COMMENT OF THE DAY: HOUSTON REAL ESTATE PROBLEMS, WITH OR WITHOUT CHEAP OIL  “The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

“The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

Tag: Buying and Selling

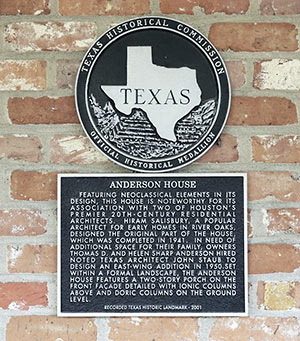

Back in April, Swamplot asked whether, for $8.1 million, this 1941 River Oaks estate by architect Hiram Salisbury with a later addition by John Staub might be torn down to allow the construction of 2 newer mansions on the same property. Today, we have our answer: No. But for $7.2 million, the answer appears to have been yes — for the tearing-down part, at least. Yesterday, the city approved a demolition permit for the property, which changed hands in July.

Back in April, Swamplot asked whether, for $8.1 million, this 1941 River Oaks estate by architect Hiram Salisbury with a later addition by John Staub might be torn down to allow the construction of 2 newer mansions on the same property. Today, we have our answer: No. But for $7.2 million, the answer appears to have been yes — for the tearing-down part, at least. Yesterday, the city approved a demolition permit for the property, which changed hands in July.

Named a Texas Historic Landmark in 2001, the central part of the home was designed by Salisbury for attorney Thomas D. Anderson and his wife, Helen Sharp Anderson. In 1950, the Andersons had Staub design the home’s east wing. Mrs. Anderson died last year, 7 years after her husband. The listing, which featured carefully staged photos of the home’s well-tended grounds and interiors as well as its won’t-ward-off-bulldozers medal from the Texas Historical Commission, also noted that the River Oaks Property Owners association had already given approval for the 67,458-sq.-ft. lot to be subdivided.

HOUSTON CHRONICLE COMPLEX DOWNTOWN GOING ON SALE — A YEAR OR 2 TOO LATE?  The Houston Chronicle‘s former real estate reporter says Hearst is putting the Chronicle complex at 801 Texas Ave. up for sale at a less-than-ideal time. Ralph Bivins reports that the newspaper’s parent company has just selected brokerage firm HFF to market the building, on the block surrounded by Milam, Travis, Texas, and Prairie, and its separate parking garage. But “Hearst would have met stronger demand by putting the Chronicle property on the market a year or two ago,” Bivins writes. “Hearst moved too late to catch the crest of the wave. The price for the Chronicle property is expected to be less than $50 million.” In July, the company announced the newspaper’s offices would be moved to revamped facilities in the former Houston Post complex at 4747 Southwest Fwy. [Realty News Report; previously on Swamplot] Photo: Ralph Bivins

The Houston Chronicle‘s former real estate reporter says Hearst is putting the Chronicle complex at 801 Texas Ave. up for sale at a less-than-ideal time. Ralph Bivins reports that the newspaper’s parent company has just selected brokerage firm HFF to market the building, on the block surrounded by Milam, Travis, Texas, and Prairie, and its separate parking garage. But “Hearst would have met stronger demand by putting the Chronicle property on the market a year or two ago,” Bivins writes. “Hearst moved too late to catch the crest of the wave. The price for the Chronicle property is expected to be less than $50 million.” In July, the company announced the newspaper’s offices would be moved to revamped facilities in the former Houston Post complex at 4747 Southwest Fwy. [Realty News Report; previously on Swamplot] Photo: Ralph Bivins

The proprietor of The Green Bone is hoping to turn this former office warehouse at the far eastern edge of East Downtown into a new home for the doggie daycare, hemp-treat outlet, and espresso stop. The Green Bone currently operates in this still-for-sale building at 2104 Leeland St., 1 mile to the southwest. Its envisioned future home in the warehouse at the corner of Rusk and Paige, which The Green Bone purchased at the beginning of this year, would encompass 3,429 sq. ft. at the corner of Rusk and Paige.

A note and FAQ sheet sent to all residents of the Avalon Square Apartments at 2400 Westheimer Rd. last Friday — informing them that the 3-story, 5-courtyard compound is now under new management — does not mention the property’s sale or identify Peak Real Estate Management as anything other than the new management company. But a representative of the firm tells Swamplot that it is also the property’s new owner, and that upgrades are planned for the 210-unit complex, not demolition. Avalon Square, which sits on a 3.72-acre site stretching between Dickey Pl. and Argonne St., was built in 1974; it last changed hands 7 years ago.

