THE COMING FORECLOSURE FLOOD “Harris County foreclosures totaled 11,837 in 2008, up 0.6 percent from 11,766 during the prior year, according to The Woodlands-based Foreclosure Information & Listing Service. The figures represent foreclosed homes up for sale on the first Tuesday of each month at the courthouse. The next auction won’t be until January. . . . Foreclosures had made double-digit percentage gains in the prior two years. But they began to moderate toward the end of 2008 because the now government-controlled mortgage finance giants Fannie Mae and Freddie Mac halted foreclosure sales between Nov. 26 and Jan. 9. Also, earlier in the year, the U.S. Department of Housing and Urban Development put a 90-day moratorium on foreclosures in areas affected by Hurricane Ike. Additionally, lenders typically hold off on foreclosures during the Christmas season, adding to the slowdown, said Michael Weaster, an agent who specializes in selling foreclosed properties for banks. ‘Nobody wants to look like ogres during the holidays,’ Weaster said. ‘So what we’ve got in the pipelines is significant.’†[Houston Chronicle]

Tag: Foreclosures

Late last night city officials were able to get an emergency court order allowing a trustee to take over the La Casita Apartments at 313 Sunnyside near Northline. And MGC Mortgage, the company left holding onto the foreclosed property, has “transferred oversight” of the 600-unit complex behind Gallery Furniture to a new management company. The agreements, along with other interventions by the city, mean the more than 1,000 residents of the all-bills-paid apartments will not be evicted, have their water or electricity shut off, or lose credit for the monthly rent they just paid:

Residents of the La Casita Apartments already felt neglected by managers who let buildings run down, even before Hurricane Ike broke windows and tore patches off roofs. But instead of starting on repairs to make the apartments livable after the storm, management skipped town, keeping the rent money and leaving the bills unpaid.

The apparent owner of La Casita is an Indiana company named Briarwood Houston LP. The complex failed a Houston Housing Authority inspection last month. Police officials are investigating the management company’s handling of the payments.

- City helps halt evictions [Houston Chronicle]

- Residents Of Foreclosed Apartments Keep Homes [Click2Houston]

- Previously in Swamplot: Foreclosure Hits Northline Renters

FORECLOSURE HITS NORTHLINE RENTERS Residents of the La Casita Apartments are worried that they may be kicked out of their homes or have their water turned off. The all-bills-paid complex is being foreclosed on. Representatives from the city are planning a meeting this evening at Northline Elementary to discuss the situation with the more than 150 1,000 people who live in the complex, which sits behind Gallery Furniture just east of the North Freeway. Officers carrying assault rifles arrived at La Casita yesterday after apartment manager Ed Thomas called the police. After a notice was posted on the property informing the renters that they would be forced to move out immediately, upset residents had blocked Thomas’s car, complaining that he wasn’t giving them acceptable answers about their situation. [abc13]

A reader points out that NexCasa — the company responsible for the Kung Fu Panda renovation covered here yesterday — has two more properties on Westview: another “‘flipper’ type ranch” one block east, which comes with owner financing — and this “ultra modern” new construction across the street.

The new construction at 8571 Westview, which our source says is “pretty far along,” will have 5 bedrooms and 5 baths in 4200 sq. ft., and is listed at $999,000.

DELINQUENT DEBT: WEST OAKS MALL SALE! Here’s another chance to clean up some of the wreckage left by mysterious investor Edward Okun: “West Oaks Mall in Houston . . . has $81.3 million in delinquent debt attached to it in the form of commercial mortgage-backed securities. Joseph Luzinski, the federally appointed bankruptcy trustee for West Oaks Mall, said he hopes to sell the mall by year’s end, though store closures continue to hamper its value. [The mall] . . . is about 80% occupied, having lost a J.C. Penney, Linens ‘n Things and Whitehall Jewelers. The mall recently cut a deal to keep its Steve & Barry’s LLC store open amid that retailer’s bankruptcy. The special servicer for the mall’s debt, LNR Partners Inc., attempted to foreclose in September 2007, but Mr. Okun forestalled the move by putting the mall into Chapter 11 bankruptcy protection the next month. A federal grand jury indicted Mr. Okun on fraud charges last March after his 1031 Tax Group LLP, a company that helped facilitate tax-free real-estate deals for small investors, collapsed into bankruptcy and didn’t return $132 million of investors’ money.” [Wall St. Journal; previously]

