ASHBY HIGHRISE: ONE PERMIT AWAY FROM APPROVAL “Having cleared six of seven departmental reviews, dating back July 30, the project only lacks clearance from Public Works and Engineering’s traffic section.” Developer Matthew Morgan says Buckhead Investment Partners will address four outstanding traffic concerns and resubmit the project for approval soon. [West University Examiner; previously]

Condos

It didn’t garner much local attention, but a certain local condo building — along with a few close friends — made a star appearance in last week’s big mortgage-scam announcement by the FBI. More than 400 people were charged in 144 separate mortgage fraud cases nationwide over the last 3 months as part of the agency’s “Operation Malicious Mortgage.” Six of those arrests were in Houston:

This indictment charges Houston-area residents Frankthea Annette Williams, Ishmael Boyd Laryea, Charles Joseph-DeShawn Wilson, Kristen Anne Way and Robert Wilfred Stanley, and Tasha Rene Bellow, of Burbank, Calif., with engaging in a scheme to defraud by providing false and fraudulent information to residential lenders to induce the lenders to fund the purchase of single family homes and condominium units.

11 News reporter Allison Triarsi describes how the scams worked:

The suspects would find a home for sale, let’s say $200,000.

They would then get a phony appraisal that would almost double the home’s actual value. In that case, $400,000.

The culprits would then look for an investor. That’s someone to actually put the house in their name using their good credit for the closing and title.

A bank would then loan the money for the house, which has the phony appraisal value. The crooks would then pay the seller the $200,000 asking price and pocket the other $200,000.

Here’s a question. If you were trying to run this scam, where would you find properties you could get appraised for as much as twice their actual value? Sure, Houston had some price runups . . . and yes, appraisals can be played. But why fake something you don’t have to?

A reader sends photos of some recent construction on the garage podium beneath the Cosmopolitan tower and asks:

What are those three giant urinals affixed to the east exterior wall of Randall Davis’ latest glass-clad erection, the one on Post Oak where James Coney Island used to be? . . .

Where is the Colossal Statue of Constantine when you need him? (Well, he’s in Rome, but that’s no help to Post Oak Boulevard!)

Sure, there’s the vaguely Roman theming going on with the marketing for Davis’s next tower across the street, the Titan. But these new constructions might be something much more contemporary . . . think Marcel Duchamp by way of Claes Oldenburg: The big fountains!

Below: the Colossal Head of Constantine . . . and the Colossal Heads of the Cosmopolitan, on display!

Is it going to happen? A construction permit for Pelican Builders’ Highland Tower was approved by the city last week.

A couple purty drawings of a unit, after the jump.

Trammell Crow Residential is planning a new apartment building on the current site of the RR Donnelley printing company building on S. Shepherd, some sleuthing neighbors tell us.

The printing company sits between two cartoon condos near W. Dallas: Randall Davis’s Gotham and Renoir. The site for the apartments will include all of the land currently owned by Donnelley, extending from Shepherd through the parking lot east to Gross St. The Nazarene Missionary Baptist Church on Newhouse St. may own a small piece of the parking lot, reports an email making the rounds in the neighborhood.

Trammell Crow, which runs the Alexan apartment chain, is reportedly still in the early stages of planning . . . though apparently far enough along for the company’s planners to request some variances from the city. One variance request

is to not have to widen Newhouse to the now required standard of 50 ft. . . . To do so would adversely impact the church and the one townhouse at the end of Newhouse.

More details and photos after the jump!

A reader has questions about the Cosmopolitan, Randall Davis’s tower-on-a-box on Post Oak:

What’s going on with this building? My wife and I looked at this last month as they were closing out and only had 2 units left, with the agent (surprise) saying they would be sold out shortly. Now there are 4 units on MLS. Are these from the builder or resales? There are only 80 units in the building–I wonder if some speculation is going on as I heard that Randall Davis offers sizable discounts to his employees, who bought several of the units at the Cosmo at a discount and are now trying to flip them. Is this Houston or Miami?

Hey, 4 units for sale out of 80 doesn’t sound too bad. On the other hand, it looks like one of the available units on MLS is, in fact, the Miami.

Cosmo buyers, readers . . . any comments?

- The Cosmopolitan Houston [Randall Davis Company]

- 1600 Post Oak Blvd. Unit 1001 [HAR]

Photo: HAR

Sure, the super-Mod architecture, elevated sidewalks, artistically moistened streets, and glistening rotunda in the new Boulevard Place renderings make the place look pretty swank, but what’s with the token strip of parking spots out front? Is this gonna be pay-to-display valet? Some kind of shopping-center twist on a velvet rope line? Or just a stab at maintaining Houston street cred: Sure, Post Oak Blvd. might be going urban upscale, but this is one development that won’t be forgetting its strip-center roots!