Photo:Â Justin McMurtry

El Tiempo’s Roland Laurenzo reports that the land under his family’s El Tiempo 1308 Cantina on Montrose Blvd. is being sold by the owner for a “multi-story apartment project development.” The restaurant, which leases the space, is looking for another Montrose spot where it can relocate after it closes early next year. Greg Morago’s report in the Chronicle doesn’t provide any additional detail about the proposed apartments, but the 1308 Cantina, bounded by West Clay St., occupies the northern third of a long block capped on the southern end by the for-sale and shuttering Gibbs Boats at West Gray St. Between those 2 properties are a tire shop and the U-Plumb-It supply store. The 1308 Cantina took over from a restaurant called Sabor, a mid-aughts upscale replacement for La Jalisciense at the same 1308 Montrose Blvd. spot.

Update, 4:30 pm:Â Here are some more details on the apartment development replacing the 1308 Cantina and many of its neighbors.

- El Tiempo 1308 Cantina may soon close [Food Chronicles]

Photo of El Tiempo 1308 Cantina from Marconi St. parking lot:Â Bill Coatney [license]

From reader Mark Lawrence come these farewell views of the almost-a-full-block compound one block north of Washington Ave at 1101 Reinerman St. that belonged to J and L Sheet Metal from the late eighties until recently. The company sold its land, bounded by Reinerman, Moy, Nett, and Center streets, to MHI McGuyer Homebuilders in late August. A sign taped to the front door (at right) notes the metal fabrication business is moving out of the Westwood Grove neighborhood, further north to 14102 Chrisman Rd., near the intersection of the Hardy Toll Rd. and Beltway 8.

From reader Mark Lawrence come these farewell views of the almost-a-full-block compound one block north of Washington Ave at 1101 Reinerman St. that belonged to J and L Sheet Metal from the late eighties until recently. The company sold its land, bounded by Reinerman, Moy, Nett, and Center streets, to MHI McGuyer Homebuilders in late August. A sign taped to the front door (at right) notes the metal fabrication business is moving out of the Westwood Grove neighborhood, further north to 14102 Chrisman Rd., near the intersection of the Hardy Toll Rd. and Beltway 8.

OLD DAILY REVIEW CAFE SPOT, NORTH MONTROSE MIGHT SOON BE UP A CREEK  Back in March, the Daily Review Café on W. Lamar St. off Dunlavy closed temporarily with a notice about “water issues”; shortly afterward the owners announced the restaurant and its extensive patio wouldn’t reopen. A “for lease” sign has been up at the space for several months, but it now appears the property has attracted a buyer. Eater Houston’s new sleuth-in-residence Jakeisha Wilmore has gathered clues that point to the participation of Gary Mosley’s Creek Group, the company behind the Onion Creek Coffee House, Dry Creek Cafe, and the Cedar Creek and Canyon Creek Bars and Grills. Only this time, the serial restaurateur appears to be flying under a different name: “A limited liability company formed under Piggy’s Tavern was filed by Mosley’s restaurant group in August,” Wilmore writes. “The group also filed for a mixed beverage permit and mixed beverage late night permit from the Texas Alcoholic Beverage Commission (TABC). The address listed to conduct business is 3412 West Lamar,” the Daily Review spot. [Eater Houston] Photo: Daily Review Café

Back in March, the Daily Review Café on W. Lamar St. off Dunlavy closed temporarily with a notice about “water issues”; shortly afterward the owners announced the restaurant and its extensive patio wouldn’t reopen. A “for lease” sign has been up at the space for several months, but it now appears the property has attracted a buyer. Eater Houston’s new sleuth-in-residence Jakeisha Wilmore has gathered clues that point to the participation of Gary Mosley’s Creek Group, the company behind the Onion Creek Coffee House, Dry Creek Cafe, and the Cedar Creek and Canyon Creek Bars and Grills. Only this time, the serial restaurateur appears to be flying under a different name: “A limited liability company formed under Piggy’s Tavern was filed by Mosley’s restaurant group in August,” Wilmore writes. “The group also filed for a mixed beverage permit and mixed beverage late night permit from the Texas Alcoholic Beverage Commission (TABC). The address listed to conduct business is 3412 West Lamar,” the Daily Review spot. [Eater Houston] Photo: Daily Review Café

REPORTS: BOCONCEPT ON WESTHEIMER WILL BE CLOSING DOWN SOON  Multiple sources tell Swamplot that the 13,525-sq.-ft. lot at the northwest corner of Westheimer Rd. and Mid Ln. that’s currently home to the BoConcept furniture store is in the process of being sold, and that the store will shut down in a few weeks. The 9,513-sq.-ft. building at 4302 Westheimer Rd., just west of the Highland Village Shopping Center, was built in 2003 as Surprises. Photo: BoConcept

Multiple sources tell Swamplot that the 13,525-sq.-ft. lot at the northwest corner of Westheimer Rd. and Mid Ln. that’s currently home to the BoConcept furniture store is in the process of being sold, and that the store will shut down in a few weeks. The 9,513-sq.-ft. building at 4302 Westheimer Rd., just west of the Highland Village Shopping Center, was built in 2003 as Surprises. Photo: BoConcept

Had you been planning a big farewell meal at Van Loc later this week? Sorry, there’s been a change of plans: The Vietnamese restaurant at 3010 Milam St. in Midtown is now officially closed for good. “There are signs on the doors apologizing for having to close earlier than expected,” a reader tells Swamplot. The reason: So much business in the last few days that they’ve “run out of food” — and order and prep times mean new orders wouldn’t be ready much before the previously planned Friday closing.

Had you been planning a big farewell meal at Van Loc later this week? Sorry, there’s been a change of plans: The Vietnamese restaurant at 3010 Milam St. in Midtown is now officially closed for good. “There are signs on the doors apologizing for having to close earlier than expected,” a reader tells Swamplot. The reason: So much business in the last few days that they’ve “run out of food” — and order and prep times mean new orders wouldn’t be ready much before the previously planned Friday closing.

Van Loc served its last meals Tuesday night. A sale of the property appears to be imminent.

- Previously on Swamplot: Midtown’s Van Loc Will Lock Up for Good This Friday; Midtown Vietnamese Restaurant Van Loc Says It’s Closing Up Shop

Photos: Allyn West/OffCite (front); Swamplot inbox (sign)

All remaining tenants of the oak-tree-lined Kirby Court Apartments on the 2600 and 2700 block of Steel St. — across Kirby Dr. from the Whole Foods Market — received notice today that all leases will be terminated on December 31st, a source tells Swamplot. The notices — sent through regular mail and certified mail, taped on front doors, and bearing some lawyerly language — do not indicate the name of any buyer, or describe what might become of the site when it is redeveloped. But according to the source, all portions of the complex have now been sold.

All remaining tenants of the oak-tree-lined Kirby Court Apartments on the 2600 and 2700 block of Steel St. — across Kirby Dr. from the Whole Foods Market — received notice today that all leases will be terminated on December 31st, a source tells Swamplot. The notices — sent through regular mail and certified mail, taped on front doors, and bearing some lawyerly language — do not indicate the name of any buyer, or describe what might become of the site when it is redeveloped. But according to the source, all portions of the complex have now been sold.

2 CORNER BANK BUILDINGS BANISHED FROM BANKING FOREVER  This 3,848-sq.-ft. former WaMu at the intersection of Barker Cypress Rd. and FM 529 Rd. has been vacant and on the market for a good 5 years now. It’s surrounded by parking spaces on a 1.152-acre lot and features a spacious 5-lane drive-thru in back. Along with a twin structure at the intersection of Louetta Rd. and N. Eldridge Pkwy. (also for sale), the Cypress building has been forcibly retired from its banking career. Chase Bank, which bought up all the Washington Mutual corner-bank leftovers, spat out locations like these it considered too close to existing Chase banks — with restrictions to prevent another bank from moving in. A few more restrictions potential buyers of the structure at 7019 Barker Cypress Rd. will want to note: You can’t put a burger joint, a nail salon, a hair salon, or a dentist’s office in there either, because any of those (as well as a few other uses) would duplicate the offerings of establishments in the adjacent Signature Kroger shopping center from which the pad site was spun off. Still-asking price: $1.1 million. [The Weitzman Group]

