Sure is nice for us Houston didn’t get caught up in that big price run-up housing markets in the rest of the country fell for! That’s why in Houston real estate is in much better shape than it is everywhere else, right?

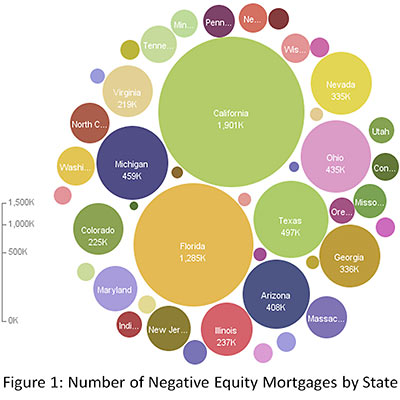

Not according to a study released yesterday by First American CoreLogic. The research firm estimates that 18.3 percent of all mortgaged properties in the Houston-Sugar Land-Baytown region are in a “negative equity position,” and another 6.7 percent are within just 5 percentage points of being there. “Negative equity,” AKA “I’ve fallen down and I can’t get up,” means a mortgage holder owes more than the underlying property is worth.

In other words, 1 in every 4 Houston-area mortgages is already in deep doo-doo.

But hey, all it’ll take to recover is for prices to rise a little! And the rest of the country is doing much worse, right?