COMMENT OF THE DAY RUNNER-UP: TRUST, BUT VERIFY  “My home didn’t flood, though a few blocks away, others did. I wonder if we could get a ‘Certificate of Nonflooding’ or some such official thing. I always laugh when I see a home listing with the words ‘Never flooded, per owner.’ Yeah, right!” [Gisgo, commenting on Metro Back in Service; Public Health Threats; A 12-Step Program for Houston’s Flooding Problem] Illustration: Lulu

“My home didn’t flood, though a few blocks away, others did. I wonder if we could get a ‘Certificate of Nonflooding’ or some such official thing. I always laugh when I see a home listing with the words ‘Never flooded, per owner.’ Yeah, right!” [Gisgo, commenting on Metro Back in Service; Public Health Threats; A 12-Step Program for Houston’s Flooding Problem] Illustration: Lulu

Buying and Selling

POPEYES, BURGER KING KING TAKING A BIG BITE OF LA MADELEINE, SWALLOWING CYCLONE ANAYA’S  Sugar Land’s Dhanani Group, owner of 501 Burger Kings and 240 Popeyes as well as 130 Houston-area convenience stores — and ranked as the country’s third-largest restaurant franchisee — has just added all 16 Houston-area La Madeleines to its holdings (plus 10 more in Austin and Louisiana), as well as the entire Cyclone Anaya’s Mexican Kitchen chain. The La Madeleine purchase, which includes the right to open an additional 57 locations of the French bakery-café chain, was completed by Sugar Land-based HZ LM Casual Foods, whose owner, Amin Dhanani, is a Dhanani Group general partner. Another Dhanani Group entity, Heritage Restaurant Group, is buying all 6 Houston-area locations of Cyclone Anaya’s from Ricardo Valencia, the youngest son of wrestling champ Cyclone Anaya, and says it has plans to open additional locations. It was Dhanani Group’s Houston Foods unit — the owner of its local Burger King franchises — that was cited by city officials in 2014 for excessive oak-hacking, after street trees surrounding several of the company’s restaurants were found cut back to tall-stump status. [Houston Business Journal; previously on Swamplot] Photo of original Cyclone Anaya’s at 1710 Durham Dr.: Accent Graphics

Sugar Land’s Dhanani Group, owner of 501 Burger Kings and 240 Popeyes as well as 130 Houston-area convenience stores — and ranked as the country’s third-largest restaurant franchisee — has just added all 16 Houston-area La Madeleines to its holdings (plus 10 more in Austin and Louisiana), as well as the entire Cyclone Anaya’s Mexican Kitchen chain. The La Madeleine purchase, which includes the right to open an additional 57 locations of the French bakery-café chain, was completed by Sugar Land-based HZ LM Casual Foods, whose owner, Amin Dhanani, is a Dhanani Group general partner. Another Dhanani Group entity, Heritage Restaurant Group, is buying all 6 Houston-area locations of Cyclone Anaya’s from Ricardo Valencia, the youngest son of wrestling champ Cyclone Anaya, and says it has plans to open additional locations. It was Dhanani Group’s Houston Foods unit — the owner of its local Burger King franchises — that was cited by city officials in 2014 for excessive oak-hacking, after street trees surrounding several of the company’s restaurants were found cut back to tall-stump status. [Houston Business Journal; previously on Swamplot] Photo of original Cyclone Anaya’s at 1710 Durham Dr.: Accent Graphics

The broker representing the new and prospective owners of the shuttered Macy’s and Dillard’s buildings at Greenspoint Mall gives just a hint of the rancor between the groups who now appear to be negotiating the mall’s future: Maddox Properties’ Jim Maddox tells Bisnow’s Kyle Hagerty that any supposed redevelopment plans hinted at by the investment group led by Chinese developer Feng Gao that now has the mall itself under contract are “full of sh*t.” [Hagerty’s punctuation.] Maddox says he hung up the phone on area Chamber of Commerce prez and mall redevelopment partner Reggie Gray after Gray complained to him that plans in place by the owners of the retired department store buildings would ruin redevelopment plans for the area.

