CITY TAX INCENTIVES TO HELP WALMART BUILD IN THE WEST END? Mayor Parker tells the Houston Press‘s Christopher Patronella Jr. that the city has been discussing the possibility of a tax-incentive agreement with the developer of the 25-acre site off Yale St. in the West End — where Walmart is planning to build a new store: “‘The city is not negotiating with [Walmart]. However, there are ongoing conversations with the developer regarding a 380 Agreement, which allows for the dedication of future tax revenues from a qualifying project to be used as reimbursement to the developer for necessary infrastructure improvements. 380 Agreements are authorized under state law and have been used previously by the city. This is still not a done deal.’ The 380 agreements, as established by the Texas Local Government Code, authorize cities to refund a portion of projected sales-tax income over a period of time. From Jan 1, 2000 to May 21, 2008, according to the City of Austin’s peer city comparison of economic development agreements, Houston has among the lowest number of such agreements with 11, next to Austin with 7. San Antonio is next in line with 43 and Dallas and Fort Worth with a combined 85. City spokesperson Janice Evans told Hair Balls that the city generally considers projects that are at least $25 million, require substantial new public infrastructure and create a measurable number of new jobs, for the 380 agreements. “The major project that I can point you to that utilized these same concepts is the planned [Regent Square] redevelopment of the former Allen House site. That project will eventually be a $750 million investment.'” [Hair Balls; previously on Swamplot]

West End

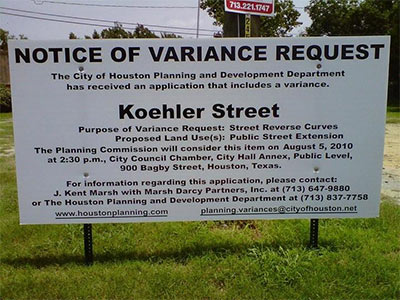

Will construction of a new Walmart off Yale St. just south of I-10 and the Heights require any variances from the Planning Commission? This sign appeared over the weekend across the street from where Koehler St. ends at Yale, just south of Dirt Bar. It appears to refer to the proposed extension of Koehler St. to Heights Blvd. shown on the Ainbinder Company site plan for the property. That’s not for the portion of the property Walmart will be occupying, but for an adjacent tract.

By Sunday night, though, the sign had been taken down. According to Kent Marsh of planning firm Marsh Darcy Partners, it was removed “erroneously” and should be reinstalled soon. Meanwhile, a separate set of signs are up along Koehler and on the other side of Yale, closer to where the Walmart is likely to go. But they appear to be for the Yale St. pad sites in the Ainbinder plan. And they aren’t for variances:

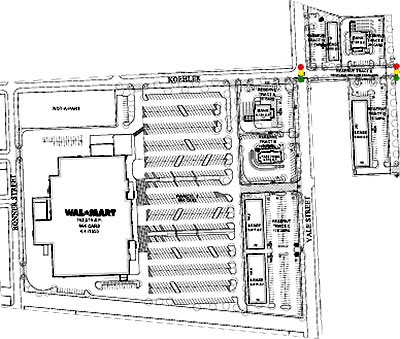

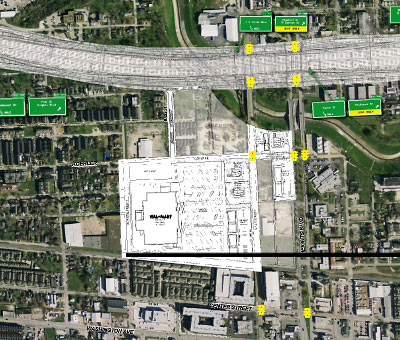

Walmart has not completed its purchase of 15 acres of the former Trinity Industries steel fabrication site on Yale St. just south of I-10 and the Heights, but an executive with the Ainbinder Company, which has owned the property for 3 years, has been quoted as saying it is no longer negotiating with any other potential buyers (H-E-B was one), and that the deal should be complete within a few weeks. A site plan obtained by the Chronicle‘s Nancy Sarnoff shows 2 bank-style pad sites and a park-in-front strip center facing Yale, in front of the 152,000-sq.-ft. Walmart’s 664-car parking lot. Also shown in that plan, as part of the proposed development: a sprawlerrific future for the current site of the Heights Plaza Apartments to the northeast of the site, featuring a strip center along Heights Blvd. and a “bank” site just to the north, at the southern edge of White Oak Bayou. Yet another strip center is shown on the back side of the bank site, facing Yale St. to the west.

