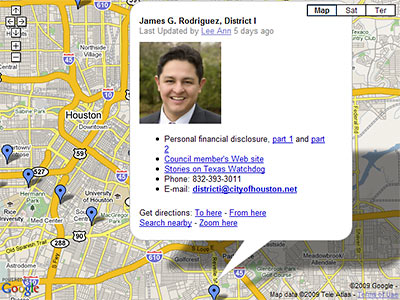

From the Twitter feed of KHOU reporter Alex Sanz, Swamplot hears news that Houston’s city council has postponed a vote on a proposal to sell the former Compaq Center at 3700 Southwest Fwy. in Greenway Plaza to Lakewood Church, for an-appraised-but way-below-assessed-value price of $7.5 million. As Swamplot explained yesterday, the church has more than 20 years left on a prepaid lease for the property and an option to extend the lease for an additional 30 years after that for a little more than $22 million — both of which significantly affect the present value of the property to the city.

From the Twitter feed of KHOU reporter Alex Sanz, Swamplot hears news that Houston’s city council has postponed a vote on a proposal to sell the former Compaq Center at 3700 Southwest Fwy. in Greenway Plaza to Lakewood Church, for an-appraised-but way-below-assessed-value price of $7.5 million. As Swamplot explained yesterday, the church has more than 20 years left on a prepaid lease for the property and an option to extend the lease for an additional 30 years after that for a little more than $22 million — both of which significantly affect the present value of the property to the city.

Is the postponement of the sale a setback for Lakewood? Why should it be!? Followers of church pastor Joel Osteen, who’s now written 3 books filled with real-estate investment advice, know that he advocates patience — especially in complicated sale or purchase situations. Why wouldn’t he want councilmembers to feel entirely comfortable with the decision they come to?

Here’s how Osteen explains it in a relevant passage from his latest book, It’s Your Time: