High-stakes real estate swindler Edward H. Okun was sentenced last week in a Virginia courtroom to 100 years in prison for absconding with about $126 million in funds entrusted to his qualified intermediary company by 1031 exchange investors. Meanwhile, back on the corner of Westheimer and Highway 6, one of his former properties went up for sale.

Okun’s Investment Properties of America bought the West Oaks Mall for $110 million in 2005. The sellers of the bankrupt property might expect to get $20 million for the million-sq.-ft. mall today, reports Globe St.‘s Amy Wolff Sorter:

The mall’s anchors include Dillard’s and Macy’s, which own their own space, and Sears, which is on a lease. [Holliday Fenoglio Fowler’s Robert] Williamson says the Sears lease is up in 2010, but negotiations are underway to keep the retailer in place.

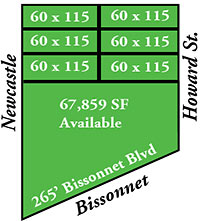

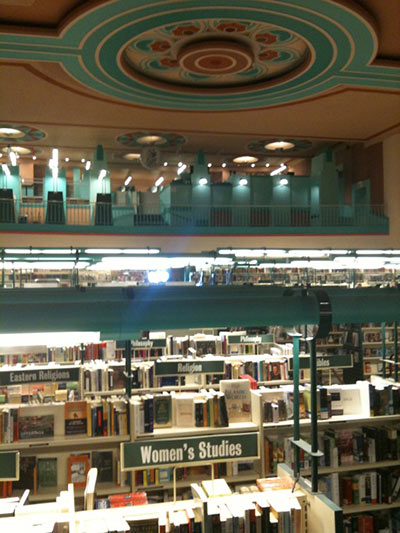

When Okun bought the mall from Somera Capital and CoastWood Capital a little less than four years ago, the asset was 95% leased, and sported $10 million worth of exterior and interior improvements. IPA had even larger plans for even more renovations on the 33-acre site, Williamson says.

Less than a year later, the owner was able to secure $86 million of permanent financing for the mall. Yet by late 2007, IPA had filed for bankruptcy protection to stave off foreclosure. Okun’s troubles and a failing economy dropped the mall’s occupancy to a little less than 70%.

How’s the mall looking these days?

CONTINUE READING THIS STORY