$150 HOUSE SELLER EXPECTS TO REFUND 500 IDENTICAL OFFERS  The real estate agent who’s been trying to sell his Heights bungalow for $150 tells reporter Paul Takahashi that — barring an “incredible surge” of new applications and fees before the June 13 deadline — he’ll be refunding the approximately 500 $150 offer fees he’s received so far for the property. For now, he says, he’s organizing his emails to filter out the more than 1,500 essays he received from would-be homebuyers who somehow got the idea that Wachs would sell them the 2-bedroom, 1-bath property even if they didn’t submit the required fee from the 500 or so who followed his instructions. All that sorting is “a time-consuming and boring” task, he tells Takahashi. Wachs had hoped the application fees would add up to the unspecified amount between $265K and $550 he figures his family’s home at 213 E. 23rd St. is worth. [Houston Business Journal; previously on Swamplot] Photo: $150 House

The real estate agent who’s been trying to sell his Heights bungalow for $150 tells reporter Paul Takahashi that — barring an “incredible surge” of new applications and fees before the June 13 deadline — he’ll be refunding the approximately 500 $150 offer fees he’s received so far for the property. For now, he says, he’s organizing his emails to filter out the more than 1,500 essays he received from would-be homebuyers who somehow got the idea that Wachs would sell them the 2-bedroom, 1-bath property even if they didn’t submit the required fee from the 500 or so who followed his instructions. All that sorting is “a time-consuming and boring” task, he tells Takahashi. Wachs had hoped the application fees would add up to the unspecified amount between $265K and $550 he figures his family’s home at 213 E. 23rd St. is worth. [Houston Business Journal; previously on Swamplot] Photo: $150 House

Quicklink

COMMENT OF THE DAY: WHAT ENDING FEDERAL FLOOD INSURANCE SUBSIDIES COULD DO FOR GALVESTON  “Biggert-Watters would have destroyed the home market in many of Galveston’s West End beach communities. My wife and I were looking at homes just as the revised rate plan went into effect in late 2013. The quote I received for JUST FLOOD INSURANCE on a $250K house was $40,000 per year. As long as the government allows federally backed mortgages in these areas, they will have to subsidize the insurance rates. It really is that simple. If the rates aren’t subsidized, the market will collapse for these homes. It will be a vicious circle. Those that need a mortgage to afford a home won’t be able to afford insurance. Those who own a home with a mortgage won’t be able to afford insurance. Homes will only be marketable to cash buyers who can self-insure. How much would you pay for a home that you could only market via an owner-financed or cash transaction? A property that would essentially be unmarketable to buyers via traditional mortgage.” [Mike Honcho, commenting on Comment of the Day: Why You Can Get Flood Insurance in Houston] Illustration: Lulu

“Biggert-Watters would have destroyed the home market in many of Galveston’s West End beach communities. My wife and I were looking at homes just as the revised rate plan went into effect in late 2013. The quote I received for JUST FLOOD INSURANCE on a $250K house was $40,000 per year. As long as the government allows federally backed mortgages in these areas, they will have to subsidize the insurance rates. It really is that simple. If the rates aren’t subsidized, the market will collapse for these homes. It will be a vicious circle. Those that need a mortgage to afford a home won’t be able to afford insurance. Those who own a home with a mortgage won’t be able to afford insurance. Homes will only be marketable to cash buyers who can self-insure. How much would you pay for a home that you could only market via an owner-financed or cash transaction? A property that would essentially be unmarketable to buyers via traditional mortgage.” [Mike Honcho, commenting on Comment of the Day: Why You Can Get Flood Insurance in Houston] Illustration: Lulu

WESTBURY CENTERETTE SITE WILL REMAIN DRY Hot off the presses from the latest Westbury Crier — amid reports on the aftermath of May’s bayou overflow events, which flooded 267 homes in the neighborhood: An update on the status of the site of the former Westbury Centerette at the corner of W. Bellfort and Chimney Rock, which was demolished in March. “Originally,” the newsletter reports, “the property owner planned to construct a facility for LA Fitness; however, we regret to announce that this plan will not proceed. The property owner continues to evaluate options for the site.” [Westbury Crier; previously on Swamplot] Video of Westbury Centerette demolition: Brays Oaks Management District

