COMMENT OF THE DAY: COOL DEVELOPMENTS NEED WACKY BUCKS “There’s plenty of eccentric millionaire money around. I guess they are just more private that they used to be? (My husband’s boss keeps bars of silver in his basement, for example.) Or, they prefer to spend their money on credit default swaps than cooky real estate schemes. C’mon rich people! Do something interesting.” [anon, commenting on Comment of the Day: A Different Kind of Money]

Financing

COMMENT OF THE DAY: A DIFFERENT KIND OF MONEY “Could the banality and sameness of what developers in Houston are constructing be in part to changed lending standards by the banks? Back in the 1970′s Gerald Hines developed very innovative office buildings for the day, employing famous architects for the design. Pennzoil Place is no cookie cutter “international style†box, that’s for sure. But back then, we didn’t have interstate banking either. For those of you born post 1985, that means ALL of our banks were headquartered in Texas. I’d assume Hines went to see Ben Love at Texas Commerce Bank, or the guys at Allied Bank, and they worked out the loans. Today, those loan officers are in New York or Charlotte, and don’t want to risk their bank’s money on something avant garde. Also, developers today rarely keep their portfolios together more than a few years. They ‘flip’ their completed properties to REITs so that they have the capital to build something else. When you need to turn your property over quickly, it’s best to have something the buyers understand, and that didn’t cost so much per square foot that you can’t make a profit selling it in 18 months. A REIT just wants to purchase something with what they feel will be a certain stream of income over a 10 year time horizon. They are oblivious to the fact that it’s not a thrilling design.” [ShadyHeightster, commenting on The Muse Moving in Next to the Post Office in Castle Court]

ASHBY HIGHRISE FUNDING HUNT ENDS WITH HUNT FUNDING  The developers of the Ashby Highrise tell Nancy Sarnoff they’ve got funding for the 21-story apartment tower that’ll replace the Maryland Manor Apartments at 1717 Bissonnet. The money’s coming from an El Paso real estate firm named Hunt. Buckhead Investment Partners also names the contractor they’ll be working with: Linbeck, whose top executive “lives in the neighborhood adjacent to the building site.” (Leo Linbeck III also started his own Super PAC, aimed at kicking out incumbents of both political parties in Congress.) The construction schedule has been pushed back, though — it’ll now begin early next year. [Houston Chronicle; previously on Swamplot] Photo: Candace Garcia

The developers of the Ashby Highrise tell Nancy Sarnoff they’ve got funding for the 21-story apartment tower that’ll replace the Maryland Manor Apartments at 1717 Bissonnet. The money’s coming from an El Paso real estate firm named Hunt. Buckhead Investment Partners also names the contractor they’ll be working with: Linbeck, whose top executive “lives in the neighborhood adjacent to the building site.” (Leo Linbeck III also started his own Super PAC, aimed at kicking out incumbents of both political parties in Congress.) The construction schedule has been pushed back, though — it’ll now begin early next year. [Houston Chronicle; previously on Swamplot] Photo: Candace Garcia

CHUY’S ENCHILADAS TO DEVOUR, SHARE  For $10.49 plus tax and tip, you could order the Elvis Presley Memorial Combo at one of the 7 Houston-area Chuy’s. Or for $11 to $13, you could buy a share of the restaurant’s stock at its impending IPO (if you can get in, of course). The regional Mexican-restaurant chain, which was bought in 2006 by a New York private-equity firm, grew from 8 locations in 2007 to 32 this year. The company plans to use the $75 million it hopes to raise in the offering to pay off debts, terminate an agreement with an advisory group, and open more than 50 additional locations over the next 4 years. [TM Daily Post] Photo of Chuy’s at 9350 Westheimer: Happy Family Travels

For $10.49 plus tax and tip, you could order the Elvis Presley Memorial Combo at one of the 7 Houston-area Chuy’s. Or for $11 to $13, you could buy a share of the restaurant’s stock at its impending IPO (if you can get in, of course). The regional Mexican-restaurant chain, which was bought in 2006 by a New York private-equity firm, grew from 8 locations in 2007 to 32 this year. The company plans to use the $75 million it hopes to raise in the offering to pay off debts, terminate an agreement with an advisory group, and open more than 50 additional locations over the next 4 years. [TM Daily Post] Photo of Chuy’s at 9350 Westheimer: Happy Family Travels

