DELINQUENT DEBT: WEST OAKS MALL SALE! Here’s another chance to clean up some of the wreckage left by mysterious investor Edward Okun: “West Oaks Mall in Houston . . . has $81.3 million in delinquent debt attached to it in the form of commercial mortgage-backed securities. Joseph Luzinski, the federally appointed bankruptcy trustee for West Oaks Mall, said he hopes to sell the mall by year’s end, though store closures continue to hamper its value. [The mall] . . . is about 80% occupied, having lost a J.C. Penney, Linens ‘n Things and Whitehall Jewelers. The mall recently cut a deal to keep its Steve & Barry’s LLC store open amid that retailer’s bankruptcy. The special servicer for the mall’s debt, LNR Partners Inc., attempted to foreclose in September 2007, but Mr. Okun forestalled the move by putting the mall into Chapter 11 bankruptcy protection the next month. A federal grand jury indicted Mr. Okun on fraud charges last March after his 1031 Tax Group LLP, a company that helped facilitate tax-free real-estate deals for small investors, collapsed into bankruptcy and didn’t return $132 million of investors’ money.” [Wall St. Journal; previously]

Tag: Financing

The West U Examiner‘s Michael Reed points out that Randall Davis has a looming deadline to complete some work on the block of Bolsover St. in Rice Village that was purchased from the city:

A condition, passed by the Houston City Council at the time of the sale, specified that some changes to the site of the high-end condo over retail project must be completed within one year.

The block was sold in August of last year so that Davis could use it as part of his Sonoma mixed-use development. Since then, Davis has run into problems finding financing, and the project has changed considerably. He now wants to build the smaller second phase — on the south side of the street — first. But the Walgreens currently on that site has a lease that won’t be up until January.

What needs to get done by the end of October?

The plugging and abandonment of the 8-inch water line within the street, and the relocation of the existing storm sewer inlets to Bolsover and Morningside.

The developer is “required to eliminate the appearance of the public street†at the intersections of Bolsover and both Kelvin and Morningside.

- Bolsover deadline at hand [West University Examiner]

- Previously in Swamplot: Sonoma: Bolsover Bulldozer, Sonoma Holdup: We Need Some Money, Council Bowls Over, So No More Street

THE FINANCIAL CRISIS: KINDA LIKE FLOODING IN MEYERLAND A rising tide sinks all prices! “When Dr. Mahmoud Amin El-Gamal, chairman of the Rice economics department, is asked — as he has often been in recent days — ‘What’s is going on with our financial institutions?’ he likes to begin his answer with an analogy of local origin. ‘It’s a lot like in the 1980s when the flooding in Meyerland caused the price of all the houses in the area to go down,’ he said, ‘even those houses that did not flood.’ El-Gamal said the same can be said of mortgage securities, many of which were ‘perfectly fine,’ but had been grouped with debts that would likely continue to go unpaid.” [West University Examiner]

Having torn down an entire block of buildings in the Rice Village for a condo project the company can’t get financed, Randall Davis has a better idea: Why not demolish the buildings on the other side of Bolsover — so they can build the second phase instead?

The Chronicle‘s Nancy Sarnoff reports that Davis and company have been unable to get a $100 million construction loan for the Sonoma mixed-use condo development he’s been marketing for a couple of years. Hey, that’s no problem! Just move on to the next project, and double down on the demo:

Now they’re negotiating for a $70 million loan with 40 percent equity to build the smaller second phase of 85 units.

“Hopefully they’ll respond positively since we have so many sales,” said Davis.

The sales, however, are for the first phase of the project, which has been 50 percent pre-sold.

And the second phase is on the south side of Bolsover, where Walgreen’s has a lease until January.

After the jump: marginal views of phase two!

The Houston Business Journal‘s Jennifer Dawson is reporting that the Novati Group’s plan to dust off a 15-year-old Ziegler Cooper design for a 20-story office tower and build it on the West Loop

The Houston Business Journal‘s Jennifer Dawson is reporting that the Novati Group’s plan to dust off a 15-year-old Ziegler Cooper design for a 20-story office tower and build it on the West Loop

appears to be in limbo. The deal isn’t dead, but it’s not moving forward.

The problems: finding debt financing . . . and that pre-leasing thing.

Meanwhile, Dawson expects Transwestern to announce details soon on a large new addition to Uptown’s Four Oaks Place — to replace the 24-Hour Fitness on Post Oak Blvd. owned by TIAA-CREF:

The proposed building being called Tower Five at Four Oaks Place is now set to be 30 stories tall, with 525,000 square feet of office space on 22 floors atop a parking garage with roughly 1,500 spaces, says Carleton Riser, head of Transwestern’s development group.

He says the building designed by architectural firm Pickard Chilton could break ground in the first quarter of 2009.

The fact that no tenants have committed to the new building won’t delay construction, Riser says.

