY: FLOATING THE STUCK-ON STONE BELOW THE STUCCO  “Can just one builder find a way to transition a column [see photo detail at right] to the ground instead of the ridiculous ‘high-water’ pants look? It looks stupid and yet you see it everywhere. I assume for stucco construction it’s done to prevent water seeping/rot.” [Limestone, commenting on Wainscot World: Channeling the Paneling Within an Almost New Older Home in Mandell Place Seeking $1.35M] Photo: HAR

“Can just one builder find a way to transition a column [see photo detail at right] to the ground instead of the ridiculous ‘high-water’ pants look? It looks stupid and yet you see it everywhere. I assume for stucco construction it’s done to prevent water seeping/rot.” [Limestone, commenting on Wainscot World: Channeling the Paneling Within an Almost New Older Home in Mandell Place Seeking $1.35M] Photo: HAR

COMMENT OF THE DAY: ZONE D’ EROTICA IS A SYMBOL OF HOUSTON FREEDOM  “I’ve always thought the Zone D’Erotica placement was one of the most charming things about Houston.

Welcome to Houston: you own it, you use it, however you want. Other cities would be finding a way to declare the parcel blighted at Simon’s behest, but in Houston that would be rightly considered outrageous.” [Spoonman, commenting on Construction Set To Begin on the Luxury Jewel Box, the Galleria’s Chi-Chi Pad Site] Photo: Candace Garcia

“I’ve always thought the Zone D’Erotica placement was one of the most charming things about Houston.

Welcome to Houston: you own it, you use it, however you want. Other cities would be finding a way to declare the parcel blighted at Simon’s behest, but in Houston that would be rightly considered outrageous.” [Spoonman, commenting on Construction Set To Begin on the Luxury Jewel Box, the Galleria’s Chi-Chi Pad Site] Photo: Candace Garcia

COMMENT OF THE DAY: HOW MT. YUPPIE WAS FORMED  “When this place opened, there was a ‘oh no, here come the yuppies‘ reaction. Now, years later, it is closing and people are complaining about how the Heights is losing its character. Basically, a reprise of ‘oh no, here come the yuppies.’ It is really just the process of yuppie sedimentary rock formation. Yuppies get older, have kids and become boring. Their hangouts go out of style and go out of business. Then, the next layer of yuppies comes in and opens new businesses and the prior layer of former yuppies groan about the neighborhood losing its character.” [Old School, commenting on Sunset Heights Wine Bar The Boom Boom Room Will Close Forever This Friday] Illustration: Lulu

“When this place opened, there was a ‘oh no, here come the yuppies‘ reaction. Now, years later, it is closing and people are complaining about how the Heights is losing its character. Basically, a reprise of ‘oh no, here come the yuppies.’ It is really just the process of yuppie sedimentary rock formation. Yuppies get older, have kids and become boring. Their hangouts go out of style and go out of business. Then, the next layer of yuppies comes in and opens new businesses and the prior layer of former yuppies groan about the neighborhood losing its character.” [Old School, commenting on Sunset Heights Wine Bar The Boom Boom Room Will Close Forever This Friday] Illustration: Lulu

COMMENT OF THE DAY: HOW TO GROW THE CITY MONEY ON TREES  “Hedge funds would blush at these returns. What did it cost the city to plant these suckers? $1k at most . . . And they got $50k apiece for them? Now I’m not saying we should celebrate the loss of these trees, but I hope right now some keen eager young city arborist is planning some oak plantings along the most outrage-worthy corridors in Houston, where they will best rankle the franchises of the future. How old does a tree have to be to elicit outrage? Maybe 20 years? At an eye-popping 22% IRR, perhaps some strategic tree-driven investments can make future union pension negotiations a bit easier . . .” [Sebastian Good, commenting on City Nets $300K Settlement for Late-Night Kirby Dr. Wendy’s Oak-Axing Incident] Illustration: Lulu

“Hedge funds would blush at these returns. What did it cost the city to plant these suckers? $1k at most . . . And they got $50k apiece for them? Now I’m not saying we should celebrate the loss of these trees, but I hope right now some keen eager young city arborist is planning some oak plantings along the most outrage-worthy corridors in Houston, where they will best rankle the franchises of the future. How old does a tree have to be to elicit outrage? Maybe 20 years? At an eye-popping 22% IRR, perhaps some strategic tree-driven investments can make future union pension negotiations a bit easier . . .” [Sebastian Good, commenting on City Nets $300K Settlement for Late-Night Kirby Dr. Wendy’s Oak-Axing Incident] Illustration: Lulu

COMMENT OF THE DAY: HOW REAL ESTATE TRAILBLAZERS REALLY CAN BURN UP THE TRAIL  “There are very real consequences for having a NIMBY-smashing attitude for developers. Yes, the developers usually get their way, but they often end up ruining it for the next guy. Ashby developers will get to build, but the next guy might not because of the high-rise buffering ordinance that passed in the wake of the Ashby uproar. 380 agreements flowed like a river to Walmart and Kroger, but community uproar has meant that only Costco has since been able to get a similar deal despite some healthy opposition in city council. And there has only been one 380 agreement in 2014 outside of the downtown urban living initiative (which does require first floor space to be retail ready). There are a whole host of development regulations that have their root in NIMBY activism: drainage detention, tree ordinance, and parking minimums, to name a few.” [Old School, commenting on Comment of the Day: Don’t Let the Locals Get in the Way of Your Project] Illustration: Lulu

“There are very real consequences for having a NIMBY-smashing attitude for developers. Yes, the developers usually get their way, but they often end up ruining it for the next guy. Ashby developers will get to build, but the next guy might not because of the high-rise buffering ordinance that passed in the wake of the Ashby uproar. 380 agreements flowed like a river to Walmart and Kroger, but community uproar has meant that only Costco has since been able to get a similar deal despite some healthy opposition in city council. And there has only been one 380 agreement in 2014 outside of the downtown urban living initiative (which does require first floor space to be retail ready). There are a whole host of development regulations that have their root in NIMBY activism: drainage detention, tree ordinance, and parking minimums, to name a few.” [Old School, commenting on Comment of the Day: Don’t Let the Locals Get in the Way of Your Project] Illustration: Lulu