COMMENT OF THE DAY: THE ASTRODOME HONEYPOT PLAN, CHEAPER THAN DEMOLITION “If someone just gave me $50 million, I’d structure a perpetuity yielding no less than a 1.2% return (which shouldn’t be at all difficult when 30-year T-bonds yield a 2.85% return) and maintain the Dome FOREVER. I say this because I recall a Chronicle article citing a cost of $600,000 per year to maintain it in mothballs. That’s just not very much money. Unless there’s a pressing need to spend $140 per square foot to reclaim the land (which would be idiotic given that Astroworld sold its land for $17 PSF and that the Reliant Arena is also on the chopping block and would yield more land), then the only thing that could possibly make sense is to do nothing. Simply wait. Then . . . the first private concern that can pony up the cash to do something appropriate with the venue that will generate hotel and/or sales tax revenue gets to capture the $600k per year for themselves. I suspect that it wouldn’t take particularly long. And then the taxpayers come out AHEAD as compared to demolishing it and the politicians get to take well-deserved credit.” [TheNiche]

COMMENT OF THE DAY: THE CRY OF THE INSTITUTIONAL FUNDRAISER “It’s all well and good to have a foundation, but what’s the fun of being a billionaire if you don’t have some buildings with your name on it?” [Robert Boyd, commenting on Midtown Arts Center Interim Design Review: How Do You Like It Now?]

GETTING CASH OUT OF THE HOUSTON PAVILIONS  The Downtown Redevelopment Authority this week approved a loan of $3.3 million to the developers of the Houston Pavilions. But the mall’s developers likely won’t need to pay it back. According to a 2006 agreement that included a promised $14.3 million of TIRZ reimbursements and grants for the sleepy downtown redevelopment project, the developers would only receive the last $3.3 million payment once the retail portion of the project was 70 percent leased. At the moment — thanks in part to efforts by management earlier this year to prevent Books-A-Million from closing up shop there — the retail spaces are 62 percent full. Not a problem: The interest-only loan will tide the developers over until they can get their numbers up. Also coming to Houston Pavilions, as part of the deal: new outdoor eating areas and an HPD “special operations” storefront. [Houston Chronicle; previously on Swamplot] Photo: Flickr user Scott DeW

The Downtown Redevelopment Authority this week approved a loan of $3.3 million to the developers of the Houston Pavilions. But the mall’s developers likely won’t need to pay it back. According to a 2006 agreement that included a promised $14.3 million of TIRZ reimbursements and grants for the sleepy downtown redevelopment project, the developers would only receive the last $3.3 million payment once the retail portion of the project was 70 percent leased. At the moment — thanks in part to efforts by management earlier this year to prevent Books-A-Million from closing up shop there — the retail spaces are 62 percent full. Not a problem: The interest-only loan will tide the developers over until they can get their numbers up. Also coming to Houston Pavilions, as part of the deal: new outdoor eating areas and an HPD “special operations” storefront. [Houston Chronicle; previously on Swamplot] Photo: Flickr user Scott DeW

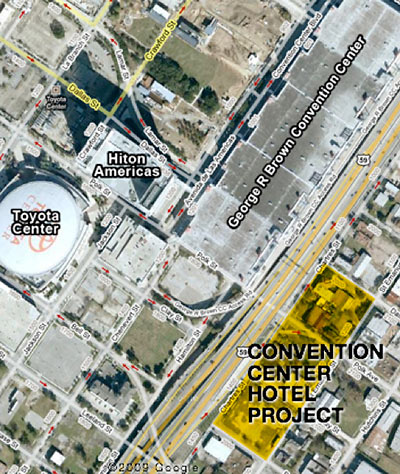

An effort led by former Houston mayor Lee P. Brown to recruit wealthy Chinese investors for a proposed 1000-room East Downtown hotel project on the opposite side of the 59 freeway from the George R. Brown convention center appears to be picking up steam. Brown is listed as chairman of the managing general partner of the project, a company named Global Century Development. Brown and Global Century’s president, Dan Nip, hope to raise money for the $225 million project from investors who want to immigrate to the U.S. through the U.S. Citizenship and Immigration Services’ EB-5 Visa program. That program, established as a result of the Immigration Act of 1990, allows foreign nationals to obtain a green card by investing a minimum of $500,000 — and thereby create 10 or more jobs — in qualified areas with high unemployment rates. An East Downtown investment zone identified by Global Century Development in the area bounded by Preston St., the 59 Freeway, I-45, and Dowling is the only area in Houston that qualifies as a “regional center” under the program.