- Office buildings on and off [Houston Business Journal]

- That Nineties Retro Tower Coming to the West Loop [Swamplot]

- New West Loop Tower: Keeping the Uptown Office Market Up to Date [Swamplot]

Rendering: Ziegler Cooper

What caused last week’s big implosion over at Royce Builders? And what’s happening now? A Swamplot informant tries to clue us in with this rich, extended view of the company’s problems:

What caused last week’s big implosion over at Royce Builders? And what’s happening now? A Swamplot informant tries to clue us in with this rich, extended view of the company’s problems:

Fact #1: Lavish spending by all of the Speers. At any given time one of two Bentley’s, Ferrari, Escalade or sports cars belonging to the family would be parked at the office. Shawn Speer and his wife Shonna were known for bragging about their lavish spending. Certainly, if you’re making money spend it, but when times are tight they were the only ones still spending money like water.

Fact #2: Example: Shonna told another employee about $30,000 shopping spree to New York and only a purse and few other items were on that steep tab.

Fact #3: As employees were crying and leaving Shonna and her best friend and manager Nicki K. were talking about moving forward with their new clothing line. This conversation opened up speculation that monies had been moved to accounts in Nikki’s name for this purpose.

Oh yes . . . there’s more!

Another report on that Royce Builders sales meeting earlier this week:

I was in attendance at the infamous “Forget the Rumors and sell, sell, sell! [meeting.] We all thought the meeting was called to thank a dedicated and hard working group of sales people. Never once did the Speers humble themselves to utter a thank you for any contributions. We were asked to continue to sell the inventory, but they could not tell us where we would close the home nor how we would get paid. They had Countrywide Sr. Loan Officer Shawna Oakley present because we were told that all the sales on the books at been transferred to her. This did not make a bit of sense because the homes still have liens. We were told the bank was in control out of one side of the mouth and then told that they were trying to find another Title Co. It is no secret that Stewart Title out on Bay Area Blvd. is up to their ears in legals.

We all felt that the Speers should have just told everyone goodbye. The building is basically empty, there are 2 construction workers, 1 accounting person, 1 hr per son and the poor girl answering all the dirty calls and giving callers the runaround. Hats off to Fox’s Mr. Carey for trying . . . to report the truth about Royce Homes.

Royce Builders now has “about 60″ employees — down from 220 earlier this year, reports the Chronicle‘s Nancy Sarnoff, who managed to get company president John Speer on the phone:

Speer said Royce is working with its lenders to complete homes that already have been started. It is also negotiating with vendors who have liens against the company.

Royce has between 60 and 80 homes that are under construction and will be completed, Speer said. Another 70 or 80 that have been contracted but not yet started are unlikely to be built.

Meanwhile, a tipster tells us that Royce

fired ALL of the project managers and construciton managers yesterday. The corporate phones are not being answered. Hammersmith mortgage, their in-house lender, was closed for good yesterday. The Stewart Title office branch in their corporate office was also closed yesterday.

. . . and adds this colorful story:

One of the PM’s (project managers) was holding a meeting yesterday with his staff of sales people and construction. This was in one of the neighborhoods he manages. He was telling the staff NOT to listen to the rumors and keep slling as usual. He got a phone call on his company cell and left the meeting for several minutes. When he returned, he informed the staff he had been fired and they are on their own.

More Royce rubbernecking . . . after the jump!

“Sonoma is mystery,” proclaims Randall Davis near the end of an excruciatingly long promotional video posted at the project’s recently updated website. Part of the mystery, of course, has been when — or whether — construction might actually begin on the 7-story condos-shops-and-parking Rice Village layer cake. Since the buildings on the site were demolished and the block of Bolsover between Kelvin and Morningside was fenced in last fall, not much has happened.

Nancy Sarnoff has some details on the delay:

Sonoma, an upscale condo and retail project planned in Rice Village, was supposed to break ground in April.

The land has been cleared to start building, but the developers have a loan commitment for just half of what it will take to build it.

“We’re ready to put a shovel in the ground,” said Julie Tysor, president of Lamesa Corp., owner of the project. “The speed of the changing lending markets wasn’t really anticipated by any of the people involved.”

- Builders hit by credit crunch as banks tighten cash flow [Houston Chronicle, via HAIF]

- Experience Sonoma [Randall Davis]

- Previously in Swamplot: Sonoma Units Available?, Council Bowls Over, So No More Street, It Takes the Village: New Mixed Use

Rendering of Sonoma: Ziegler Cooper Architects

A reader asks:

Has anyone else heard the rumor that Mosaic Hermann Park’s South Tower (already under construction) is going all rental once complete?

It would be kinda cute if the second condo tower did end up switching to apartments, since the first tower went in the opposite direction:

[Phillips Development managing director Donald] Phillips says the company financed the first Mosaic tower as a rental property because that was the only way to secure funding.

“We did whatever we had to do to get the thing built,” he says.