Updated views of Blvd Place, including the new Ritz-Carlton and Hanover towers — plus a site plan and a Whole Foods puzzle! It’s all below:

There will be a grand total of 652-and-a-half private bathrooms in Houston’s Turnberry Tower. Apparently this is the kind of attention to detail that’s needed to attract buyers who are flush with assets:

When meeting with buyers, Turnberry’s sales staff emphasizes the high life they’ll enjoy, said [Turnberry Ltd. vice president Jim] Cohen, with the 40-year-old condo tower developer.

They’re told, for example, that when they hang out by the pool, a Turnberry staffer will offer a cool towel for their neck and wipe sunscreen from their sunglasses.

- A lifestyle as well as a home [Houston Chronicle]

- Tune In to the Turnberry Tower [Swamplot]

- Nine and a Half Bathrooms: The Turnberry Tower Penthouse Evacuation Plan [Swamplot]

Image of Turnberry Tower plaza-level pools: Turnberry Ltd.

Chronicle reporter Matt Stiles continues his tour of substandard Houston apartments, stopping this week for a visit at the 172-unit Candlewood Glen Apartments, near the 5400 block of DeSoto:

Now, only about 12 units remain legally occupied, and the management office is shuttered. Rotting trash sits in piles. Copper pipes and air conditioners’ coils have been ripped on a mass scale from burglarized units. The swimming pool is filled with water the color of crude oil.

“It’s just a horrible place,” said Roy Millmore, executive director of the Near Northwest Management District, an organization that focuses on reducing crime in the area.

The poor conditions inside the complex have persisted for months, in part because many of the property’s 43 fourplexes are owned by out-of-state investors, rather than a single owner. That makes applying pressure to improve conditions more complicated for city inspectors.

Still, code inspectors had not visited the property in a decade until the Houston Chronicle documented its conditions. City officials say they had not received complaints from people living there and that they are trying to enforce codes more aggressively than in years past.

After the jump: Stiles’s Candlewood Glen Apartments photo tour. Plus: Available now!

We get mail . . . from a reader who’s considering renting one of the many available condos in Montrose’s famed Tremont Tower:

I am moving to Houston in June and when I was looking around for housing I found an ad for a rental at Tremont Towers. I went to look at the place and liked it but something seemed odd to me. If this place is as nice as it looks, it is in Montrose (apparently a desirable area to live) why is is so silent and why does one man own at least 5 separate units and even more odd, why are they so cheap when last year they were valued at >300K (odd even in this real estate market). So, I plugged them into Google and started following a trail. I read about Jordan Fogle and Heather Mickelson.

I talked to my possible future landlord and he told me a story that Jordan Fogle confused the builder of Tremont with the ones who built her home. In addition he offered a story that the Heather Mickelson had purchased the property and then not long after moving in decided to move out with her boyfriend. Since they would not purchase the property back from her she sabotaged the apartment by opening her windows through all weather which then lead to some horrible development of mold.

My issue is that since the coverage in 2005-2006 I haven’t been able to find much information and I cannot verify either side of this tale. I was wondering if any readers had passed on more information about the Towers or if anything had been done in this building that had nearly 100% foreclosure. I am concerned because I would prefer to avoid paying nearly a thousand a month just so I can get sick and not be able to work.

A little more below, plus: your chance to help!

Expect to see a lot more, uh . . . interesting advertising for the Mosaic towers on Almeda. Nancy Sarnoff reported in the Chronicle this past weekend that “about 65 units have closed” out of a total 790 in the two towers. The second glass tower is currently under construction at the eastern edge of Hermann Park.

That’s a long way to go, but the path sounds a whole lot steeper when you compare Sarnoff’s report to what Jennifer Dawson reported in the Houston Business Journal last August:

As of last week, 218 condos had sold in the first tower. Units in the second phase won’t go on sale until early next year. Ken Manfredi of Miami-based Developer Sales Group is handling Mosaic’s condo sales.

After the jump: More evocative ad imagery! Plus: the view from above.

If you’re curious what the upper reaches of Montrose Blvd. look like from the viewpoint of an actual pedestrian, you’ll want to see blogger Charles Kuffner’s recent annotated photo walking tour of the area. Kuffner, who lived on Van Buren St. in the nineties, describes more recent developments on and around Montrose and Studemont — from West Gray north to Washington:

I did this partly to document what it looks like now – if you used to live there but haven’t seen it in awhile, you’ll be amazed – and partly to point out what I think can be done to make the eventual finished product better. . . .

My thesis is simple. This is already an incredibly densely developed corridor, and it’s going to get more so as the new high rise is built [see Swamplot’s story here] and several parcels of now-empty land get sold and turned into something else. It’s already fairly pedestrian-friendly, but that needs to be improved. And for all the housing in that mile-long stretch of road, there’s not enough to do.

