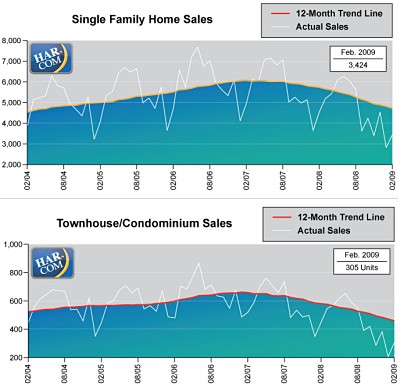

More comments on Greenwood King’s April market report, which focuses on real estate activity in Houston’s higher-end neighborhoods. A second reader focuses on prices, determined to find storm clouds in the report’s silver lining:

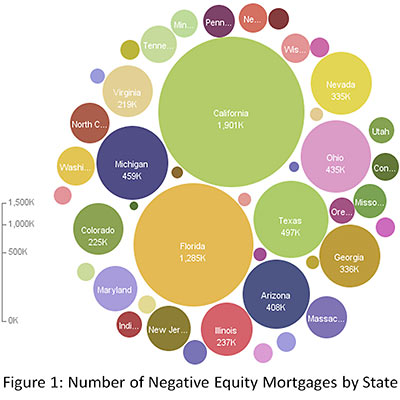

While some avg. sales prices are higher, this is most likely due to builders no longer buying lots to build on for b/t 400 and 500k.

Last week you had a poster ask to see the evidence of price declines and an eroding market. Here is further evidence of a declining market. Moreover, the poster requested to see comps that show declines. I think I have proof. Can we get a Realtor to confirm that a prime West U. property–3128 Lafayette–sold for 700,000 over two years ago and now has been recently reduced to 699,000. Welcome back to 2007–[how] much further do we have to go?

One problem with finding these declining comp examples (and I think there are more, and more on the way), is that the Realtors control all of the data and are reluctant to admit that the prime inner loop area that has been so good to them is begining to substantially turn negative.

- April Houston Market Report (PDF) [Greenwood King Properties]

- Greenwood King April Report: Getting a Little Crowded at the Top of the Market [Swamplot]

- Comment of the Day: Show Me the Deals!

Photo of 3128 Lafayette St. in West University: HAR