- Mosaic orders double-dip as second condo tower moves forward [Houston Business Journal]

- Mosaic: Second Tower Rising [Swamplot]

- Mosaic: More Condos Available! [Swamplot]

Photo: Aerial photo of Mosaic from June: Aero Photo

UNITED TITLE: OUT OF TEXAS IN A HURRY United Title of Texas, a subsidiary of Mercury Companies, has shut down. “The local offices are in Clear Lake, Pearland, Cinco Ranch, Cypresswood, The Woodlands and on Richmond Avenue. . . . United Title is an independent agency that relied on national title companies to underwrite its policies.” [Houston Chronicle]

It didn’t garner much local attention, but a certain local condo building — along with a few close friends — made a star appearance in last week’s big mortgage-scam announcement by the FBI. More than 400 people were charged in 144 separate mortgage fraud cases nationwide over the last 3 months as part of the agency’s “Operation Malicious Mortgage.” Six of those arrests were in Houston:

This indictment charges Houston-area residents Frankthea Annette Williams, Ishmael Boyd Laryea, Charles Joseph-DeShawn Wilson, Kristen Anne Way and Robert Wilfred Stanley, and Tasha Rene Bellow, of Burbank, Calif., with engaging in a scheme to defraud by providing false and fraudulent information to residential lenders to induce the lenders to fund the purchase of single family homes and condominium units.

11 News reporter Allison Triarsi describes how the scams worked:

The suspects would find a home for sale, let’s say $200,000.

They would then get a phony appraisal that would almost double the home’s actual value. In that case, $400,000.

The culprits would then look for an investor. That’s someone to actually put the house in their name using their good credit for the closing and title.

A bank would then loan the money for the house, which has the phony appraisal value. The crooks would then pay the seller the $200,000 asking price and pocket the other $200,000.

Here’s a question. If you were trying to run this scam, where would you find properties you could get appraised for as much as twice their actual value? Sure, Houston had some price runups . . . and yes, appraisals can be played. But why fake something you don’t have to?

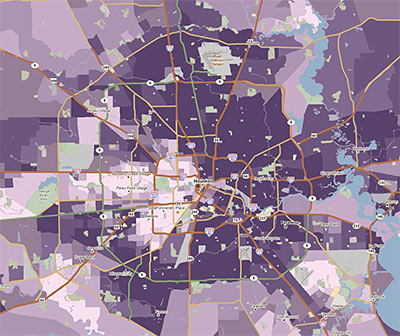

Here’s a tool likely to be useful to armchair developers interested in the lay of the land. PolicyMap is a new GIS website that allows you to view a range of local market and demographic data for Houston or any area of the country. You can see how local crime statistics, an interesting array of mortgage categories (such as the percentage of piggyback, subprime, and refi loans), income distributions, and even donations to presidential candidates look on a map. (Big surprise: Pearland and the Energy Corridor really like John McCain!)

PolicyMap is a project of The Reinvestment Fund, a non-profit community-development financial institution from Philadelphia. Some of the advanced features require a subscription, but there’s plenty to play around with for free.

The quick map above shows what Houston areas took out the most subprime loans in 2006. (The darkest purple means more than 50% of all mortgages funded that year.) If you discover more interesting neighborhood stories demonstrated nicely in PolicyMap maps, share your finds in the comments.

An update on the 1031-exchange debacle surrounding the West Oaks Mall: In March, the mysterious Edward Okun — the mall’s owner — was indicted by a Virginia grand jury on charges of mail fraud, for misappropriating $132 million invested in his 1031 exchange company, 1031 Tax Group — along with bulk cash smuggling and related charges. Days later, Okun was arrested in his home on Hibiscus Island in Miami Beach.

To the 340 investors who had trusted $150 million of their 1031-exchange funds to supposedly-qualified intermediaries controlled by Okun, this was good news. But it doesn’t necessarily mean they’ll get their money back — or find a way around the huge tax liability now associated with their failed exchanges.

The 1031-exchange investors in Okun’s 1031 Tax Group had hoped to recoup some of their missing funds by raiding Okun’s other assets — including the West Oaks Mall. But the Okun-controlled companies that owned the mall declared Chapter 11 bankruptcy in October.

Today, the Costar Group reports that the freestanding building formerly known as JCPenney at the West Oaks Mall has been put up for sale, along with a mall in Salina, Kansas. The trustee in the bankruptcy case has hired Keen Realty, the new real estate division of KPMG Corporate Finance, to market both properties.

- Okun Assets Go on the Market [CoStar Group]

- Case History Prior to the Appointment of the Trustee [The 1031 Tax Group Bankruptcy Trustee]

- West Oaks Mall: Your Exchanges Are No Good Here [Swamplot]

Lou Minatti asks the $54 million question:

Why is Discovery Green a sea of brands? Waste Management, Inc. Gardens? OK, I understand the revenue issue. Are these naming rights perpetual?

Dunno about the perpetual part, but the list of brand and donor names on the new 12-acre Downtown park’s many features does go on and on! A few of our favorites: The Kinder Large Dog Run, the Martin Family Scent Garden, and the Marathon Oil Bike Racks.

Fortunately, Houstonian Kim Borja didn’t have to pay anything to choose the park’s name — he won the naming contest:

The response was overwhelming: more than 6,200 entries were submitted, and a theme soon emerged. Houstonians wanted a name that was distinctive and unusual, including elements that mirrored Houston itself. Words such as “surprising,” “unexpected” and “vital” were reoccurring.

If this place had ended up with a name like “Unexpected Gardens,” we’d all probably want there to be a serious donation behind it.

After the jump: that long list of Discovery Green’s branded park parts — plus: a few yet-unbranded park features may still be available!