WHEN ALL THOSE CORNERS WERE ITCHING FOR BANKS Coming soon to a courthouse near you: Ponderosa Land Development Co. and the bank corner that got away: “Ponderosa bought nearly an acre in Sugar Land three years ago from Gateway Financial for a price of $1.8 million. The land at the corner of State Highway 6 and Settlers Way was purchased for development of a JP Morgan Chase Bank branch. Over the past five years, Ponderosa has built about 50 bank branches in Texas for Chase Bank. [Ponderosa’s James] Chang says Ponderosa had already secured a long-term ground lease with the bank, and an investor was lined up to buy the property once the building was complete. Shortly after the land acquisition closed in April 2007, Ponderosa demolished a gas station that was operating on the site to prepare for construction of the bank branch. In the process, Ponderosa learned that the Sugar Land site carries a deed restriction prohibiting construction of a financial institution. The alleged oversight on the part of AmeriPoint [Title] in conducting a title search put the brakes on development. ‘Missing the restriction was kind of an important miss,’ says Chang. Stewart Title wrote a title insurance policy based on AmeriPoint’s work. . . . Ponderosa filed suit in July 2008 to recover the $1.8 million land purchase price. The firm is also seeking $1.6 million for three years of lost profits. Ponderosa tried to collect on the firm’s $1.8 million title insurance policy, but Chang says Stewart Title claims the diminished value of the land is $200,000.” [Houston Business Journal]

Development Strategies

ASHBY HIGHRISE DEVELOPERS DROP NAMES, MOVE TO DISTRICT COURT  What do the Fairmont Museum District, La Maison on Revere, Millennium Greenway, and 2121 Mid Lane apartments, the Medical Clinic of Houston, and the trigger-happy Sonoma development in the Rice Village have in common? They all make cameo appearances in the latest version of Buckhead Investment Partners’ lawsuit against the city of Houston. The claim: that none of those projects were subjected to the same traffic restrictions as Buckhead’s proposed 23-story tower on the corner of Bissonnet and Ashby, next to Southampton: “The Ashby high-rise developers re-filed their lawsuit April 7 in state district court, where it will focus more heavily on claims the project was denied permits for its original design because it was subjected to ‘capricious and unreasonable’ standards.

Court documents submitted by attorneys for the Buckhead Development Partners, show the suit against Houston continues to center on the city’s application of the driveway ordinance as a basis to refuse a final building permit.

The city has said it is correct in its application of the ordinance and the inclusion of ‘trip-count’ standards to guarantee safety and ensure streets in the neighborhood remain passable.” [River Oaks Examiner; previously on Swamplot] Rendering: Buckhead Investment Partners

What do the Fairmont Museum District, La Maison on Revere, Millennium Greenway, and 2121 Mid Lane apartments, the Medical Clinic of Houston, and the trigger-happy Sonoma development in the Rice Village have in common? They all make cameo appearances in the latest version of Buckhead Investment Partners’ lawsuit against the city of Houston. The claim: that none of those projects were subjected to the same traffic restrictions as Buckhead’s proposed 23-story tower on the corner of Bissonnet and Ashby, next to Southampton: “The Ashby high-rise developers re-filed their lawsuit April 7 in state district court, where it will focus more heavily on claims the project was denied permits for its original design because it was subjected to ‘capricious and unreasonable’ standards.

Court documents submitted by attorneys for the Buckhead Development Partners, show the suit against Houston continues to center on the city’s application of the driveway ordinance as a basis to refuse a final building permit.

