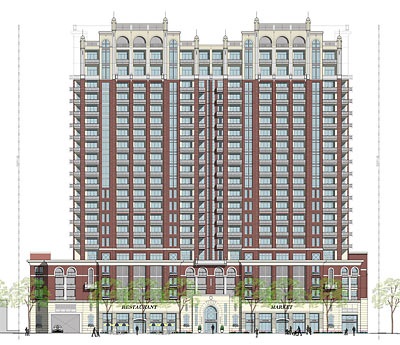

Why hasn’t this cute little cottage on South Blvd. in Boulevard Oaks been snapped up yet?

Location: 1930 South Blvd., Boulevard Oaks

Location: 1930 South Blvd., Boulevard Oaks

Details: 5 bedrooms, 6 full and 4 half-baths; 7,863 sq. ft. on a 10,140-sq.-ft. lot

Price: $2,450,000

History: Original home on property torn down in fall of 2007. Listed for $2.6 million during construction; price cut $150K last Halloween.

Our nominator writes in:

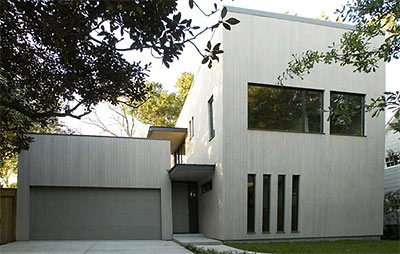

I’ve walked through this home. It’s a vacuous monument to the “price per square foot” itch that’s infected so many builders trying to make a buck in fancier neighborhoods. If you can get $300 a square foot for a 3,000 square foot house, why not build a 6,000 square foot house and double the take? And think of the bonus you could get for 7,863!

So the design becomes a ridiculous exercise in racking up square footage for no useful reason. Most of the experience of this house consists of walking down long, built-to-impress but useless hallways. The master bedroom is big enough to skate in.

This place only looks like a great deal on paper. I hope studying this home will make realtors and builders and buyers and appraisers think twice about applying mindless per-square foot pricing formulas.

Because this is what you end up with.

So . . . how should you price it?