About those plans: Spring Real Estate Investment’s Zulfiqar Karedia, Hagerty reports, is seeking to develop a truck stop on a 4-acre portion of its newly purchased Macy’s property fronting I-45. Maddox says a restaurant distribution business is slated to take over the Dillard’s property in the mall’s southwest corner — after a sale he brokered last week closes in September.

THE END OF THE GREENSPOINT MALL IS UPON US  Greenspoint Mall may close its doors for good in as little as 60 days, a source tells Click2Houston reporter Sophia Beausoleil — after news broke late Friday that the hobbled 42-year-old shopping center at I-45 North and Beltway 8 is under contract for purchase by an investment group headed by Chinese investor Gao Feng. Global Plaza Union says it is still considering several different redevelopment concepts for its newly acquired property. Not included in the purchase, but expected to be added to it for any transformation to take place: the 3 independently owned anchor store sites within the property. The Sears store at the southeast corner of the property closed 7 years ago; the Macy’s, in the northwest corner, shut down earlier this year; the Dillard’s in the southwest corner, closest to the freeway interchange, is one of only 2 anchors still operating in the mall. (The other is a Palais Royal.) [Click2Houston; Houston Chronicle ($); previously on Swamplot] Photo: Colliers International

Greenspoint Mall may close its doors for good in as little as 60 days, a source tells Click2Houston reporter Sophia Beausoleil — after news broke late Friday that the hobbled 42-year-old shopping center at I-45 North and Beltway 8 is under contract for purchase by an investment group headed by Chinese investor Gao Feng. Global Plaza Union says it is still considering several different redevelopment concepts for its newly acquired property. Not included in the purchase, but expected to be added to it for any transformation to take place: the 3 independently owned anchor store sites within the property. The Sears store at the southeast corner of the property closed 7 years ago; the Macy’s, in the northwest corner, shut down earlier this year; the Dillard’s in the southwest corner, closest to the freeway interchange, is one of only 2 anchors still operating in the mall. (The other is a Palais Royal.) [Click2Houston; Houston Chronicle ($); previously on Swamplot] Photo: Colliers International

COMMENTS OF THE DAY: WHEN HOUSTON JEWELRY WRAPPED A SHINY BAND AROUND A COUPLE OF DOWNTOWN BUILDINGS AT 720 RUSK  “We bought this building from Star Furniture in 1966 and operated in it until 1983 when we were offered a very generous price at the top of the market. After we left the building stayed empty until the Subway opened. . . . This is how the building looked when it was remodeled by architect Arnold Hendler in 1966.” [Rex Solomon, commenting on Downtown Houston Is Now Down To A Single Street-Level Subway] Photo: Houston Jewelry

“We bought this building from Star Furniture in 1966 and operated in it until 1983 when we were offered a very generous price at the top of the market. After we left the building stayed empty until the Subway opened. . . . This is how the building looked when it was remodeled by architect Arnold Hendler in 1966.” [Rex Solomon, commenting on Downtown Houston Is Now Down To A Single Street-Level Subway] Photo: Houston Jewelry