The city has said it is correct in its application of the ordinance and the inclusion of ‘trip-count’ standards to guarantee safety and ensure streets in the neighborhood remain passable.” [River Oaks Examiner; previously on Swamplot] Rendering: Buckhead Investment Partners

COMMENT OF THE DAY: CHIN UP, WEINGARTEN! “I don’t totally understand Weingarten’s defensiveness here. After all, they totally earned the wrath of people in the community who would like to see older, architecturally significant buildings preserved in some fashion when they tore down the north side of the shopping center at Shepherd and Gray. They made a calculation then that peoples’ upset feelings would not outweigh the financial benefit. Given this, why do they care what people think now? Did the negative publicity before actually hurt them in any material way? (I’ve made a point of not shopping at the new B&N even though I am a compulsive book-buyer, but I have no illusions that me and people like me have any impact on their bottom line.)” [RWB, commenting on Weingarten Exec Blames Those Alabama Theater Demolition Drawings on Staples]

Intrepid River Oaks Examiner reporter Michael Reed tries to get answers to that nagging question on the mind of every person who’s walked or driven by the vacant site of the former Wilshire Village Apartments on Dunlavy near West Alabama in the last month: What’s the deal with that little square of land in the back of the site that’s been taped off with a handwritten address sign?

Since the yellow tape was not in the shape of a fallen body, our first guess was the little cordoned-off area had something to do with some “truly odd†city code. . . . Perhaps it involved an obscure extremely minimum lot size ordinance, an idea we soon discarded because it almost made sense.

Carefully attuned to Wilshire Village’s well-documented vortex of absurdity, and being careful — professional journalist that he is — not to trespass on the site, Reed takes a photo of the city green tag on the sign while standing on the public sidewalk. Then, all David Hemmings-like, takes it home to enlarge it and read what it says:

COMMENT OF THE DAY: THE WILSHIRE VILLAGE CURSE “. . . I think we can officially call this site cursed as everyone who has anything to do with it seems to begin making insane decisions about what to do with it. A grocery store?? Really?!?” [mstark, commenting on H-E-B: Yes, We’re Buying the Wilshire Village Site]

Hey, good one! Remember all those revisions Buckhead Investment Partners finally made to the Ashby High Rise plans — cutting out a bunch of the ground-floor retail space, enlarging the restaurant, and putting that big driveway loop on Bissonnet — so that the city might finally approve the Southampton-side tower? Yesterday the developers told the Chronicle‘s Mike Snyder they were really just part of an elaborate fake-out maneuver:

Between July 2007 and August of this year, city officials rejected applications for the project 11 times on grounds that traffic it generated would increase congestion on nearby streets to unacceptable levels.

In August, the city approved a 12th application after [Buckhead’s Matthew] Morgan and [Kevin] Kirton removed all the commercial uses except the restaurant and reduced the number of residential units. The developers said Wednesday that they changed their plans to test whether the city would approve their project under any circumstances, but never intended to build anything other than the project they designed in 2007.

Aw, c’mon: If you actually did go ahead and build the approved plans, that would be a great stunt too! But how did these fun-loving developers happen upon such a wacky strategy? Snyder provides some insight into their inspiration:

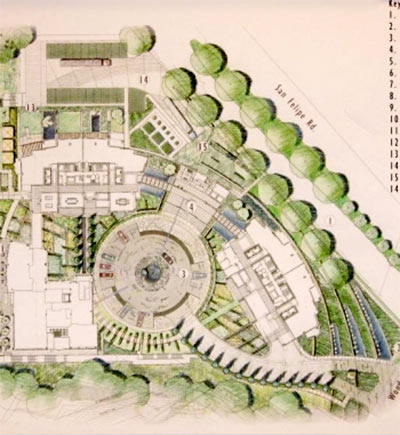

Just a month ago, an executive of Brooklyn’s Boymelgreen Developers was telling the Chronicle‘s Nancy Sarnoff that the company was still committed to building those twin 28-floor condo towers at the very end of Woodway on San Felipe, next door to the old Dolce & Freddo gelato shop. Development director Sara Mirski reported that the firm planned to start construction on the Ziegler Cooper design next year, after completing a new market analysis in the spring.

The former shopping-center site, just a leap over Buffalo Bayou from Piney Point Village, was purchased by an Israeli company controlled by developer Shaya Boymelgreen 2 years ago, just days after another Boymelgreen affiliate flipped the property at the corner of Richmond and Post Oak — the site of the former Mason Jar and Steak & Ale — for a quick $24 million profit.