Kuffner’s guide is a Flickr photo set. You’ll get the most out of it if you view it as a slideshow with the captions turned on (on the link, click on Options in the lower right corner, then make sure Always Show Title and Description is checked).

After the jump: A few more photos from Kuffner’s tour, plus an ID on those new condos behind Pronto!

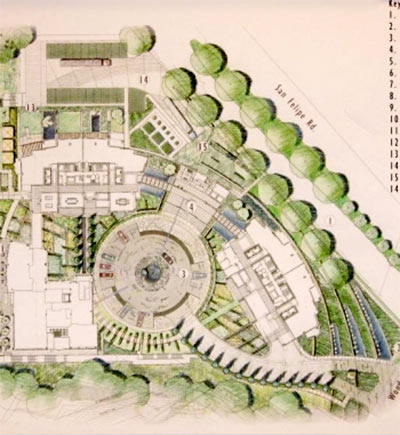

This landscape plan from the Boymelgreen website is our first glimpse of the two condo towers the company is planning for 5.5 acres on the southwest corner of the intersection of San Felipe and a short segment of Woodway — just west of Voss, on the Right Bank of Buffalo Bayou. And this morning the Houston Business Journal has more to report:

New York City-based Boymelgreen Developers is developing the project for landowner Azorim, a publicly traded company in Israel of which Boymelgreen owns 64 percent. . . . The unnamed project will consist of two buildings with 28 residential floors each and an 18,000-square-foot fitness center and spa. The project will have a total of 237 condos starting at $1 million each. Units will be an average size of 2,500 square feet.

The architect is Ziegler Cooper. Boymelgreen’s website refers to the project as the San Felipe Condominiums. (And it reports a building that’s 14 condos smaller.)

Jennifer Dawson’s report in the HBJ says that sales won’t start until the fall, after a sales center — which will later “be converted into a spa, restaurant or office building” — is built on the site of the former Dolce & Freddo next door.

Below the fold: That 1960s office-and-shopping center on the site won’t go quietly!

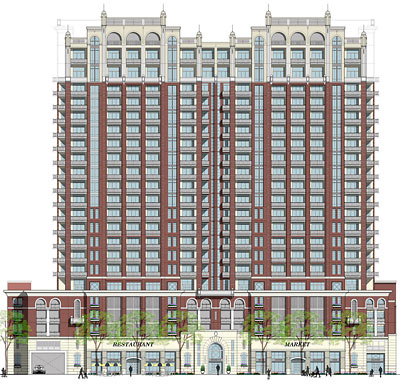

Today comes news that the developers of the Ashby Highrise won’t wait any longer to strike a deal with the city — and are proceeding with permit applications for their original 23-story apartment and condo tower next to Southampton. Writing in the Chronicle, Mike Snyder reports that Buckhead Investment Partners had submitted a proposal for a slightly smaller tower to the city three weeks ago but had received no response.

The proposed smaller 22-story tower, which didn’t get much support from neighborhood groups, would have featured a narrower tower with 130 condo units and four detached townhouses along Ashby, two floors of underground parking and two more above grade, plus a small park on one corner. Buckhead principals Matthew Morgan and Kevin Kirton told Snyder the reduced number of units would “eliminate any possibility the project would cause unacceptable traffic congestion.”

A document outlining the proposal, however, shows the offer is contingent on significant financial concessions by the city: An immediate refund of about $500,000 for new sewer lines the developers installed to serve the project, along with a payment to the developers of up to $2.15 million, over as long as 10 years, from revenue generated by increased tax values on the site.

Meanwhile, Buckhead’s fancy new website now features a far more complete collection of presentation drawings of what appears to be the original 23-story tower. There doesn’t seem to be any mention on the site of the 22-story all-condo tower proposal.

After the jump, lots of tower drawings from the new website — including . . . kids hugging puppies!

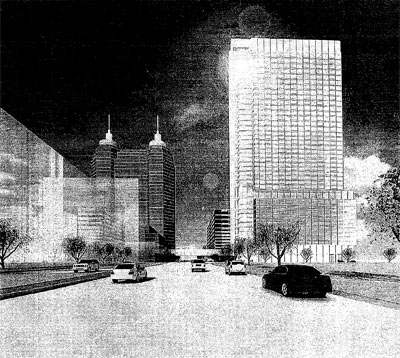

From fuzzy video stills to washed-out photocopies: In the agenda handout for today’s Planning Commission hearing are hazy images that provide even more details about the new 40-story hotel and condo tower Medistar wants to build on Main St. in the Medical Center, at the eastern boundary of Southgate.

The drawing labels identify the hotel as the Houstonian Texas Medical Center, or Houstonian TMC for short. The architect is the Hill Glazier Studio of HKS, out of California. And a section drawing gives an actual height for the tower.

After the jump: It’s very tall!