University of Houston officials have asked Metro to move a portion of the Southeast Line, currently under construction, off its planned route — and off campus. Work on portions of the line on Wheeler and Scott streets near Robertson Stadium came to a standstill 2 months ago, West U Examiner reporter Michael Reed notes. Metro and UH officials have apparently been negotiating on the layout of the light-rail route since that time, but so far, according to Reed, there’s been no agreement.

Metro’s planned design for the line requires the transit agency to purchase a total of 4.48 acres of UH property, much of it in a strip along the eastern side of Scott St., just west of the stadium. A plan submitted to the Department of Transportation for funding last year shows the line and a Scott/Cleburne station on the east side of Scott St., on part of what’s currently a stadium parking lot. (The map, below, also shows that Metro adjusted the plan from a 2008 layout that would have eaten up more UH property.)

Long before he sold the land where the brand-new BBVA Compass Stadium for the Houston Dynamo soccer team now sits to the city, former council member and longtime land speculator Louis Macey had a deal ready to go that would have turned the vacant land into some sort of close-to-Downtown entertainment venue, Catie Dixon reports: “He ended up with six blocks around Bastrop and Texas, which

Long before he sold the land where the brand-new BBVA Compass Stadium for the Houston Dynamo soccer team now sits to the city, former council member and longtime land speculator Louis Macey had a deal ready to go that would have turned the vacant land into some sort of close-to-Downtown entertainment venue, Catie Dixon reports: “He ended up with six blocks around Bastrop and Texas, which  Houston’s Midway Companies, along with an unnamed New York Partner, is set to acquire Houston Pavilions from the receiver who took over the Downtown mall last year, according to a report in today’s HBJ. Reporter Jennifer Dawson notes reports to the bankruptcy court indicate that the development’s retail space is now 66 percent leased, and the property has a positive cash flow — before debt service. In the year before its default, Pavilions’ original developer made no payments on its original $120.6 million 2007 loan. [Houston Business Journal;

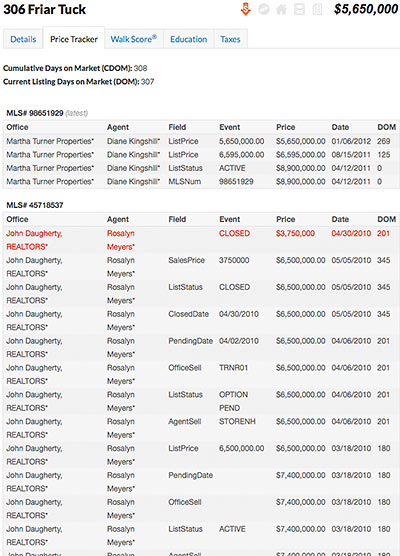

Houston’s Midway Companies, along with an unnamed New York Partner, is set to acquire Houston Pavilions from the receiver who took over the Downtown mall last year, according to a report in today’s HBJ. Reporter Jennifer Dawson notes reports to the bankruptcy court indicate that the development’s retail space is now 66 percent leased, and the property has a positive cash flow — before debt service. In the year before its default, Pavilions’ original developer made no payments on its original $120.6 million 2007 loan. [Houston Business Journal;  Heriz, Aubusson, and Kerman rugs; antique music boxes; Dresden porcelains; sterling silver tea sets; antique Limoges dinnerware; Roger Clemens-autographed baseballs; Hermes, Louis Vuitton, Chanel, and Alexandra Knight handbags; Manolo Blahnik alligator pumps, and a few lightly worn outfits from Yves St. Laurent, Bill Blass, and Prada are among the items you may expect to find at the upcoming garage sale being thrown by Port Commissioner Elyse Lanier and her husband, former Houston Mayor Bob Lanier. The occasion: the recent sale — after almost 3 years on the market — of their 13,386-sq.-ft., 11-bathroom River Oaks estate (pictured) at 3665 Willowick for more than $6 million, a bit more than half their original asking price, and another notch below the just-under $7 million they resigned themselves to when they dropped the asking price for the last time late last year. Why the sell-off? “I just don’t have room to fit it all,” Elyse Lanier tells society reporter Shelby Hodge.

Heriz, Aubusson, and Kerman rugs; antique music boxes; Dresden porcelains; sterling silver tea sets; antique Limoges dinnerware; Roger Clemens-autographed baseballs; Hermes, Louis Vuitton, Chanel, and Alexandra Knight handbags; Manolo Blahnik alligator pumps, and a few lightly worn outfits from Yves St. Laurent, Bill Blass, and Prada are among the items you may expect to find at the upcoming garage sale being thrown by Port Commissioner Elyse Lanier and her husband, former Houston Mayor Bob Lanier. The occasion: the recent sale — after almost 3 years on the market — of their 13,386-sq.-ft., 11-bathroom River Oaks estate (pictured) at 3665 Willowick for more than $6 million, a bit more than half their original asking price, and another notch below the just-under $7 million they resigned themselves to when they dropped the asking price for the last time late last year. Why the sell-off? “I just don’t have room to fit it all,” Elyse Lanier tells society reporter Shelby Hodge.

Today’s the day all 18 remaining Texas locations of Bally Total Fitness — including 9 in Houston — are scheduled to switch over to control by their new owner, Blast! Fitness. Before

Today’s the day all 18 remaining Texas locations of Bally Total Fitness — including 9 in Houston — are scheduled to switch over to control by their new owner, Blast! Fitness. Before

The Woodlands Mall location is among the 11 anchor stores around the country Sears announced it will sell to mall operator General Growth Properties.

The Woodlands Mall location is among the 11 anchor stores around the country Sears announced it will sell to mall operator General Growth Properties.