THE MICHAEL B. SMUCK APARTMENT FLIPS BEGIN Triumph Land & Capital Management, the company that bought two other former Smucked apartment complexes, has already flipped a third: “‘The seller had bought the loan on Village at Loch Katrine, then foreclosed on it, then sold the property,’ says Russell D. Jones, vice president of Apartment Realty Advisors in Houston. He says Andrew Chong had signed the purchase agreement before Triumph Land & Capital foreclosed on the loan. Although Jones kept mum about the price, area sources believe the Village at Loch Katrine, situated at 16545 Loch Katrine Lane, sold for $6.5 million to $7 million.” [Globe St.; previously]

A Dallas real-estate firm is ready to rescue the Huntwick Apartments on FM 1960 near Wunderlich Rd. from receivership — and also from its management, before that, by Louisiana real-estate investor Michael B. Smuck.

As of last year, just as it prepared to file for bankruptcy, Smuck’s Louisiana-based MBS Companies owned 65 apartment buildings in Texas — 33 of them in the Houston area. Even prior to that, the company’s property-maintenance skills had reached legendary status. The president and executive vice president of the Houston Apartment Association relayed complaints from residents and neighbors of MBS apartments to the Wall Street Journal last year, and reported that the griping had only increased after the influx of residents fleeing Hurricane Katrina in late 2005.

Here’s a commenter on the Houston Politics blog back in April (quoted in Swamplot), describing the scene at the 288-unit Huntwick:

Balconies have collapsed, lots of overgrown vegetation, the paint is peeling, there is obviously a total lack of maintenance. A large tree split in half on their property adjacent to Coral Gables Dr., and after the dead half lay on the ground (in plain view) for over 6 months, a crew finally cut it into smaller pieces, which then lay in the same spot for another 6 months.

After the jump: What’s happening to the Huntwick, plus the complete Michael B. Smuck Houston apartment roster!

PROPERTY TAX PROTESTS: DIFFERENT COUNTIES, DIFFERENT RULES Bring up the number of foreclosures and the amount of time properties have been sitting on the market in your neighborhood when you protest your property taxes, and the Harris County Appraisal District will take that evidence into account. But the Fort Bend County Appraisal District won’t. [Houston Press]

Chronicle reporter Matt Stiles continues his tour of substandard Houston apartments, stopping this week for a visit at the 172-unit Candlewood Glen Apartments, near the 5400 block of DeSoto:

Now, only about 12 units remain legally occupied, and the management office is shuttered. Rotting trash sits in piles. Copper pipes and air conditioners’ coils have been ripped on a mass scale from burglarized units. The swimming pool is filled with water the color of crude oil.

“It’s just a horrible place,” said Roy Millmore, executive director of the Near Northwest Management District, an organization that focuses on reducing crime in the area.

The poor conditions inside the complex have persisted for months, in part because many of the property’s 43 fourplexes are owned by out-of-state investors, rather than a single owner. That makes applying pressure to improve conditions more complicated for city inspectors.

Still, code inspectors had not visited the property in a decade until the Houston Chronicle documented its conditions. City officials say they had not received complaints from people living there and that they are trying to enforce codes more aggressively than in years past.

After the jump: Stiles’s Candlewood Glen Apartments photo tour. Plus: Available now!