Ainbinder has the Heights Plaza Apartments at 205 Heights Blvd. under contract. Speaking at a meeting organized by city council member Ed Gonzalez, Michael Ainbinder said he expects to close on that property this fall and include the land in the retail development, bringing its total land area to 24 acres. Nicgk, who took extensive notes on the meeting and included them in his blog, They Are Building a Wal-Mart on My Street, reports that the developers are claiming that the development will not be “a ‘typical suburban’ project.” Nicgk reports an Ainbinder representative noted the

‘warehouse’ type of architecture; they noted the ‘Core’ apartments, and ‘Berger Iron Works’ on the corner plot of land. They intend to keep that type of neighborhood feel to the development

-It was described as a more modern warehouse/urban type of feel . . . Ainbinder assured that the infrastructure of the land, and surrounding, would be brought up to appropriate specs to support.

Below: a few photos of the site from a larger set and scouting report by another neighborhood blogger, Charles Kuffner.

MAYOR PARKER TO WALMART: START TALKING “This is not yet a done deal. The property has been assembled for a major retail venture. When that moves forward, there will be careful review for impact on traffic, mobility and city infrastructure. I encourage Wal-Mart, or any other retailer interested in the property, to open dialogue with the Greater Heights and Washington Avenue Super Neighborhoods 15 and 22 as well as other neighborhood groups and civic clubs in that area.” [Hair Balls; previously on Swamplot]

Armed with your suggestions, roving Swamplot photographer Candace Garcia set out to document the smallest freestanding commercial buildings in Houston she could find. And here are the results! Above, “The Spot” hair salon at 1207 Westheimer in Montrose, at the corner of Commonwealth.

More tiny:

We have a correction on the location of the new Walmart headed for the area just south of I-10 and the Heights. Our source was off by a block: The property in question is bounded by Yale on the east, Koehler on the north, Bonner on the west, and the railroad tracks to the south. That’s a much bigger site than the former Sons of Hermann property a block east. A proposed development plan obtained by Nancy Sarnoff at the Chronicle indicates there’ll be plenty of pad-site fun in the project too. The site plan from the Ainbinder Company and Moody Rambin Retail shown above also shows a much-fattened Bass Ct. connecting the development to a new east-bound feeder road along I-10.

The plans show a 152,000-sq.-ft. Walmart (that’s almost 3 1/2 acres of floor space, but who’s counting?) and a 664-car parking lot. according to Sarnoff. “A Wal-Mart spokeswoman confirmed the company’s interest in the site, but would not provide additional details,” she writes.

A 25-acre Trinity Industries steel fabrication plant was the last development at this location. A portion at 107 Yale was home to the Heights Armature Works, where flickr photographer meltedplastic caught these cozy scenes, featured on Swamplot last year:

“I’d need to get in shape to move into this house,” writes the Swamplot reader who sent in this listing for one of those new $million-plus homes in the fenced-off Caceres compound wedged between Reinerman, Feagan, and Detering streets in the West End.

Is this stucco structure really five stories tall?

So much new stuff going on it’s impossible to keep track of it all!

- Opening Soon? A new “Houston Ave. Bar” at the site of the former Farmers Coffee Shop on the corner of Houston Ave. and White Oak. Here’s the evidence: A permit for a “2 story addition” to the property was approved by the city last month. The corner is already a popular gathering place for floodwaters — several commenters on HAIF have posted photos of the intersection after Hurricane Ike (see above) and Tropical Storm Allison.

- Moved: The Central City Co-op Wednesday market, from that Ecclesia space next to the Taft St. Coffee House to new digs at the Grace Lutheran Church at 2515 Waugh, just north of Missouri St. Sunday markets are still at Discovery Green. Next up for the co-op crew: Selling enough veggies to pay off those loans used for the church buildout.

- Opening Softly, Later This Month: A place called Canopy, from the folks who brought you that place called Shade. Claire Smith and Russell Murrell’s new restaurant will go in the spot where Tony Ruppe’s was, in the double-decked strip center at 3939 Montrose, reports Cleverley Stone. Three meals a day, 7 days a week, plus 3 seating areas:

a bright and refreshing dining room, festive bar and side street patio. We will eventually offer curbside “to go” service.

- Opening Early Next Month: The brand-new Dessert Shoppe, in the strip center portion of 19th Streete in the Heights. Fred Eats Houston writes that sisters Sara and RaeMarie Villar will be serving up “whole cakes and pies to individual desserts, along with assorted breakfast pastries, cookies, quiches, cupcakes, and some breads.”