HOUSTON’S UNACCOUNTABLE TIRZS AFFLICT BOTH THE POOR AND THE ULTRA-RICH  “The TIRZ system benefits high-dollar commercial areas and essentially ignores poorer neighborhoods that are primarily residential,” writes reporter Steve Jansen in a longish article that attempts to explain Houston’s arcane and secretive system of Tax Increment Reinvestment Zones. But there’s seething at the other end of the economic spectrum as well — especially over the Uptown TIRZ’s plan to install dedicated bus lanes down the center of Post Oak Blvd. Comments University Line light-rail and Uptown bus lane opponent Daphne Scarborough, who’s attended some anti-TIRZ gatherings, to Jansen: “I’ve never seen so many angry multimillionaires and -billionaires in one room.†[Houston Press; previously on Swamplot] Drawing of proposed Post Oak bus lanes: Uptown Management District

“The TIRZ system benefits high-dollar commercial areas and essentially ignores poorer neighborhoods that are primarily residential,” writes reporter Steve Jansen in a longish article that attempts to explain Houston’s arcane and secretive system of Tax Increment Reinvestment Zones. But there’s seething at the other end of the economic spectrum as well — especially over the Uptown TIRZ’s plan to install dedicated bus lanes down the center of Post Oak Blvd. Comments University Line light-rail and Uptown bus lane opponent Daphne Scarborough, who’s attended some anti-TIRZ gatherings, to Jansen: “I’ve never seen so many angry multimillionaires and -billionaires in one room.†[Houston Press; previously on Swamplot] Drawing of proposed Post Oak bus lanes: Uptown Management District

SEWAGE NOW FLOWING PROPERLY UNDER GULF FWY. AGAIN  That pipe break spotted underneath an I-45 South overpass leaking what appeared to be raw sewage onto a concrete path adjacent to Brays Bayou last week has now been repaired — or at least covered with a new sleeve. A photo of the fix also shows flood-remnant bouquets still intact along the pipe’s length at the bayou crossing south of Idylwood and just east of Telephone Rd. Photo: Allyn West

That pipe break spotted underneath an I-45 South overpass leaking what appeared to be raw sewage onto a concrete path adjacent to Brays Bayou last week has now been repaired — or at least covered with a new sleeve. A photo of the fix also shows flood-remnant bouquets still intact along the pipe’s length at the bayou crossing south of Idylwood and just east of Telephone Rd. Photo: Allyn West

COMMENT OF THE DAY: WHY YOU CAN GET FLOOD INSURANCE IN HOUSTON  “There is no market at all for flood insurance. It’s a massive federal subsidy that is merely administered by private companies.

You can’t effectively insure against floods.

This is one of those things many Texans like to ignore — that our coastal development is highly subsidized in the form of the government-backed NFIP.” [JR, commenting on Comment of the Day: A Better Way To Tell If Your Home Is Going to Flood] Illustration: Lulu

“There is no market at all for flood insurance. It’s a massive federal subsidy that is merely administered by private companies.

You can’t effectively insure against floods.

This is one of those things many Texans like to ignore — that our coastal development is highly subsidized in the form of the government-backed NFIP.” [JR, commenting on Comment of the Day: A Better Way To Tell If Your Home Is Going to Flood] Illustration: Lulu

AN ART CRITIC TOURS TEXAS A&M  On a recent visit to College Station, Rice and UT Grad Rainey Knudson tries to get past Texas A&M’s fortress chic: “So yes: to this outsider anyway, the A&M campus feels unattractive, humorless and a little silly. They have more bronze statues than you can shake a stick at, there are overbearing messages of social conservatism everywhere, and if you’re interested in good art, you’re out of luck, at least in the public spaces. These people couldn’t paint bigger targets on themselves for ridicule if they tried, right? And yet: the president of the school famously leaves the door to his house on campus unlocked. Students and faculty will tell you not to lock your car, that you could leave a computer lying somewhere on campus and it would still be there when you get back. And it would. That’s the flip side to all the sanctimoniousness at A&M: there really is a palpable, profoundly likeable sense of honor at the place (and I’m not just saying that because it’s one of their six core values that’s repeated all over campus.)” [Glasstire] Photo: Rainey Knudson

