COMMENT OF THE DAY: ANOTHER GRAND PARKWAY REVENUE STUDY “I think it’s time to feature just which entities have acquired land adjacent to this boondoggle. List which individuals hold controlling interest and then we can discuss interesting sidelights like contributions to various elected officials.” [devans, commenting on Investing in the Grand Parkway]

Financing

INVESTING IN THE GRAND PARKWAY Commuters struggling to cross the Katy Prairie on congested House Hahl Rd. will be happy to learn that traffic relief is on the way: Harris County’s commissioners voted yesterday to apply for $181 million in federal stimulus money for the Segment E marshland cut-through of the Grand Parkway, which will connect major employment and shopping centers in Katy and Cypress. $20 million in engineering and other contracts for the project were awarded a few months ago, but the commissioners yesterday approved a “comprehensive traffic and revenue study” for the segment. The study, which won’t be complete before construction begins in February, will help support claims that the road will be able to pay for itself, with tolls. [Houston Chronicle; more from Houston Tomorrow, both via Off the Kuff]

There’s a new $2 million bed and breakfast going up in Midtown? The Chronicle‘s Nancy Sarnoff reports that the project’s developers were “able to persuade a lender” to finance construction of their 3-story “New Orleans-style” B&B, which has already broken ground at 2800 Brazos, at the corner of Drew St.:

“It was a little challenging early on in the process,†[developer Genora] Boykins said. “The thing that made the difference is we really didn’t give up on the vision we have.†. . .

That sort of positive thinking is apparently nothing new for Boykins, an attorney for Reliant Energy who serves on the Downtown Management District board of directors — along with her La Maison partner, Centerpoint Energy community relations VP Sharon Owens.

Kirbyjon Caldwell, the pastor of 14,000-member Windsor Village United Methodist Church, provides more insight into Boykins’s real-estate techniques in Chapter 3 of his now-decade-old bestseller, The Gospel of Good Success: A Road Map to Spiritual, Emotional and Financial Wholeness:

FIGHTING THE NEW APPRAISAL RULES A Swamplot reader draws attention to a “rumored email” purporting to show that the National Association of Realtors is gearing up for a campaign against the Housing Valuation Code of Conduct that went into effect at the beginning of May. The HVCC was meant to safeguard the independence of appraisals — in part by prohibiting loan officers, mortgage brokers, and real estate agents from selecting the appraiser for a particular property. The email, posted on a San Fernando Valley real-estate blog, indicates that the NAR is pushing Congress to impose an 18-month moratorium on the new code. Our reader wonders if recent stories of “unfair appraisals” — such as this one — are the result of a larger “orchestrated campaign” against the new rules. [Effective Demand; Swamplot inbox]

THE FEDERAL RESERVE’S EXTENDED STAY IN HOUSTON Extended Stay Hotels, which operates 21 extended-stay hotels in Houston under the Homestead Studio Suites, StudioPLUS Deluxe Studios, Extended Stay America, and Crossland Economy Studios brands, declared Chapter 11 bankruptcy earlier this week. How is the Fed involved? “The Federal Reserve holds $744 million of various junior classes of debt and $153 million in the senior debt that the central bank assumed after the collapse of Bear Stearns, which held a sizable amount of the hotel chain’s debt. The losses are mounting for the Fed on those Bear Stearns assets, which continue to sour. Extended Stay loans were held on the Fed’s balance sheet via a company called Maiden Lane that the central bank lent $29 billion in June 2008 to purchase $30 billion of Bears’ assets.” [Deal Journal; more at Calculated Risk]

COMMENT OF THE DAY: THE UPPER LIMITS OF INNER LOOP RENTS “The reason the inner loop is ‘soft’ is simple math. A tiny apartment is now something like $1,200 per month. Meanwhile, my mortgage on my inner-loop house is just over $1,300.” [me, commenting on Where Rents Have Dropped]

The giant inflatable-boat-like structure shown here afloat in an otherwise-empty East Downtown six-pack superblock is the latest rendition of . . . the new Houston Dynamo soccer stadium! The Houston Chronicle‘s Bernardo Fallas has details:

The Dynamo want to have the roughly $85 million, 22,000-seat stadium ready for opening day 2011. They envision an all-round two-level, all-seater venue with 34 suites, 86 concession point-of-sales, a 3,000 square-foot club level and a party deck on the southeast corner.

Loving that subtle “soccer fans on a life raft” imagery? It gets better: The open-air stadium’s playing surface will be a full story underground!

A financial blogger going by the overused name of Tyler Durden points to some fishy behavior on the part of banks promoting a new stock offering by troubled Weingarten Realty. Writes the reader who alerted Swamplot to the story:

This may be a bit too finance-y for you, but apparently a recent Weingarten equity offering is being used to pay down debt to banks, which the author of this post (and me) find a bit suspicious. Further shenanigans? Analyst recommendations changing for the better just before the tender.

Is this too finance-y for Swamplot? Let’s find out!

