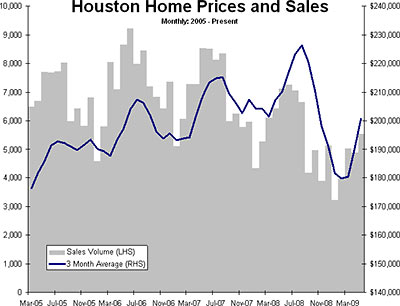

Swamplot’s chart-wielding analyst is back with a few comments on the Houston Association of Realtors’ latest report and media push:

Median and average home sales prices fell $7,200 from the prior month. This was including increased activity to get the $8,000 home buyer tax credit in under the wire! Now it is not fair to compare month to month numbers as seasonal factors are working against the housing market this month.

So we get some good spin from the realtors: “Home prices up 5%†“Sales up 13.8%†…this maps directly over to the mainstream press with no research: “Home sales rise for second month,†“Home prices up 5%,†“Sales up 13.8%†Homeowners in this town should be proud that such a hardworking PR machine still gins out great product!

Why would you call those year-over-year increases spin?

The realtors get to make a press release every month and every month something is a “record†and the press is under deadlines and it gets copied in verbatim. This is home prices up 5% and sales up 13.8% from HURRICANE IKE with no caveat in the headline going out to 200,000 print readers and as many web readers! Not bad for a days work.

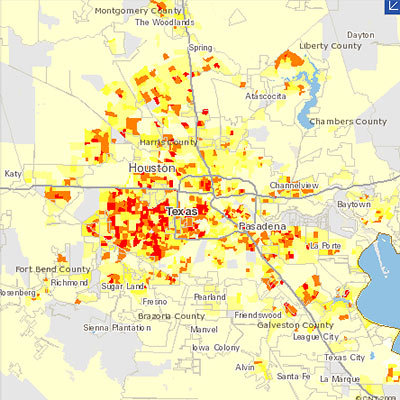

Oh, yeah. Forgot about that whole Ike thing. So what’s the market looking like really?