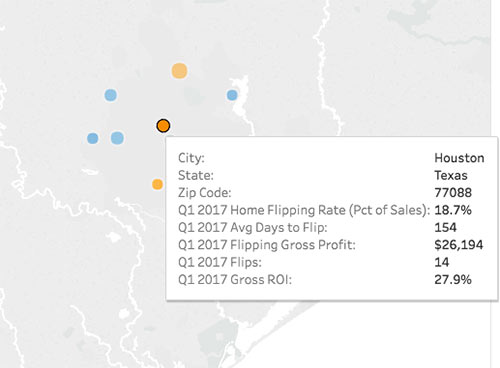

Houston doesn’t show up anywhere in Attom Data Solutions latest rankings of the nation’s home-flipping hotspots, but zoom into the heatmap accompanying the company’s first-quarter report and you’ll find some interesting neighborhoods highlighted. Attom defines a home flip as a single-family home or condo that sells twice within a 12-month period in arms-length transactions (as recorded in public sales deeds). From January through March of this year, it counted 14 flippy transactions in the 77088 Zip Code — which is bounded roughly by I-45, W. Little York, the Tomball Pkwy., and Houston-Rosslyn Rd. and includes Acres Homes — accounting for 18.7 percent of sales in the area — the highest percentage in Houston. Next-strongest home-flipping hotspots: 77096 (Meyerland and Westbury), with 10 flips accounting for 13.7 percent of sales; 77089 (Southbelt and part of Pearland) also with 10 flips totaling 12.2 percent; 77373 in Spring with 22 flips (but only reaching 11.6 percent); and 77018, (Garden Oaks and Oak Forest), which saw 11 flips, or 9.4 percent of that area’s transactions.

LAND PURCHASES BEGINNING ALONG PROPOSED HOUSTON-TO-DALLAS BULLET TRAIN ROUTE  Texas Central Railway’s CEO tells Realty News Report’s Ralph Bivins that owners of some properties in the projected path of the planned Houston-to-Dallas 200mph rail line have already agreed to sell their land to the company, which is hoping to get started on construction of the 90-minute route next year. Tim B. Keith says he’s “encouraged with the progress” of what he refers to as the project’s “voluntary land purchase program.” He notes that “Texas’ Constitution and state statutes have long granted eminent domain authority to railroads such as Texas Central, as well as pipeline companies, electric power companies and other industries,” but calls eminent domain “a last resort.” The line’s Houston station is now planned for “the area along the 610 Loop between 290 and I-10″ after a Federal Railroad Administration review rejected the idea of a Downtown stop because of projected high costs and environmental impacts. [Realty News Report; Houston Public Media; previously on Swamplot] Photo of Tokaido Shinkansen Tokyo-Osaka line: Texas Central Railway

Texas Central Railway’s CEO tells Realty News Report’s Ralph Bivins that owners of some properties in the projected path of the planned Houston-to-Dallas 200mph rail line have already agreed to sell their land to the company, which is hoping to get started on construction of the 90-minute route next year. Tim B. Keith says he’s “encouraged with the progress” of what he refers to as the project’s “voluntary land purchase program.” He notes that “Texas’ Constitution and state statutes have long granted eminent domain authority to railroads such as Texas Central, as well as pipeline companies, electric power companies and other industries,” but calls eminent domain “a last resort.” The line’s Houston station is now planned for “the area along the 610 Loop between 290 and I-10″ after a Federal Railroad Administration review rejected the idea of a Downtown stop because of projected high costs and environmental impacts. [Realty News Report; Houston Public Media; previously on Swamplot] Photo of Tokaido Shinkansen Tokyo-Osaka line: Texas Central Railway

Whatever’s in store for the 136-acre former KBR site along the the Ship Channel at 4100 Clinton Dr., CityCentre developer Midway now looks to be involved. Documents filed with the county clerk’s office near the end of May reveal that Cathexis Holdings recently sold the site to KBRN, an entity connected to Midway through a recently minted corporate partnership (and officially located down the hall from Midway’s CityCentre office.)

And might Midway — which also heads the team that turned failed Downtown Mall Houston Pavilions into GreenStreet, and is developing the Kirby Grove park-and-office-building complex along the banks of the Southwest Fwy. in Upper Kirby — have some big office-shopping-residential-and-park-y plans in mind for this vast property, which lies about a mile and a half downstream from Downtown? A couple of clues are out there:

The custom home and office building of Heights homebuilder Fisher Homes at 832 Yale St. is currently up for sale or lease. Construction on the just-under-15,000-sq.-ft. building south of 9th St. wrapped up near the end of 2014; the property listing indicates that availability started in January of this year.