We get mail . . . from a reader who’s considering renting one of the many available condos in Montrose’s famed Tremont Tower:

I am moving to Houston in June and when I was looking around for housing I found an ad for a rental at Tremont Towers. I went to look at the place and liked it but something seemed odd to me. If this place is as nice as it looks, it is in Montrose (apparently a desirable area to live) why is is so silent and why does one man own at least 5 separate units and even more odd, why are they so cheap when last year they were valued at >300K (odd even in this real estate market). So, I plugged them into Google and started following a trail. I read about Jordan Fogle and Heather Mickelson.

I talked to my possible future landlord and he told me a story that Jordan Fogle confused the builder of Tremont with the ones who built her home. In addition he offered a story that the Heather Mickelson had purchased the property and then not long after moving in decided to move out with her boyfriend. Since they would not purchase the property back from her she sabotaged the apartment by opening her windows through all weather which then lead to some horrible development of mold.

My issue is that since the coverage in 2005-2006 I haven’t been able to find much information and I cannot verify either side of this tale. I was wondering if any readers had passed on more information about the Towers or if anything had been done in this building that had nearly 100% foreclosure. I am concerned because I would prefer to avoid paying nearly a thousand a month just so I can get sick and not be able to work.

A little more below, plus: your chance to help!

A story by Paul Knight in this week’s Houston Press adds a little color to the Houston foreclosure map:

Houston’s 77449 ZIP code, on the northwest side, made the top 100 in the nation for 2007. The area saw rapid growth in the early part of the decade, with retail strip centers and a sea of new homes popping up almost overnight.

“They started developing that area really aggressively,” says Erion Shehaj, a Houston realtor who specializes in foreclosed homes. “Like clockwork…[foreclosures] have been popping up one after another, because they were pushing them to people that couldn’t really afford them in the first place.”

Large signs are now planted along the roadside, advertising housing deals such as “Inventory Clearance!” and “Closeout Specials.”

One subdivision in the area that was hit particularly hard is Bear Creek Meadows. The neighborhood was developed about five years ago, with houses priced in the $120,000 range and marketed to first-time buyers.

Below the fold: More on Bear Creek Meadows, plus a few photos to illustrate Knight’s reporting on foreclosure cleanups.

An update on the 1031-exchange debacle surrounding the West Oaks Mall: In March, the mysterious Edward Okun — the mall’s owner — was indicted by a Virginia grand jury on charges of mail fraud, for misappropriating $132 million invested in his 1031 exchange company, 1031 Tax Group — along with bulk cash smuggling and related charges. Days later, Okun was arrested in his home on Hibiscus Island in Miami Beach.

To the 340 investors who had trusted $150 million of their 1031-exchange funds to supposedly-qualified intermediaries controlled by Okun, this was good news. But it doesn’t necessarily mean they’ll get their money back — or find a way around the huge tax liability now associated with their failed exchanges.

The 1031-exchange investors in Okun’s 1031 Tax Group had hoped to recoup some of their missing funds by raiding Okun’s other assets — including the West Oaks Mall. But the Okun-controlled companies that owned the mall declared Chapter 11 bankruptcy in October.

Today, the Costar Group reports that the freestanding building formerly known as JCPenney at the West Oaks Mall has been put up for sale, along with a mall in Salina, Kansas. The trustee in the bankruptcy case has hired Keen Realty, the new real estate division of KPMG Corporate Finance, to market both properties.

- Okun Assets Go on the Market [CoStar Group]

- Case History Prior to the Appointment of the Trustee [The 1031 Tax Group Bankruptcy Trustee]

- West Oaks Mall: Your Exchanges Are No Good Here [Swamplot]

Git yer fresh, hot foreclosure listings right here! Hey, not all of them are newish red-brick homes in the low hundreds outside Beltway 8!

This house at 1902 Wagon Gap Trail, for example . . . isn’t brick! It’s in Ponderosa Forest, just north of FM1960, which means it’s super-convenient to . . . FM1960! And it just popped up on the market, listed for $129,000! Not bad for a 1970s 4-bedroom, 3 1/2-bath, 3,119-sq.-ft. two-story with diagonal wood siding.

