A 20-or-so-acre piece of the 104-acre part-time parking lot across the South Loop from Reliant Park formerly known as AstroWorld has traded hands, a developer tells HBJ reporter Jennifer Dawson. But the buyer hasn’t identified itself, and Dawson couldn’t get any of the parties involved to tell her who it is (Dawson says she spoke to 15 people to report her story). Who owns the remaining 80 or so acres of the giant parcel on the south side of the South Loop, between Kirby and Fannin, at the end of the rail line? At last report, a partnership controlled by Fort Worth’s Mallick Group, who bought it in 2010 for $10 cash — and a willingness to assume the previous owner’s $74 million loan.

But a consultant who claims to be involved in redevelopment efforts on the property would only refer to the owner of the main portion of the vacant lot as “an out-of-state land investor” — who has now, she says, created a master plan for the site. Heather Schueppert tells Dawson that details of a proposed mixed-use project — probably combining office, retail, medical and hospitality components — will be revealed quietly in the next couple of months, but won’t be unveiled to the general public for at least a year.

CONTINUE READING THIS STORY

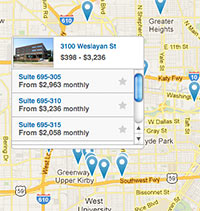

A new website launched by a Houston startup aims to simplify the complicated process of leasing and setting up shop in a new office, warehouse, restaurant, or retail space. Kicked off this month with about 1,500 Houston property listings from about a dozen local and national brokers,

A new website launched by a Houston startup aims to simplify the complicated process of leasing and setting up shop in a new office, warehouse, restaurant, or retail space. Kicked off this month with about 1,500 Houston property listings from about a dozen local and national brokers,  A 3-month-old website that aims to collect and broadcast detailed information about existing buildings — including photos, square footage counts, ownership and management contacts, projects and renovations, and LEED certification levels — opened its catalog of Austin, Dallas, and Houston commercial and mixed-use structures this week.

A 3-month-old website that aims to collect and broadcast detailed information about existing buildings — including photos, square footage counts, ownership and management contacts, projects and renovations, and LEED certification levels — opened its catalog of Austin, Dallas, and Houston commercial and mixed-use structures this week.

Dismemberment of the

Dismemberment of the

Four years after its opening, the troubled Downtown mall-office complex known as Houston Pavilions may sell for $50 to $75 million below the cost of its construction. To avoid foreclosure on a loan valued at $130.7 million, the developers turned the property over to a receiver late last year; Transwestern is now marketing the project for sale. Offices are fully occupied, but the big problem is the 59-percent-vacant retail portion of the project, says Real Estate Alert: “More than half of the retail tenants haven’t been paying full rent because the overall retail occupancy rate remains below the prescribed threshold cited in their leases. A buyer could convert about 42,000 sf of vacant retail space into offices to exploit downtown Houston’s booming office market . . . However,

Four years after its opening, the troubled Downtown mall-office complex known as Houston Pavilions may sell for $50 to $75 million below the cost of its construction. To avoid foreclosure on a loan valued at $130.7 million, the developers turned the property over to a receiver late last year; Transwestern is now marketing the project for sale. Offices are fully occupied, but the big problem is the 59-percent-vacant retail portion of the project, says Real Estate Alert: “More than half of the retail tenants haven’t been paying full rent because the overall retail occupancy rate remains below the prescribed threshold cited in their leases. A buyer could convert about 42,000 sf of vacant retail space into offices to exploit downtown Houston’s booming office market . . . However,

The Woodlands Mall location is among the 11 anchor stores around the country Sears announced it will sell to mall operator General Growth Properties.

The Woodlands Mall location is among the 11 anchor stores around the country Sears announced it will sell to mall operator General Growth Properties.