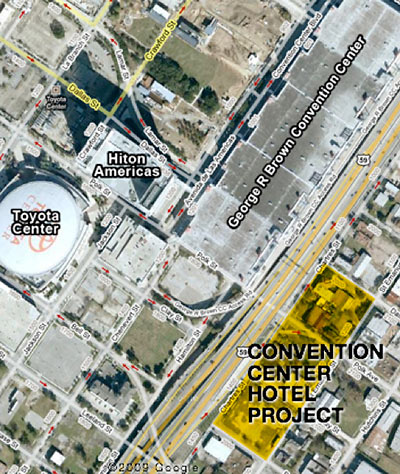

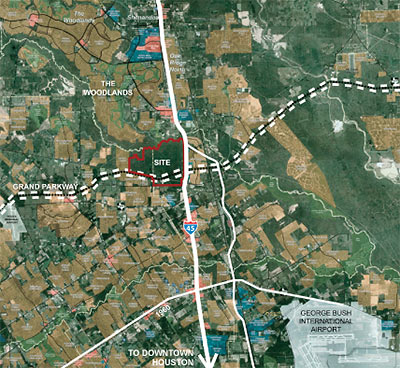

An effort led by former Houston mayor Lee P. Brown to recruit wealthy Chinese investors for a proposed 1000-room East Downtown hotel project on the opposite side of the 59 freeway from the George R. Brown convention center appears to be picking up steam. Brown is listed as chairman of the managing general partner of the project, a company named Global Century Development. Brown and Global Century’s president, Dan Nip, hope to raise money for the $225 million project from investors who want to immigrate to the U.S. through the U.S. Citizenship and Immigration Services’ EB-5 Visa program. That program, established as a result of the Immigration Act of 1990, allows foreign nationals to obtain a green card by investing a minimum of $500,000 — and thereby create 10 or more jobs — in qualified areas with high unemployment rates. An East Downtown investment zone identified by Global Century Development in the area bounded by Preston St., the 59 Freeway, I-45, and Dowling is the only area in Houston that qualifies as a “regional center” under the program.

A Powerpoint presentation prepared by Global Century Development that appears to date from last year sites the proposed hotel on three adjacent blocks near Saint Emanuel and Polk St. But a report in today’s Houston Business Journal by Jennifer Dawson indicates plans for the East Downtown hotel are focused on only 2 of those blocks, which Nip controls: They’re bounded by Polk, Saint Emanuel, Bell, and Chartres. Dawson reports that a pedestrian bridge connecting the hotel to the convention center across the freeway is being planned, but a schematic drawing of a bridge featured in the presentation appears to show it only crossing Chartres St., requiring pedestrians to cross under the freeway:

“the HOA has financial and legal problems. it’s operating month-2-month; no reserves. even though our assessments are supposed to cover exterior repairs of our units, you may never get your units repaired, unless you do it yourself. many of the units have serious plumbing problems. if the HOA is dissolved, PV may become a free-for-all; it’s almost that now. if you’re willing to risk all of that, then go ahead and buy, otherwise, don’t.” [

“the HOA has financial and legal problems. it’s operating month-2-month; no reserves. even though our assessments are supposed to cover exterior repairs of our units, you may never get your units repaired, unless you do it yourself. many of the units have serious plumbing problems. if the HOA is dissolved, PV may become a free-for-all; it’s almost that now. if you’re willing to risk all of that, then go ahead and buy, otherwise, don’t.” [