After the jump, a few furtive interior shots of this foreclosed-upon bargain, plus a special something in back!

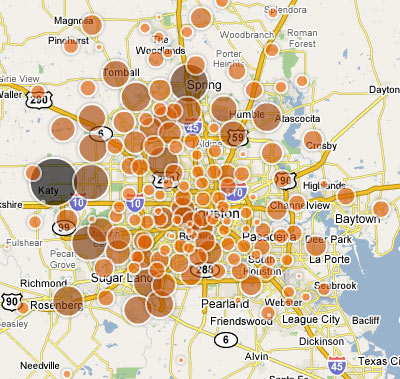

There’s been so much exciting news for dedicated Houston foreclosure gawkers lately. Last month’s HAR redesign added a feature that allows anyone to search current MLS listings for foreclosed properties. And now the Chronicle has put together its own database chronicling foreclosed properties by neighborhood. Plus, the paper includes the handy interactive foreclosure map pictured above, full of dancing bubbles!

A lot of that bubbly makes it look like the foreclosure corks have been popping more frequently in the outside-Beltway-8 neighborhoods, with Katy the big winner. And the map is fun to play with and click on. But don’t miss the more mundane-looking 2007 Neighborhood Foreclosure list, which allows you to sort data on neighborhoods that had 5 or more foreclosures last year, and which spills some fun real-estate secrets . . . like Tremont Tower‘s 97.37 percent foreclosure rate! Bear Creek Meadows‘s 83 foreclosures! And the Memorial Cove Loft Condos’ perfect record: 20 units, 20 foreclosures — in one year! How’d we miss that one?

If you have time to play with these fun tools, and unearth any interesting data, let us know what you find!

- Houston-area foreclosure map by ZIP code [Houston Chronicle]

- 2007 Neighborhood Foreclosures [Houston Chronicle]

- Area foreclosure rate slows, but problems still lurk [Houston Chronicle]

- Thirteen Fun and Obsessive Things To Do on the New HAR.com [Swamplot]

- The Dirty Little Secret Behind the Montrose Foreclosure Hump [Swamplot]

- Bear Creek Meadows Fourclosure Sale! [Swamplot]

A househunter writes in with questions about the townhome at 5248 Larkin St. Unit D, calling it “possibly the strangest property I’ve ever seen.”

A househunter writes in with questions about the townhome at 5248 Larkin St. Unit D, calling it “possibly the strangest property I’ve ever seen.”

When I saw it on HAR.com, I thought I’d better be ready to spring with an offer immediately . . . I’m a first time home-buyer, so honestly, no expert. I’ve looked in Cottage Grove before, but with the exception of 2620 Detering, nothing of this size is that cheap.

On the same lot are three other identical townhouses, all advertised as new and offered at $315,000 by Mike Adams Enterprises. Unit D is listed for $219,000 and is being sold by a division of Sallie Mae.

The price is not weird for the neighborhood — I just think it’s odd that you have this foreclosure that is discounted $100k below the three new properties and they are on the same lot. . . .

The foreclosure sign is still hanging in the hallway, the red code violations are still on the door, and I’m just curious. . . .

Inspections were performed in spring of 2007 . . . but it doesn’t look like the code violations were addressed. If someone lived there, I’d be very surprised. . . .

I mean, it’s weird because they had nails in the wall –lots of nails, including ones in spots you wouldn’t necessarily hang pictures. At some point, someone had hung a television in the master bedroom. But it didn’t look as if the range had ever been used, that the showers, etc, had ever been used. If someone lived there, it was an extremely short period of time and they didn’t do anything but watch television. We were wondering at first if it had been a model home and that would account for the wear on the stairs and the holes in the wall and the nails. . . .

There were way too many red flags for me . . .

After the jump: more photos from the listing . . . and flags!