But those were the good ol’ days. Now Boymelgreen may have a few other things to take care of before he can get going on the San Felipe Condominiums:

Channel 2 investigative reporter Amy Davis sends a KPRC newschopper to buzz the 80-acre Cypress party pad estate of former Royce Builders president John Speer. More than a year after we featured the innumerable builder upgrades of that Mack-Daddy mansion on Swamplot, it’s still sitting on the market — for the same $9.8 million.

Meanwhile, less than a mile to the west, sales aren’t going so well either in former Royce Homes subdivision Grant Meadows:

“Houses are in disrepair. Fences are in disrepair,” explained homeowner Matt Adams. “The whole neighborhood’s been left in ruins.” . . .

Royce stopped paying the bill for the street lights in Grant Meadows in July 2008.

Reliant recently switched them off, and told homeowners they must pay the $14,000 owed before they can turn them back on.

“It’s pitch black out here at night,” said homeowner Evit Byrd, who planned to retire in Grant Meadows with his wife. “You can’t see anything.”

But there’s some good news: Speer has been building again! His new company, Vestalia Homes, which Speer founded 3 weeks after he closed down Royce, is busy constructing and selling homes a little closer to FM 1960, in a subdivision called the Lakes of Cypress Forest.

THIS TIME, FOR THE DEVELOPERS Two proposals out of Mayor White’s office earlier this year — one to pay down the consumer debt of homebuyers, the other to give $5,000 bonuses to Realtors representing buyers in 8 revitalization areas — didn’t get very far. But City Council approved the latest version yesterday: $620,000 in construction subsidies from the TIRZ Affordable Housing Fund for 10 homes — 4 in Trinity Gardens and 6 in the Fourth Ward. The participating builders and CDCs are to be chosen by the city’s Housing and Community Development Director. “The developers may sell the homes after they are used for at least a year as models, but the net proceeds must be reinvested in the same community.” [Houston Chronicle, via Swamplot inbox; details on page 200 here (PDF)]

HISTORY IN THE MAKING A whole lotta railroad action next to the site of the planned Crawford Stations on the East End line, between Minute Maid Park and Discovery Green — but will this train be rolling?: “If a series of deals go through, the city would be able to create a ‘super block’ previously eyed for a new hotel, redevelop Avenida De Las Americas and move two historic houses and a railroad engine to create a small historic area on the eastern side of downtown. The train would complement the homes and proposed heritage center — which would be paid for with privately raised funds — and underscore the importance of locomotives in Houston’s history in facilities across the street from the former Union Station. . . . But the plans also call for an unusual process to sell land to a wealthy, well-connected real estate investor and former council member, and force the city to move the historic homes.. . . Several City Council members raised questions about the initial step in the process, which the council will consider today, to appoint an independent appraiser to name a price for the land on Avenida De Las Americas, between Capitol and Rusk. If the city sees the price as favorable and decides to sell, it would then be up to Louis Macey, who owns a far larger piece of land that abuts the area, to buy. . . . Andy Icken, deputy director of the city’s Department of Public Works and Engineering, said the city needs to relocate the homes before the Metropolitan Transit Authority begins building light rail lines along Capitol and Rusk. . . . The city has chosen to sell the houses through a process normally used with abandonments because it is likely to get more money that way, he said. By itself the land’s potential may be limited, but if an appraiser can consider its value in the context of other downtown land — which is possible in this case because Macey is the adjacent landowner — it is almost certain to fetch a higher price, he said.” [Houston Chronicle]

What are these Campbell Construction Company workers doing? Just building a fence down aways on Barron Ln. from their Missouri City office — in order to block the driveway belonging to their neighbor, Cesar Larias. Owner Jeff Campbell ordered the fence built after Larias refused to pay a $50 monthly fee to access his own garage.

Ten years ago, Campbell bought several parcels — one of which apparently includes Larias’s driveway and most of his front yard — from a tax auction. How’d they come up for sale? Channel 2 reporter Stephen Dean explains:

Court documents reviewed by Local 2 Investigates show that the original landowner who developed the entire neighborhood had divided off several of the strips of land in question, hoping to sell them separately someday if the government expanded Hillcroft Street down through the subdivision. That expansion never happened.