Amenities at the Morrison Heights and Studemont Mid-Rise developer’s mixed-use space include an indoor basketball court, downtown views from the above-3rd-story rooftop terrace, and various conference rooms. Floorplans of the building show the middle-of-the-house driveway (which provides access to the backyard parking lot) separating a 437-sq.-ft. apartment (circled in dotted red below) from the main structure:

The deal is sealed on the University of Texas’s purchase of a 100-acre hunk of land south of South Main St. as of last Friday. The sale marks the first concrete move toward UT’s planned Houston campus, though closings on the parcel patchwork comprising the rest of the 300-ish ac. likely won’t wrap up until early 2017, according to a press release from the school’s Office of Public Affairs.

The sold land is a forested tract northwest of the wiggly intersection of Willowbend Dr. and Buffalo Spdwy.; the property is split along a northwest-southeast diagonal by a linear drainage feature which makes an appearance in those preliminary campus designs (shown from the north in the image above).

That land was owned previously by Buffalo Lakes Ltd., an entity associated with UT grad John Kirksey of Kirksey Architecture. A plan for a Buffalo Lakes master-planned community (see below) was drawn up more than 4 years ago by Kirksey for the same space:

Confirming a rumor Swamplot noted last week, the HBJ’s Roxana Asgarian reports that “one of the largest residential developers in Houston” has plans to transform two-thirds of the site of former pedestrian shopping district Westbury Square into 100 to 125 townhomes. Camelot Realty Group’s Tom Cervone tells Asgarian a group of developers going by the name of Villas at Westbury Square has the property on West Bellfort near Chimney Rock and West Bellfort under contract from its longtime owner, Alfred Antonini.

Confirming a rumor Swamplot noted last week, the HBJ’s Roxana Asgarian reports that “one of the largest residential developers in Houston” has plans to transform two-thirds of the site of former pedestrian shopping district Westbury Square into 100 to 125 townhomes. Camelot Realty Group’s Tom Cervone tells Asgarian a group of developers going by the name of Villas at Westbury Square has the property on West Bellfort near Chimney Rock and West Bellfort under contract from its longtime owner, Alfred Antonini.

All 11 remaining Westbury Square buildings — including the longtime home of the Company OnStage theater group — will be torn down in 30 days, the real estate agent says. Two of the more dilapidated structures from the complex were demolished last year; the Home Depot next door (visible in the distance in the photo below) was built on land that previously belonged to the complex.

BUYER OF CHRONICLE COMPLEX DOWNTOWN NOT EXPECTED TO CRUSH IT JUST YET  The deal could still fall through, cautions Ralph Bivins, but real estate development firm Hines is in the middle of negotiating a purchase of the Houston Chronicle’s complex and parking garage at 801 Texas Ave. downtown. Expected sale price: “more than $50 million, perhaps as much as $55 million.” But Bivins doesn’t think Hines is ready to knock down the structures and build another of its downtown office developments on the 99,184 sq. ft. of land on 2 blocks right away. Instead, he writes, the company “appears to be seeking to lock up a prime skyscraper development site for future years.” [Realty News Report; previously on Swamplot] Photo: Walter P Moore

The deal could still fall through, cautions Ralph Bivins, but real estate development firm Hines is in the middle of negotiating a purchase of the Houston Chronicle’s complex and parking garage at 801 Texas Ave. downtown. Expected sale price: “more than $50 million, perhaps as much as $55 million.” But Bivins doesn’t think Hines is ready to knock down the structures and build another of its downtown office developments on the 99,184 sq. ft. of land on 2 blocks right away. Instead, he writes, the company “appears to be seeking to lock up a prime skyscraper development site for future years.” [Realty News Report; previously on Swamplot] Photo: Walter P Moore