This 3,848-sq.-ft. former WaMu at the intersection of Barker Cypress Rd. and FM 529 Rd. has been vacant and on the market for a good 5 years now. It’s surrounded by parking spaces on a 1.152-acre lot and features a spacious 5-lane drive-thru in back. Along with a twin structure at the intersection of Louetta Rd. and N. Eldridge Pkwy. (also for sale), the Cypress building has been forcibly retired from its banking career. Chase Bank, which bought up all the Washington Mutual corner-bank leftovers, spat out locations like these it considered too close to existing Chase banks — with restrictions to prevent another bank from moving in. A few more restrictions potential buyers of the structure at 7019 Barker Cypress Rd. will want to note: You can’t put a burger joint, a nail salon, a hair salon, or a dentist’s office in there either, because any of those (as well as a few other uses) would duplicate the offerings of establishments in the adjacent Signature Kroger shopping center from which the pad site was spun off. Still-asking price: $1.1 million. [The Weitzman Group]

Developers have become very interested in Spring Branch, notes a Swamplot tipster. The latest evidence: the recent sale of the Blalock Woods Apartments (pictured above), just north of the Katy-Fwy.-side 99 Ranch Market at 1111 Blalock Rd. The new owner of the townhome-style complex is a group put together by investment and apartment-development firm Stanmore Partners. The property changed hands on October 1st; on the same date, residents of the Spring Branch apartment complex received a brief letter saying Greystar Management Services will be taking over management of all 316 units. The letter didn’t reveal the name of the property’s new owner, and didn’t say anything about shutting down the place, but a source tells Swamplot that no new leases are being written, and that a “departure deadline” of June 2015 is being planned.

A RANDALL DAVIS-FLAVORED HIGHRISE FOR THE EAST SIDE OF THE WEST LOOP  Themed-residence developer Randall Davis is planning another Galleria-area condo project, and it looks like this one won’t have to share space with any fast-food drive-thrus — unless, of course, he wants it to. The HBJ‘s Paul Takahashi is reporting that Davis plans to construct an 85-to-100-unit highrise on a 1.8-acre site at 2021 Westcreek Ln., until recently occupied by a portion of the Westcreek Apartments. (It’s labeled Parcel D in the view at left.) Davis’s block is immediately north of the SkyHouse River Oaks, which is already under construction. It fronts San Felipe, across from Ashley Furniture, and its eastern flank abuts the Target parking lot. If Davis still wants some sort of fast-food spot to land next to his so-far-unnamed project, though, he could certainly make it happen: Takahashi reports he’ll be building on a little less than half of the site, and selling off 45,000 sq. ft. of it to developers. [Houston Business Journal; previously on Swamplot] Image: CBRE

Themed-residence developer Randall Davis is planning another Galleria-area condo project, and it looks like this one won’t have to share space with any fast-food drive-thrus — unless, of course, he wants it to. The HBJ‘s Paul Takahashi is reporting that Davis plans to construct an 85-to-100-unit highrise on a 1.8-acre site at 2021 Westcreek Ln., until recently occupied by a portion of the Westcreek Apartments. (It’s labeled Parcel D in the view at left.) Davis’s block is immediately north of the SkyHouse River Oaks, which is already under construction. It fronts San Felipe, across from Ashley Furniture, and its eastern flank abuts the Target parking lot. If Davis still wants some sort of fast-food spot to land next to his so-far-unnamed project, though, he could certainly make it happen: Takahashi reports he’ll be building on a little less than half of the site, and selling off 45,000 sq. ft. of it to developers. [Houston Business Journal; previously on Swamplot] Image: CBRE

COMMENT OF THE DAY: BUYERS WILL BE COMING TO SCOOP UP YOUR ENTIRE CONDO COMPLEX  “I don’t know how it went for Park Memorial, but with these Post Oak Townhomes only some number deemed the majority had to approve it, and the hearsay is that there was a lot of misery and gnashing of teeth by those who did not want to sell.

I am surprised there was not more media chatter about the sale of this complex. To me, it seemed flat out REMARKABLE that you could get even half to agree in a complex of that size. A big story + a harbinger of the future for aging condos.” [Harold Mandell, commenting on The End of the Post Oak Park Townhomes] Illustration: Lulu

“I don’t know how it went for Park Memorial, but with these Post Oak Townhomes only some number deemed the majority had to approve it, and the hearsay is that there was a lot of misery and gnashing of teeth by those who did not want to sell.

I am surprised there was not more media chatter about the sale of this complex. To me, it seemed flat out REMARKABLE that you could get even half to agree in a complex of that size. A big story + a harbinger of the future for aging condos.” [Harold Mandell, commenting on The End of the Post Oak Park Townhomes] Illustration: Lulu