The original landowner died and Fort Bend County ended up selling the parcels of subdivided land at an auction on the courthouse steps because no one was paying taxes on those parcels anymore.

Until Campbell asked him and several neighbors to start paying a fee to access their own properties, Larias had no idea that his driveway and front yard did not belong to his family’s homestead. Alas, such appears to be the case.

Asked if he has considered selling the land back to the homeowners, Campbell said, “Yeah, but the amount they want to give for it, I don’t want to sell it for that. You see the situation that I’m in?”

Campbell insisted he’s not trying to gouge the neighbors or force them from their homes, although he admitted he may want to expand his nearby construction business.

“Well, my decision was to have them pay something to use it,” said Campbell. “I’ve been really above and beyond fair about it. I’m not trying to hurt these people.”

He admitted that it may appear heavy-handed for him to have placed a Dumpster across the driveway when the Larios family stopped paying for access.

Wait! How’d you reporter dudes find out about the Dumpster?

COMMENT OF THE DAY: MEMORIAL REAL ESTATE IMPERATIVES “The house is old. The house must be torn down. The house will be replaced by one with separate rooms for every task imaginable. The house will have a six car garage – the new four car garage. A realtor will advertise the property with ‘old growth trees’. This must be done.” [tcpIV, commenting on Daily Demolition Report: Taking from Friar Tuck and Little John]

East End blogger Dana Jennings was eager to see what the owners of what was once the Avalon Theater at the corner of Lawndale and 75th St. — just east of the Forest Park Cemetery — had in mind for the property. From last month:

It’s most recent use was as a church. Usually alot of traffic, both foot and vehicular, was seen on Sundays. They’ve moved to a more hopeful location about 2 years ago.

I always thought this would be remodeled into apartment homes. It’s right across the street from La Michocana Meat Market and Grocery, the 99 Cent store, CVS pharmacy, fast food and the Washateria. The bus line runs along Lawndale. It’s a lively corner, active, but again, and I know I’m repeating myself, it’s not threatening. In other obvious words, it would make a great place for new apartments.

The building, still labeled “Living Hope Church,” was demolished September 4th. So what’s the latest on the property?

The Wilshire Village soap opera continues: A source sends Swamplot two trustee’s sale notices for the now-demolished 7.68-acre apartment complex at the corner of W. Alabama and Dunlavy.

How deep into it is the owner? There’s a first lien of $10,742,000 to Amegy Bank, now “wholly due and payable”! That lien dates from January 31, 2006 — the same date, according to HCAD, that the owner, a limited partnership named Alabama & Dunlavy Ltd., took over the property.

The second notice documents problems with Alabama & Dunlavy Ltd.’s separate mezzanine financing with Wedge Real Estate, in the amount of $3 million. That separate promissory note appears to date from May 30th of 2008. Both trustee’s sale notices are dated earlier this month.

Our source comments:

It is rather interesting that Wedge Holdings is the mezz lender, with Wedge being Mayor Bill White’s former company. I feel certain that Matt [Dilick] will avert foreclosure by filing bankruptcy, if he has not already done so.

Oh but if if if foreclosure somehow isn’t averted, where and when might eager Swamplotters be able to snap up this fine scraped property?

COMMENT OF THE DAY: THE VALUE OF FAILED DEVELOPMENTS “The financial failure of Mosaic is not related to zoning or neighborhood protection. Mosaic represents a massive mixed-use project that will (eventually) fill up and further the civic goals of increasing population density and adding positively to the streetscape. In the mean time, the FDIC and out-of-state investors are paying the property tax bill on units that aren’t occupied by people that would stress our infrastructure. Where’s the downside in that? If the alternative were a vacant lot, Mosaic is far preferable from a civic perspective. . . .” [TheNiche, commenting on Only the Towers Remain Standing: Mosaic and Friends Break the Bank]