WESTBURY SQUARE HEADED FOR SALE, EXILE OF REMAINING TENANTS  A sales contract is pending on the remaining portions of faded pedestrian shopping district Westbury Square, a note posted to the home page of The Company OnStage and sent to the group’s subscribers announces. The note does not address rumored plans to divide the purchased site near the intersection of West Bellfort and Chimney Rock into more than 100 townhome lots, but does indicate that completion of the sale will likely bring an end to the company’s 33-year residency at 536 Westbury Square (pictured here). The theater group is postponing the announcement of its upcoming season, and says it is looking to relocate. Two buildings in the complex were torn down early last year. [The Company OnStage; previously on Swamplot] Photo: The Company OnStage

A sales contract is pending on the remaining portions of faded pedestrian shopping district Westbury Square, a note posted to the home page of The Company OnStage and sent to the group’s subscribers announces. The note does not address rumored plans to divide the purchased site near the intersection of West Bellfort and Chimney Rock into more than 100 townhome lots, but does indicate that completion of the sale will likely bring an end to the company’s 33-year residency at 536 Westbury Square (pictured here). The theater group is postponing the announcement of its upcoming season, and says it is looking to relocate. Two buildings in the complex were torn down early last year. [The Company OnStage; previously on Swamplot] Photo: The Company OnStage

The complicated transaction that allowed the city to sell the 10.52-acre brownfield site along Allen Parkway between the Federal Reserve building and Allen Parkway Village to an apartment developer was concluded in late April, the Houston Business Journal‘s Paul Takahashi reports. Alliance Residential paid $39.9 million for the property along Gillette St., where the city began operating a solid waste incinerator in the 1920s and later converted the site for use as its fleet maintenance facility. The company immediately sold the northern 6 acres to an unnamed private investor; Alliance now plans to build a 365-unit apartment complex on the southern half of the property, fronting Gillette and West Dallas St.

The complicated transaction that allowed the city to sell the 10.52-acre brownfield site along Allen Parkway between the Federal Reserve building and Allen Parkway Village to an apartment developer was concluded in late April, the Houston Business Journal‘s Paul Takahashi reports. Alliance Residential paid $39.9 million for the property along Gillette St., where the city began operating a solid waste incinerator in the 1920s and later converted the site for use as its fleet maintenance facility. The company immediately sold the northern 6 acres to an unnamed private investor; Alliance now plans to build a 365-unit apartment complex on the southern half of the property, fronting Gillette and West Dallas St.

$150 HOUSE SELLER EXPECTS TO REFUND 500 IDENTICAL OFFERS  The real estate agent who’s been trying to sell his Heights bungalow for $150 tells reporter Paul Takahashi that — barring an “incredible surge” of new applications and fees before the June 13 deadline — he’ll be refunding the approximately 500 $150 offer fees he’s received so far for the property. For now, he says, he’s organizing his emails to filter out the more than 1,500 essays he received from would-be homebuyers who somehow got the idea that Wachs would sell them the 2-bedroom, 1-bath property even if they didn’t submit the required fee from the 500 or so who followed his instructions. All that sorting is “a time-consuming and boring” task, he tells Takahashi. Wachs had hoped the application fees would add up to the unspecified amount between $265K and $550 he figures his family’s home at 213 E. 23rd St. is worth. [Houston Business Journal; previously on Swamplot] Photo: $150 House

The real estate agent who’s been trying to sell his Heights bungalow for $150 tells reporter Paul Takahashi that — barring an “incredible surge” of new applications and fees before the June 13 deadline — he’ll be refunding the approximately 500 $150 offer fees he’s received so far for the property. For now, he says, he’s organizing his emails to filter out the more than 1,500 essays he received from would-be homebuyers who somehow got the idea that Wachs would sell them the 2-bedroom, 1-bath property even if they didn’t submit the required fee from the 500 or so who followed his instructions. All that sorting is “a time-consuming and boring” task, he tells Takahashi. Wachs had hoped the application fees would add up to the unspecified amount between $265K and $550 he figures his family’s home at 213 E. 23rd St. is worth. [Houston Business Journal; previously on Swamplot] Photo: $150 House