A Powerpoint presentation prepared by Global Century Development that appears to date from last year sites the proposed hotel on three adjacent blocks near Saint Emanuel and Polk St. But a report in today’s Houston Business Journal by Jennifer Dawson indicates plans for the East Downtown hotel are focused on only 2 of those blocks, which Nip controls: They’re bounded by Polk, Saint Emanuel, Bell, and Chartres. Dawson reports that a pedestrian bridge connecting the hotel to the convention center across the freeway is being planned, but a schematic drawing of a bridge featured in the presentation appears to show it only crossing Chartres St., requiring pedestrians to cross under the freeway:

COMMENT OF THE DAY: THE MODS AND THE BANKERS  “My fiance and I have wanted to purchase this home for over a year. We’ve heard the banks won’t approve financing due to the foundation problems; we’d love to restore it to [its] original glory, it needs a MCM loving family–maybe you’re an investor who’d like to help us out? We don’t want this house to get into the wrong hands, it’ll break our hearts.” [Jessica Define, commenting on Scouting Report on a Walnut Bend Mod]

“My fiance and I have wanted to purchase this home for over a year. We’ve heard the banks won’t approve financing due to the foundation problems; we’d love to restore it to [its] original glory, it needs a MCM loving family–maybe you’re an investor who’d like to help us out? We don’t want this house to get into the wrong hands, it’ll break our hearts.” [Jessica Define, commenting on Scouting Report on a Walnut Bend Mod]

From the window of his office behind the Galleria, Swamplot reader Warren Pattison snaps this view showing a crane installing a large sign on the site of a new office tower scheduled to go up at 3009 Post Oak Blvd. That’s the former site of Tony’s Ballroom, wedged between the Water Wall and the West Loop. An executive with the U.S. unit of Swedish project development and construction company Skanska announced back in January that the project should begin construction by the end of this year, but the company didn’t close on the deal to buy the land — from a subsidiary of Hines — until September. The company will be financing the building by itself. A fanciful view of the design for the now-19-story tower, by local architecture firm Kirksey, as it might appear if no buildings or billboards were nearby, and everybody abandoned the West Loop:

A COME-FROM-BEHIND VICTORY FOR HOUSTON’S DRAINAGE FUND Surprise! A late flood of support turned the tide for the “Renew Houston” campaign. Proposition 1, the city charter amendment that sets up a separate pool of money for drainage improvements and establishes new taxpayer fees to pay for it, ended up passing by a very narrow margin: a little more than 7,000 votes. The amendment was supported heavily by engineering and construction firms. [Bay Area Citizen]

Just what is it that’s allowed construction on the Mirabeau B. condos on the corner of Hyde Park and Waugh to go forward when so many other projects have stalled? How about a little thing called . . . zero debt. After flirting with turning the building rental last year, developer Joey Romano now says he’s back to the original plan of selling all 14 units in the 4-story building — though he’ll also consider leases with purchase options “on a case by case basis.” Construction began in May; Romano expects the building to be complete by next July.

METRO LIGHT RAIL CONSTRUCTION SLOWS TO A CRAWL More repercussions from Metro’s Spanish-train procurement fiasco and the transit agency’s ensuing budget crisis: This morning CEO George Greanias announced dramatic cutbacks on all new light-rail construction until the future of the project’s federal funding becomes clearer. This year’s expansion budget is being cut by almost 70 percent, but the project is not shutting down completely — because doing so would cost an additional $200 million, Greanias and board chairman Gilbert Garcia said. Left to lope along until the end of the year: Utility work on the North and Southeast Lines, and utility and road work in “select areas” of the East End Line [Hair Balls; previously on Swamplot]

Those trains from Spain that gave the feds cause to complain yesterday are gonna delay the completion of all three light-rail lines now under construction, Metro announced today. The transit agency backed off its earlier ETA for the North, Southeast, and East End lines, saying that meeting the previously announced October 2013 completion date is no longer feasible. The problem: getting at $900 million in grant money from the Federal Transit Administration, which Metro had been expecting to arrive soon. The FTA is now requiring a promise from the transit agency to rebid the railcar contract before it’ll continue considering the application for the bulk of those funds. Sez Metro: “A delay of up to one year is anticipated.”

- Metro: Completion of 3 light-rail lines pushed back up to a year [River Oaks Examiner]

- Clarification Regarding Rail Construction Schedule [Metro]

- Previously on Swamplot: Feds To Metro: Back off the Spanish Trains and We’ll Fund Your North and Southeast Lines

Drawing of future Southeast Corridor light rail line on MLK near Madalyn Ln.: Metro

FEDS TO METRO: BACK OFF THE SPANISH TRAINS AND WE’LL FUND YOUR NORTH AND SOUTHEAST LINES Calling the results of its 4-month-long investigation “both alarming and disturbing,” the Federal Transit Administration scolded Houston’s transit agency for systematically trying to bypass federal rules in the signing of 2 light-rail-vehicle contracts with a Spanish manufacturer. But the violations won’t derail funding for the light rail lines — as long as Metro’s new management team promises to rebid the contract and follow federal “Buy America” rules. A letter from FTA administrator Peter Rogoff said Houston commuters shouldn’t be punished for Metro’s violations: “The Administration still believes that the North and Southeast Corridor projects have merit and we stand behind our Fiscal Year 2011 budget request of $150 million for the two projects.†[FTA]