- Reopened, for the First Time Since Ike: The Shriner’s Hospital for Children in Galveston. The combined boards of the International Shriners and Shriners Hospitals for Children had originally decided to close the hospital for good, after 30 inches of water wandered through the building’s first floor during the Hurricane. Shriners voting at this summer’s convention in San Antonio reversed that decision. The new hospital will have a smaller staff and budget. The Chronicle‘s Todd Ackerman reports that the hospital should already be open for reconstructive surgery cases; burn victims will have to wait until December for treatment.

And yet even more new stuff:

COMMENT OF THE DAY: KICKING BACK ON WASHINGTON AVE. “I live in the Core (since October 2008), and I’m certain that there are no plans to extend this complex across the street. The Core is a great place to live, but like every other large inner city complex, they’ve been slow to fill vacancies here. With that said, it would be foolish for them to even consider expanding. The last I heard, there were plans to put a small two story shopping strip there similar to the one on the other side of the Core. Still no solid plans though from anyone. By the way, if anyone wants to live here in the Core, put me as a reference and you and i both will get cash back.” [Hector Garcia, commenting on Washington Ave.: Extending The Core?]

A West End resident writes in with a question about plans for the former Trinity Steel plant off Koehler St. between Yale and Bonner:

They have recently begun demolishing the huge industrial warehouses that made up the Trinity Industries complex. Our Civic Club President seems to think they are building an extension of the The Core apartment complex that just went up at 3990 Washington Avenue (www.thecoreapts.com). That would be a disaster since the Trinity Industry property parcel is HUGE and if they are going to be ALL apartments, our narrow neighborhood streets will be clogged constantly with all that extra traffic.

I can’t find anything about who developed The Core to see if they have any updates on their website about future extension plans. Do you have any leads on what is going on and going up there?

The Core Apartments were developed by the Morgan Group. Any Swamplot readers have the scoop on future plans for the site?

Bonus question after the jump:

Sharp-witted observers, start your metaphors! Residents of the Park Memorial condos — who’ve been racing to sell their condo complex before any of the units start dropping into the parking garage that sits beneath them — have a new problem. City officials, terrified of a not-merely-figurative condo-market collapse, slapped bright orange notices on all the doors of the Memorial Dr. complex yesterday, notifying all 108 residents that they will need to permanently vacate their homes by September 15th.

The order came after a city inspector and an independent inspector both confirmed that the concrete parking garage structure underneath some of the condo units is in immediate danger of collapse. In late July, the city had warned residents that the garage “may experience catastrophic failure at any time.â€

After the jump, a couple more photos of the condo campus . . . from the listing for a recent sale.

City officials posted signs at the Gables of Inwood Apartments near Antoine Forest yesterday notifying residents that they need to vacate the property by Monday. The owner of the 165-unit complex, Collins Ofoegbu of El Sobrante, California, has received notices of more than 240 violations from city inspectors since purchasing the property in 2006.

Some received the news from orange “notice to vacate” signs affixed to their doors. The signs also warned residents that power would be disconnected Monday.

“I need, like, two or three months,” said an agitated Jolanda Hernandez, who waved a recent rent receipt while complaining in Spanish. “I need time so I can move out of here.”

Matt Stiles’s report in the Chronicle indicates there are also problems at a closer-in property with a much larger group of owners: the Park Memorial Condominiums near the corner of Memorial and Detering. Stiles says city inspectors planned to post notices at the condominiums at 5292 Memorial warning residents that the parking garage is unsafe and “may experience catastrophic failure at any time.”

After the jump: More highlights from reporter Matt Stiles’s personal collection of dangerous-apartment photos!

For those of you still fascinated by that Tin House in Rice Military designed by Natalye Appel featured here Wednesday: Photos of the house dating from the . . . uh, Golden Age of Tin Houses in the West End, circa 1992.

Remember when it looked like the entire West End was going to go . . . metal? It was going to be the Tin House District: Hot young architects inserting daring steel-sided homes between ramshackle bungalows . . . with great sensitivity to the sleepy little neighborhood.

Here’s a Rice Military home Natalye Appel designed for Sarah Balinskas in 1992. And it’s for lease! Have a peek inside . . .

A reader sends photos of the new Memorial Hills Apartments under construction just north of Memorial Drive and west of Jackson Hill at 3200 Scotland St., on the site of the old . . . Memorial Hills Apartments! The new apartments are being developed by Gables Residential, and were designed by Ziegler Cooper Architects.

The apartments will be 8 stories tall and face Cleveland Park directly to the south. The parking garage will be on the north side of the site.

Below: more reader photos of the construction site, plus pretty words and pictures from Ziegler Cooper!