COMMENT OF THE DAY: WILSHIRE VILLAGE PAYMENT DUE “I forgot to mention that with regard to the loan Dilick took out to pay for taxes on the property four years ago, sources have reported that the bank set a deadline of early April 2009 for him to take steps toward paying back that loan. In demolishing the apartments and selling the land, Dilick would be able to pay back the loan and make a profit as well. . . . As to the comment, ‘This is private property. The owner should be able to do with it as he sees fit,’ the problem is that Jay Cohen, who inherited the property from his parents, still holds 80 percent ownership. Sadly, he was duped or forced by circumstance into signing over managing control to Dilick. . . .” [dredger, commenting on Comment of the Day: Grand Unified Wilshire Village Conspiracy Theory]

COMMENT OF THE DAY: PRESSURE TO CONFORM “The maximum conforming loan at an 80% LTV translates to a selling price of just over $520k. Given the current interest rate premium on jumbo mortgages, new-builds that are just a little over this amount are tending to languish on the market, whereas those in the sub-$500k range seem to still be selling briskly. If I were a developer planning on putting up some $600k+ houses, I might re-think my plans and target buyers who can take advantage of the current low rates for conforming loans.” [Angostura, commenting on Latest Greenwood King Report: On the Double!]

COMMENT OF THE DAY: DOWNTOWN HILTON GARDEN INN FURNITURE PLAN “Financing? WEDGE’s principal can find the money for this project in his couch cushions. According to ArabianBusiness.com, Issam Fares is currently the 32nd richest Arab on the planet with a net worth of $2.4 Billion.” [Bernard, commenting on Downtown Wallflower: A New Hilton Garden Inn?]

Sure is nice for us Houston didn’t get caught up in that big price run-up housing markets in the rest of the country fell for! That’s why in Houston real estate is in much better shape than it is everywhere else, right?

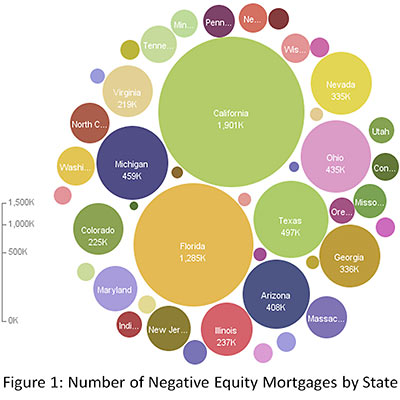

Not according to a study released yesterday by First American CoreLogic. The research firm estimates that 18.3 percent of all mortgaged properties in the Houston-Sugar Land-Baytown region are in a “negative equity position,” and another 6.7 percent are within just 5 percentage points of being there. “Negative equity,” AKA “I’ve fallen down and I can’t get up,” means a mortgage holder owes more than the underlying property is worth.

In other words, 1 in every 4 Houston-area mortgages is already in deep doo-doo.

But hey, all it’ll take to recover is for prices to rise a little! And the rest of the country is doing much worse, right?

Buyers didn’t show up for the latest sale at the old JCPenney building next to West Oaks Mall. So Wachovia Bank will foreclose on the property soon, the CoStar Group reports.

The bankruptcy trustee for the collapsed financial empire of Edward H. Okun had listed the vacant building, which Okun’s 1031 Tax Group had bought for $4 million. But no buyers were willing to pay even the amount of the financing, which was $3 million.

The Houston JCPenney building and a mall in Salina, Kansas — also now facing foreclosure — are Okun’s last remaining properties.

- Trustee’s Newsletter #12 [The 1031 Tax Group Bankruptcy Trustee]

- Last of Okun Empire Will End in Foreclosure [CoStar Group]

- Previously in Swamplot: West Oaks Mall Bankruptcy Sale: JCPenneys on the Dollar, West Oaks Mall: Your Exchanges Are No Good Here

WESTCREEK APARTMENTS: REFINANCED, WAITING The Austin-based owners of Westheimer’s Westcreek at River Oaks Apartments — just inside the Loop, just west of the giant new steel sculpture known as High Street — have refinanced the 574-unit complex with a $27.5 million, 7-year, floating-rate loan that allows prepayment with a penalty: “A flexible prepayment also means when market conditions warrant, the owner can redevelop the asset, which sits on 14.5 acres. ‘This is a well-maintained, but older property that sits on dirt, and the dirt is actually worth more than the apartments,’ [Matt] Greer [of Capmark Finance] explains. He says the asset’s owning partnership, which consists of local management company Kaplan Management Co. Inc. and an equity partner, will redevelop the property when market conditions come back.” [Globe St.]

So where are all the half-built homes? That question, asked by a Swamplot reader last week, prompted a slew of comments from other readers eager to identify pockets and neighborhoods in and around Houston where construction has come to a halt because of problems connected to the nationwide housing-market collapse. (As well as a few where construction stopped for reasons of a more local nature.)

Swamplot reader subprimelandguy suggested looking at Northwest Houston:

You need to go to the suburban areas, particularly the non master planned communities between the Beltway and Highway 6 / 1960. The most aggressive one is actually inside the Beltway near West Road and Gessner – a former Royce Homes (go figure) development called Westwood Gardens. It is a bombed out poster child for the subprime fiasco.

Then late yesterday, subprimelandguy sent in photos!