On a recent visit to College Station, Rice and UT Grad Rainey Knudson tries to get past Texas A&M’s fortress chic: “So yes: to this outsider anyway, the A&M campus feels unattractive, humorless and a little silly. They have more bronze statues than you can shake a stick at, there are overbearing messages of social conservatism everywhere, and if you’re interested in good art, you’re out of luck, at least in the public spaces. These people couldn’t paint bigger targets on themselves for ridicule if they tried, right? And yet: the president of the school famously leaves the door to his house on campus unlocked. Students and faculty will tell you not to lock your car, that you could leave a computer lying somewhere on campus and it would still be there when you get back. And it would. That’s the flip side to all the sanctimoniousness at A&M: there really is a palpable, profoundly likeable sense of honor at the place (and I’m not just saying that because it’s one of their six core values that’s repeated all over campus.)” [Glasstire] Photo: Rainey Knudson

AND NOW A DOWNTOWN DANCE PERFORMANCE ABOUT FLOODING Invitations to the latest site-specific performance by the Karen Stokes Dance company went out on May 25th, the day before a good part of Houston woke up to find various areas in and around the city under water. But the company had already been rehearsing its latest work for some time by then. Coincidence, fortunate timing, or simply a local arts group’s demonstration of a level-headed understanding of the Houston landscape? From the team that brought you last year’s by-the-Ship-Channel performance of Channel/1836 now comes Drench, which — as shown in excerpts previewed in the trailer video above — reimagines Discovery Green’s Gateway Fountain as a flood zone. Shows, part of a performance that includes the work of Belgian art group Chanson d’Eau, begin at 8 pm tonight and tomorrow. [Discovery Green; more info] Video: Karen Stokes Dance

A FUNNY THING HAPPENED ON THE WAY TO SELLING THIS HEIGHTS BUNGALOW FOR $150  Three weeks since the announcement, and with a little more than a week remaining before the June 13 deadline, more than 2,000 essays have come in from would-be buyers requesting that Heights real estate agent Mark Wachs sell his Heights bungalow at 213 E. 23rd St. to them for one heartening reason or another. But writing in The Leader, Kim Hogstrom reveals a more curious development: The vast majority of the applicants either can’t or don’t want to follow Wachs’s instructions — or never bothered to look at them too closely. Only about 500 of the submitted 200-word essays came with the required $150 application fee. With enough fees coming in from also-rans, some fortunate buyer would be able to purchase the 2-bedroom, 1,056-sq.-ft., 2-bedroom, 1-bath bungalow for just $150 (plus title and closing costs) — and still allow Wachs to receive what he thinks the house is worth, which he hints is somewhere between $265K and $550K. On the website he set up for the offer, Wachs states that application fees will be refunded if he doesn’t end up with a buyer using this method; he also indicates he might extend the deadline. [The Leader; previously on Swamplot] Photo: Mark Wachs

Three weeks since the announcement, and with a little more than a week remaining before the June 13 deadline, more than 2,000 essays have come in from would-be buyers requesting that Heights real estate agent Mark Wachs sell his Heights bungalow at 213 E. 23rd St. to them for one heartening reason or another. But writing in The Leader, Kim Hogstrom reveals a more curious development: The vast majority of the applicants either can’t or don’t want to follow Wachs’s instructions — or never bothered to look at them too closely. Only about 500 of the submitted 200-word essays came with the required $150 application fee. With enough fees coming in from also-rans, some fortunate buyer would be able to purchase the 2-bedroom, 1,056-sq.-ft., 2-bedroom, 1-bath bungalow for just $150 (plus title and closing costs) — and still allow Wachs to receive what he thinks the house is worth, which he hints is somewhere between $265K and $550K. On the website he set up for the offer, Wachs states that application fees will be refunded if he doesn’t end up with a buyer using this method; he also indicates he might extend the deadline. [The Leader; previously on Swamplot] Photo: Mark Wachs

YUM YUM CHA CLOSING HINTS AT RICE’S PLANS FOR RETAIL BUILDING IT BOUGHT NEXT TO VILLAGE ARCADE  The owner of Rice Village dim sum spot Yum Yum Cha tells Eric Sandler that Rice University’s management company “can’t decide what they’re going to do” with the building it bought earlier at the corner of Times Blvd. and Kelvin St., but that demolition is possible. Yum Yum Cha was offered only a 6-month renewal on its lease. Instead, the restaurant, which has occupied the space at 2435 Times Blvd. for 10 years, will be shutting down June 15th or as soon as it runs out of food — whichever comes first. The 1955 building that houses it forms a small portion of a double block dominated by the Rice-owned Village Arcade shopping center — but lacks any off-street parking of its own. Remaining tenants in the building are Grace Anna’s boutique, Myth Hair Salon & Spa, Joseph Keith Jewelry, and — around the corner — Vietnamese restaurant Miss Saigon. Yum Yum Cha owner Lisa Mak says she and her father, the restaurant’s chef, are already looking for a new location. [CultureMap; previously on Swamplot] Photo: Swamplot inbox

The owner of Rice Village dim sum spot Yum Yum Cha tells Eric Sandler that Rice University’s management company “can’t decide what they’re going to do” with the building it bought earlier at the corner of Times Blvd. and Kelvin St., but that demolition is possible. Yum Yum Cha was offered only a 6-month renewal on its lease. Instead, the restaurant, which has occupied the space at 2435 Times Blvd. for 10 years, will be shutting down June 15th or as soon as it runs out of food — whichever comes first. The 1955 building that houses it forms a small portion of a double block dominated by the Rice-owned Village Arcade shopping center — but lacks any off-street parking of its own. Remaining tenants in the building are Grace Anna’s boutique, Myth Hair Salon & Spa, Joseph Keith Jewelry, and — around the corner — Vietnamese restaurant Miss Saigon. Yum Yum Cha owner Lisa Mak says she and her father, the restaurant’s chef, are already looking for a new location. [CultureMap; previously on Swamplot] Photo: Swamplot inbox

COMMENT OF THE DAY: WILL THE NEW BIKE TRAIL SYSTEM BE THIS SHOCKING?  “Here’s something a little off topic but has to do with putting trails on power easements. Has anyone ever experienced what happens when you ride under the lines down the dirt road in Memorial Park? The electromagnetic field actually shocks you where you are touching the frame or handlebars especially during peak Summer usage hours and when sweaty. Not sure if that’s ever been addressed.” [j, commenting on FPSF Moving Next to the Astrodome; I-10 Toll Hike Delay; Secrets of the I-45 Redo Plan] Illustration: Lulu

“Here’s something a little off topic but has to do with putting trails on power easements. Has anyone ever experienced what happens when you ride under the lines down the dirt road in Memorial Park? The electromagnetic field actually shocks you where you are touching the frame or handlebars especially during peak Summer usage hours and when sweaty. Not sure if that’s ever been addressed.” [j, commenting on FPSF Moving Next to the Astrodome; I-10 Toll Hike Delay; Secrets of the I-45 Redo Plan] Illustration: Lulu

CAT CAFE LOOKING FOR A COZY SPOT TO CURL UP SOMEWHERE NEAR MONTROSE, RICE VILLAGE, WEST U  A group looking to establish Houston’s first-ever combo café and cat lounge is focusing its search on existing retail or former restaurant spaces to lease in the Montrose, Rice Village, or West University areas. The website for Lola’s Cat Café says the new venue will be “more than just a coffee shop with cats.” Instead, it’ll be a hangout for people “who are either looking to adopt a cat or would like to spend some time hanging out with our resident kitties.” All cats on hand will be adoptable. [Lola’s Cat Café] Photo: Lola’s Cat Café

A group looking to establish Houston’s first-ever combo café and cat lounge is focusing its search on existing retail or former restaurant spaces to lease in the Montrose, Rice Village, or West University areas. The website for Lola’s Cat Café says the new venue will be “more than just a coffee shop with cats.” Instead, it’ll be a hangout for people “who are either looking to adopt a cat or would like to spend some time hanging out with our resident kitties.” All cats on hand will be adoptable. [Lola’s Cat Café] Photo: Lola’s Cat Café

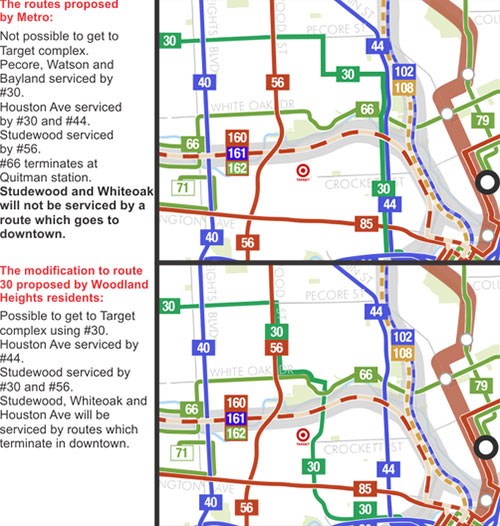

WOODLAND HEIGHTS BUS MAPPERS TO METRO: YOUR NEW ROUTE PLAN MISSES THE TARGET  Metro says it’ll be ready to go with its new bus network on August 16, but that hasn’t prevented various groups from petitioning the transit agency to make late adjustments to its route map. One group of Woodland Heights residents is trying to get the new 30 route, which late in the process was shifted east to parallel the new 44 route down Houston Ave into Downtown, shifted west to Watson, Taylor, and Sawyer streets between Pecore and Memorial Dr. before entering Downtown from the west. The current proposed alignment leaves the Sawyer Heights shopping center and its Target without a bus stop. [Not of It] Diagram: Philip Teague

Metro says it’ll be ready to go with its new bus network on August 16, but that hasn’t prevented various groups from petitioning the transit agency to make late adjustments to its route map. One group of Woodland Heights residents is trying to get the new 30 route, which late in the process was shifted east to parallel the new 44 route down Houston Ave into Downtown, shifted west to Watson, Taylor, and Sawyer streets between Pecore and Memorial Dr. before entering Downtown from the west. The current proposed alignment leaves the Sawyer Heights shopping center and its Target without a bus stop. [Not of It] Diagram: Philip Teague

COMMENT OF THE DAY: HIGH WATER BECOMES US  “Does anybody else feel Houston looks really great in a flood? Other cities have mountains or snow or awesome historic architecture, colorful boisterous festivals . . . But from what I see, flooded Houston is green and peaceful — the perfect spot to live!” [movocelot, commenting on Comment of the Day: A Better Way To Tell If Your Home Is Going To Flood] Illustration: Lulu

“Does anybody else feel Houston looks really great in a flood? Other cities have mountains or snow or awesome historic architecture, colorful boisterous festivals . . . But from what I see, flooded Houston is green and peaceful — the perfect spot to live!” [movocelot, commenting on Comment of the Day: A Better Way To Tell If Your Home Is Going To Flood] Illustration: Lulu

HOW TO SEE YOUR PHOTOS ON SWAMPLOT  Got some good flood pics you’d like to share with a wider audience? Or maybe some drier images of Houston street or strip-mall life that deserve to be highlighted on this site? The Swamplot Flickr pool is hungry for your photographic contributions! To join, just click the “+ Join Group” button at the top of this page. Pics that are more Houston-as-you-see-it than Chamber-of-Commerce-y are preferred. Just be sure to provide location info for each cité-vérité image you submit — or geotag them, if that’s easier. Photo of I-45: Paul via Swamplot Flickr Pool [license]

Got some good flood pics you’d like to share with a wider audience? Or maybe some drier images of Houston street or strip-mall life that deserve to be highlighted on this site? The Swamplot Flickr pool is hungry for your photographic contributions! To join, just click the “+ Join Group” button at the top of this page. Pics that are more Houston-as-you-see-it than Chamber-of-Commerce-y are preferred. Just be sure to provide location info for each cité-vérité image you submit — or geotag them, if that’s easier. Photo of I-45: Paul via Swamplot Flickr Pool [license]